Get the free Application for Registration as an Insurance/Reinsurance Intermediary

Show details

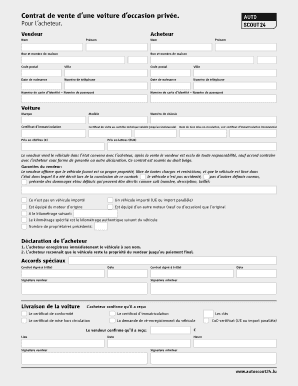

Este documento es una solicitud para el registro de intermediarios de seguros y reaseguros, incluyendo detalles sobre la firma, requisitos profesionales y la información de fondo necesaria para la

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for registration as

Edit your application for registration as form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for registration as form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for registration as online

To use the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for registration as. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for registration as

How to fill out Application for Registration as an Insurance/Reinsurance Intermediary

01

Obtain the Application for Registration as an Insurance/Reinsurance Intermediary form from the relevant regulatory authority's website or office.

02

Fill in your personal details, including your name, contact information, and business address.

03

Provide information about your qualifications and experience in the insurance industry.

04

Include details of the types of insurance or reinsurance products you intend to handle.

05

Submit background information or any necessary documentation, such as proof of identity and relevant certifications.

06

Pay any required application fees as specified by the regulatory body.

07

Review the entire application for completeness and accuracy before submitting.

08

Submit the application to the designated regulatory authority, either online or through traditional mail as instructed.

Who needs Application for Registration as an Insurance/Reinsurance Intermediary?

01

Individuals or businesses wishing to operate as intermediaries in the insurance or reinsurance sector.

02

Brokers seeking to facilitate transactions between insurers and clients.

03

Agents representing insurance companies to sell their products to consumers.

04

Any entity that necessitates official registration to legally operate and provide intermediary services in insurance or reinsurance.

Fill

form

: Try Risk Free

People Also Ask about

What degree do you need to be an insurance broker?

To pursue a career path as an insurance broker, it's best to start by earning a college degree in insurance, business, economics, or finance. A college degree can give you a strong background and skills to help you excel in your role. ing to Zippia, 64% of brokers have a Bachelor's degree4.

What is a reinsurance license?

A license granted to a firm authorizes all members of that firm to act as reinsurance intermediaries. Insurance regulators may treat insurance companies differently depending on whether they maintain an office in-state, considered a resident, or out-of-state, considered a nonresident.

How much do reinsurance brokers make?

$106,300 is the 25th percentile. Salaries below this are outliers. $111,500 is the 75th percentile.

Is Oliver a reinsurance intermediary placing reinsurance?

Oliver is a reinsurance intermediary, which means his primary role is to facilitate the placement of reinsurance between insurers and reinsurers. In this capacity, he does not engage with the public or the policyholders of the insurers he works with.

What does a broker do in reinsurance?

The process of purchasing reinsurance can be time-consuming and complex, which is why many insurance companies rely on the expertise of reinsurance brokers. These brokers possess specialized skills that enable them to secure the best deals while providing comprehensive support both before and after the sale.

What do you need to be a reinsurance broker?

Qualifications & Education No formal academic requirements. Some employers require a degree or equivalent qualification. In-house training is typical. Attendance at courses run by professional institutions may be required. Registration with a regulatory authority may be required in some positions.

How to start a career in reinsurance?

The baseline requirement for becoming a reinsurance analyst is to obtain a bachelor's degree in business fields, such as finance, economics, business management, or accounting, It is particularly advantageous to study a business-related field that involves heavy mathematics.

What is a reinsurance intermediary?

A Reinsurance Intermediary-manager means any person, firm, association, or corporation that has authority to bind, or manages all or part of the assumed reinsurance business of, a reinsurer (including the management of a separate division, department, or underwriting office) and acts as an agent for the reinsurer

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Registration as an Insurance/Reinsurance Intermediary?

It is a formal request made to regulatory authorities for obtaining official recognition to operate as an intermediary in the insurance or reinsurance sector.

Who is required to file Application for Registration as an Insurance/Reinsurance Intermediary?

Any individual or entity that wishes to act as an insurance or reinsurance intermediary must file this application to comply with legal and regulatory requirements.

How to fill out Application for Registration as an Insurance/Reinsurance Intermediary?

The application must be completed by providing accurate and complete information as required by the relevant regulatory body, often including details about the applicant's identity, business activities, and financial standing.

What is the purpose of Application for Registration as an Insurance/Reinsurance Intermediary?

The purpose is to ensure that individuals or entities meet the necessary legal and professional standards to operate safely and effectively in the insurance and reinsurance markets.

What information must be reported on Application for Registration as an Insurance/Reinsurance Intermediary?

The application typically requires identity details, business structure, financial information, proof of qualifications, and any relevant experience in the insurance sector.

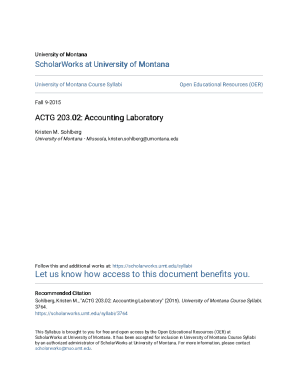

Fill out your application for registration as online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Registration As is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.