Get the free U.S. TREAS Form treas-irs-1040-schedule-c-ez-1999

Show details

This form is used by sole proprietors to report net profit from a business with minimal expenses and no employees, allowing a simplified filing compared to Schedule C.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us treas form treas-irs-1040-schedule-c-ez-1999

Edit your us treas form treas-irs-1040-schedule-c-ez-1999 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us treas form treas-irs-1040-schedule-c-ez-1999 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit us treas form treas-irs-1040-schedule-c-ez-1999 online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit us treas form treas-irs-1040-schedule-c-ez-1999. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

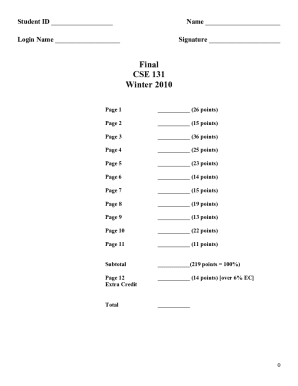

How to fill out us treas form treas-irs-1040-schedule-c-ez-1999

How to fill out U.S. TREAS Form treas-irs-1040-schedule-c-ez-1999

01

Obtain the U.S. TREAS Form 1040 Schedule C-EZ from the IRS website or local IRS office.

02

Fill in your name and Social Security number at the top of the form.

03

Indicate your business name and address if it differs from your own.

04

Provide your principal business activity code.

05

Report your gross receipts or sales for the year.

06

Fill in the total expenses incurred, limited to those allowed in Schedule C-EZ.

07

Calculate your net profit or loss by subtracting total expenses from gross receipts.

08

Sign and date the form before submission.

Who needs U.S. TREAS Form treas-irs-1040-schedule-c-ez-1999?

01

Individuals who are self-employed and earn income from a sole proprietorship.

02

Small business owners with simple business structures and less than $5,000 in expenses.

03

Taxpayers who qualify under the criteria set for using Schedule C-EZ, including the lack of inventory or business loss.

Fill

form

: Try Risk Free

People Also Ask about

What happens if I didn't file a schedule C?

What happens if I don't file a Schedule C form? Not filing a Schedule C form could result in serious financial penalties. Self-employed income is considered taxable income by the IRS, so you want to make sure you are filing one each year.

What is the minimum income to file Schedule C?

There is no minimum income for filing a Schedule C. If you earn any self-employment income you'll need to report it on Schedule C. However, the limit for paying self-employment tax is $400. If you earn less than $400, you typically do not have to file Schedule SE or pay self-employment tax.

Will the IRS catch a missing 1099C?

Will the IRS catch a missing 1099? The IRS knows about any income that gets reported on a 1099, even if you forgot to include it on your tax return. This is because a business that sends you a Form 1099 also reports the information to the IRS.

Will a schedule C trigger an audit?

When you're filing your taxes for the year, your Schedule C form will show your reported income. If you incorrectly report your income, it can increase your chance of being audited. This includes: Reporting a higher-than-average income.

What happens if I don't file a schedule C?

What happens if I don't file a Schedule C form? Not filing a Schedule C form could result in serious financial penalties. Self-employed income is considered taxable income by the IRS, so you want to make sure you are filing one each year.

Who fills out a 1040 schedule C form?

Who files a Schedule C tax form? If you're self-employed and set up your business as a sole proprietorship (not registered as multi-member LLC or corporation) or single-member LLC taxed as a sole proprietorship, you should file Schedule C with your Form 1040 to report the profit or loss for your business.

Does the IRS look at Schedule C?

The IRS has audited significantly less than 1% of all individual returns in recent years, so most taxpayers can rest easy. But if you file a Schedule C to report profit or loss from a business, your odds of drawing additional IRS scrutiny go up. Schedule C is a treasure trove of tax deductions for self-employed people.

What is the Schedule C tax form used for?

Use Schedule C (Form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole proprietor. An activity qualifies as a business if your primary purpose for engaging in the activity is for income or profit and you are involved in the activity with continuity and regularity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is U.S. TREAS Form treas-irs-1040-schedule-c-ez-1999?

U.S. TREAS Form 1040 Schedule C-EZ (1999) is a simplified tax form used by sole proprietors to report income and expenses from their business with less complexity than the standard Schedule C.

Who is required to file U.S. TREAS Form treas-irs-1040-schedule-c-ez-1999?

Businesses that meet certain criteria, such as having no inventory, no losses, and total expenses under $5,000, are required to file U.S. TREAS Form 1040 Schedule C-EZ - typically sole proprietors with simpler financial situations.

How to fill out U.S. TREAS Form treas-irs-1040-schedule-c-ez-1999?

To fill out U.S. TREAS Form 1040 Schedule C-EZ, you need to provide basic information about your business, report gross receipts, and summarize your business expenses. Instructions for each line item are included with the form.

What is the purpose of U.S. TREAS Form treas-irs-1040-schedule-c-ez-1999?

The purpose of U.S. TREAS Form 1040 Schedule C-EZ is to allow sole proprietors to report their business income and claim eligible expenses for tax purposes in a streamlined manner.

What information must be reported on U.S. TREAS Form treas-irs-1040-schedule-c-ez-1999?

Information that must be reported includes your business name, type of business, gross income, total business expenses, and net profit or loss from the business.

Fill out your us treas form treas-irs-1040-schedule-c-ez-1999 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Treas Form Treas-Irs-1040-Schedule-C-Ez-1999 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.