Get the free Application for family allowances for a salaried employee - cvcicaisseavs

Show details

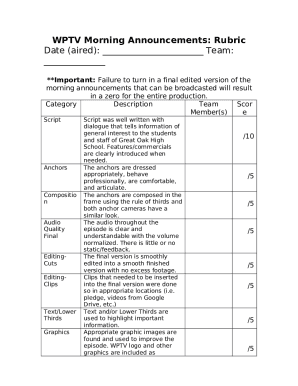

This document is an application form for family allowances for salaried employees, detailing the required information for claimants and their employers regarding family status, employment, and child

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for family allowances

Edit your application for family allowances form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for family allowances form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for family allowances online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit application for family allowances. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for family allowances

How to fill out Application for family allowances for a salaried employee

01

Obtain the Application for Family Allowances form from your employer or the relevant government agency.

02

Fill out your personal information at the top of the form including your name, address, and contact number.

03

Provide your employment details such as your job title, salary, and length of employment.

04

List the names and birth dates of each child or dependent for whom you are claiming allowances.

05

Indicate your marital status and provide details of your spouse if applicable.

06

Attach any required documents such as birth certificates of children or proof of your employment.

07

Review the completed application for accuracy and completeness.

08

Sign and date the application form.

09

Submit the application to your employer or the designated agency as instructed.

Who needs Application for family allowances for a salaried employee?

01

Salaried employees with dependent children or family members who qualify for financial assistance.

02

Employees who have recently experienced changes in family status, such as marriage or new children.

03

Individuals seeking to claim government-provided family allowances as part of their employee benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is the education allowance in Geneva?

Education allowances: You can receive an education allowance for children aged 16-25 while they are completing their initial education (including apprenticeships). Allowances vary between cantons, but cannot be lower than 268 francs per month and child.

What country pays the highest child benefit?

The level of the package varies within and between countries by the number of children, type of family and by earnings. Austria, Luxembourg and Finland have the most generous package. After charges for services and housing costs a number of countries provide no support for children.

How much money do you get per child in Switzerland?

Table 1: Family allowance entitlements per child and month CantonChild allowanceEducation allowance Vaud Child 1-2: CHF 300 Additional children: CHF 340 Child 1-2: CHF 400 Additional children: CHF 440 Zug CHF 330 Age 16-18: CHF 330 Age 18+: CHF 385 Zurich Age 0-12: CHF 215 Age 12-16: CHF 268 CHF 26823 more rows • Jan 6, 2025

What are family allowances?

Family allowance gives a surviving spouse and children access to a passing spouse or parent's estate in the interim between passing and the distribution of the estate . The family allowance gives spouses and children necessary financial support that is determined by statute in each state.

What are the family allowances in Geneva?

The maximum allowance is CHF 329.60 per day, for 112 days. In case of motherhood, the Geneva allowances compensate the Federal allowances. In case of adoption, the allowances are paid to the mother or the father. The base allowance corresponds to 80% of the average income earned before the birth of the child.

How much does Switzerland pay per child?

How much do I receive? You receive a monthly allowance of CHF 215 for each child aged 0 to 16 (or until the age of 20 if the child is not working due to a health problems). For children in education up to the age of 25, the allowance is CHF 268 a month.

What is the child allowance in Switzerland 2025?

From 2025, the minimum rates for child and education allowances will be increased. Child allowance will increase from CHF 200 to CHF 215 per month, while education allowance will increase from CHF 250 to CHF 268 per month.

Does Switzerland provide money to families with kids?

There are three different family allowances: (1) child allowances, which by federal law since 2009 have to be at least CHF 200 per month,4 (2) education allowances, which by federal law have to be at least CHF 250 per month, and (3) the one‐time birth payment with no federal minimum payout.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for family allowances for a salaried employee?

The Application for family allowances for a salaried employee is a formal document that employees submit to request financial support from the government to cover the costs of raising children or dependents.

Who is required to file Application for family allowances for a salaried employee?

Salaried employees who have dependent children or dependents meeting specific eligibility criteria are required to file this application to receive family allowances.

How to fill out Application for family allowances for a salaried employee?

To fill out the Application for family allowances, employees need to provide personal information, details about their dependents, employment information, and any necessary documentation, ensuring all fields are completed accurately.

What is the purpose of Application for family allowances for a salaried employee?

The purpose of the Application for family allowances is to provide financial assistance to employees in order to support them in meeting the costs associated with raising children and managing family responsibilities.

What information must be reported on Application for family allowances for a salaried employee?

The application must report personal identification details, employment information, the number of dependents, their ages, proof of relationship, and any other relevant financial information required by the authorities.

Fill out your application for family allowances online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Family Allowances is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.