TN RV-F1403901 2004 free printable template

Show details

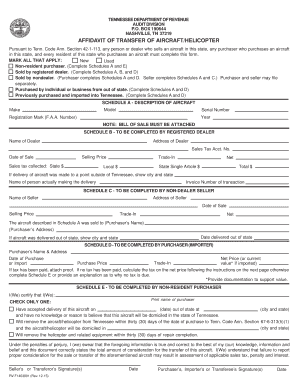

TENNESSEE DEPARTMENT OF REVENUE AUDIT DIVISION P. O. BOX 190644 NASHVILLE TN 37219 AFFIDAVIT OF TRANSFER OF AIRCRAFT/HELICOPTER Pursuant to TCA 42-1-113 any person or dealer who sells an aircraft in this state any purchaser who purchases an aircraft in this state and every resident of this state who purchases an aircraft shall report to the Department of Revenue the following information. MARK ALL THAT APPLY New Used Non-resident purchaser Comple...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TN RV-F1403901

Edit your TN RV-F1403901 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TN RV-F1403901 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TN RV-F1403901 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit TN RV-F1403901. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TN RV-F1403901 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TN RV-F1403901

How to fill out TN RV-F1403901

01

Obtain a copy of the TN RV-F1403901 form from the official website or local office.

02

Read the instructions carefully before starting to fill out the form.

03

Provide your personal information, including your name, address, and contact details in the designated sections.

04

Indicate the type of application you are submitting as per the options given on the form.

05

Complete all required fields accurately to avoid any delays in processing.

06

If applicable, attach any necessary documentation that supports your application.

07

Review the completed form for any errors or omissions.

08

Sign and date the form at the designated section.

09

Submit the form via mail or in person at the appropriate office as instructed.

Who needs TN RV-F1403901?

01

Individuals applying for a vehicle registration or title in Tennessee.

02

Residents of Tennessee who have recently purchased a vehicle.

03

Individuals who need to update their vehicle information or details.

Fill

form

: Try Risk Free

People Also Ask about

What is the use tax on aircraft in Tennessee?

Tennessee applies a 7% state tax on the total amount of consideration, a local tax on the first $1,600, and a State single article tax rate of 2.75% on the following $1,600.

Is Tennessee a fly away state?

Currently, there is no bill activity affecting your state.State Aviation Taxes. Casual Sale “Yard Sale Rule”NoFly Away RuleYesTrade In ValueYesCredit for Tax PaidYesMX Parts ExemptionNo7 more rows

What states do not have aircraft use tax?

Besides, an over-ocean closing for a U.S. aircraft is unnecessary. Several states (Alaska, Connecticut, Delaware, Massachusetts, Montana, New Hampshire, Oregon and Rhode Island) have basically no sales tax on business jet sales.

What is the use tax in Nashville TN?

What is the sales tax rate in Nashville, Tennessee? The minimum combined 2023 sales tax rate for Nashville, Tennessee is 9.25%. This is the total of state, county and city sales tax rates. The Tennessee sales tax rate is currently 7%.

Is there a tax on aircraft?

Overview. California sales tax generally applies to the sale of vehicles, vessels, and aircraft in this state from a registered dealer. Use tax applies to the sale of vehicles, vessels, and aircraft purchased from non-dealers (for example, private parties) or from outside California for use in this state.

How much is use tax in Tennessee?

Tennessee has a 7.00 percent state sales tax rate, a max local sales tax rate of 2.75 percent, and an average combined state and local sales tax rate of 9.55 percent. Tennessee's tax system ranks 14th overall on our 2023 State Business Tax Climate Index.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit TN RV-F1403901 on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing TN RV-F1403901 right away.

Can I edit TN RV-F1403901 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign TN RV-F1403901 on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How can I fill out TN RV-F1403901 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your TN RV-F1403901, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is TN RV-F1403901?

TN RV-F1403901 is a tax form used in the state of Tennessee for reporting and remitting various taxes related to business activities.

Who is required to file TN RV-F1403901?

Businesses operating in Tennessee that are subject to the specific taxes covered by TN RV-F1403901 are required to file this form.

How to fill out TN RV-F1403901?

To fill out TN RV-F1403901, you need to provide your business information, tax identification number, and complete the sections related to the specific taxes you are reporting.

What is the purpose of TN RV-F1403901?

The purpose of TN RV-F1403901 is to facilitate the reporting and payment of state taxes by businesses in Tennessee.

What information must be reported on TN RV-F1403901?

The information that must be reported on TN RV-F1403901 includes business identification details, the type of taxes being reported, the amount owed, and any relevant deductions or exemptions.

Fill out your TN RV-F1403901 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TN RV-f1403901 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.