Get the free Foundation for Vested Pension Benefits - docs liberty-vorsorge

Show details

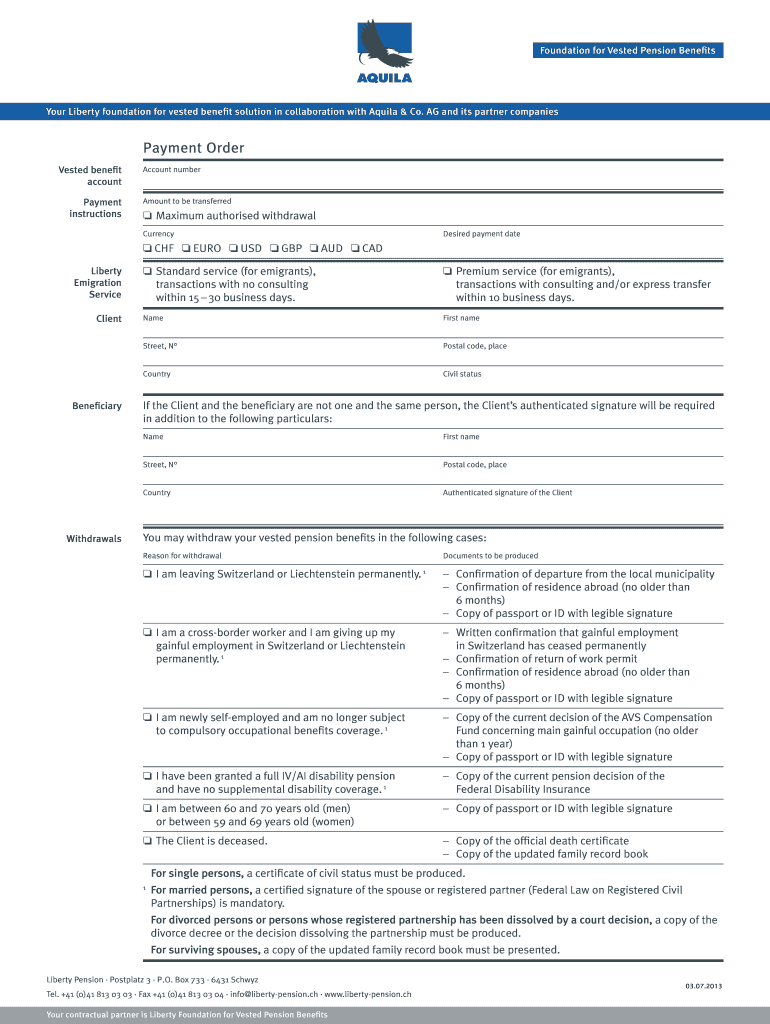

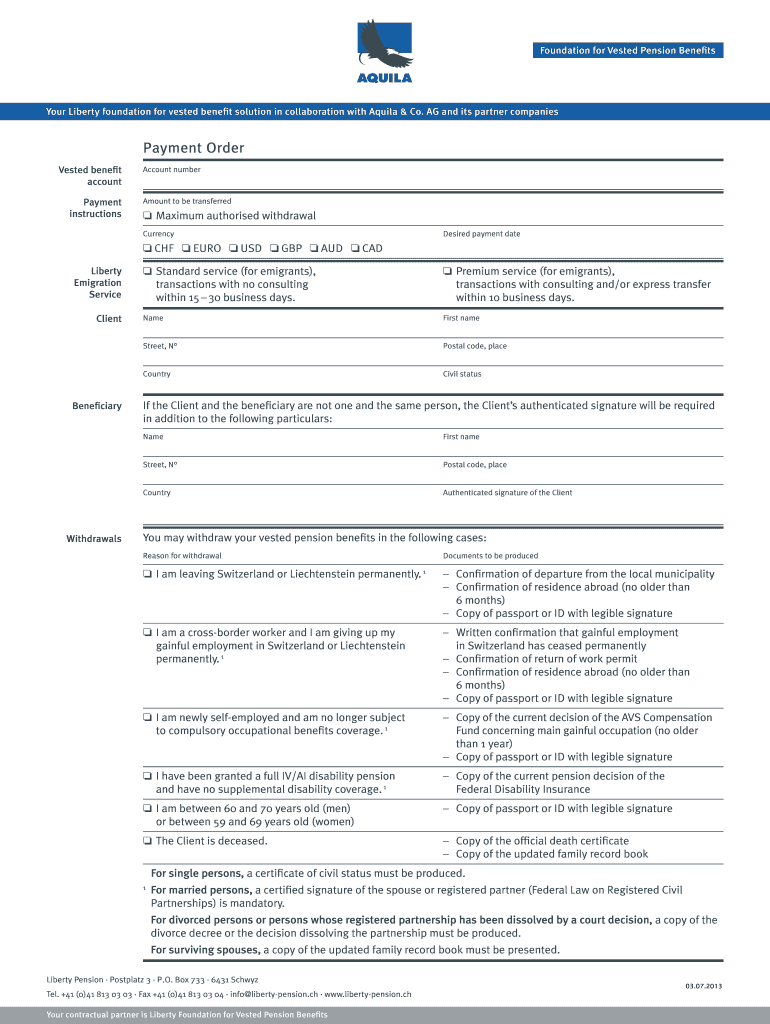

This document serves as a payment order for the withdrawal of vested pension benefits, including instructions and requirements related to different types of withdrawals.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foundation for vested pension

Edit your foundation for vested pension form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foundation for vested pension form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit foundation for vested pension online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit foundation for vested pension. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out foundation for vested pension

How to fill out Foundation for Vested Pension Benefits

01

Gather your personal information, including your Social Security number and employment details.

02

Obtain the Foundation for Vested Pension Benefits form from the relevant pension plan provider or website.

03

Read the instructions carefully before starting to fill out the form.

04

Fill in your name, address, and contact information in the designated sections.

05

Provide your employment history, including the names of previous employers and the durations of your employment.

06

Indicate any other relevant financial information as required, such as previous pension benefits received.

07

Review your entries for accuracy and completeness.

08

Sign and date the form to certify that the information provided is correct.

09

Submit the completed form to the appropriate pension plan provider via mail or online submission, as per their guidelines.

Who needs Foundation for Vested Pension Benefits?

01

Individuals who have participated in a pension plan and are entitled to vested benefits.

02

Employees transitioning to new jobs who need to understand their pension benefits.

03

Retirees seeking to claim their pension benefits from previous employers.

04

Financial advisers helping clients manage their retirement plans.

Fill

form

: Try Risk Free

People Also Ask about

What is the fee for UBS vested benefits account?

The account maintenance fee for the vested benefits account is CHF 3 per month.

What does vested benefit mean?

A vested benefit is a financial package granted to employees who have met the requirements to receive a full, instead of partial, benefit. Vested benefits include cash, employee stock options (ESO), health insurance, 401(k) plans, retirement plans, and pensions.

What is a vested pension benefit?

“Vesting” in a retirement plan means ownership. This means that each employee will vest, or own, a certain percentage of their account in the plan each year. An employee who is 100% vested in his or her account balance owns 100% of it and the employer cannot forfeit, or take it back, for any reason.

How long does it take to be fully vested in pension?

If you're like most public workers, you probably have to work five to seven years before you can qualify for any pension benefits — reaching this threshold is known as vesting. Before vesting, no pension benefits have been guaranteed.

What is the meaning of vesting benefits?

If you were 55 or older on T-day but transferred to a new fund after T-day, your T-day vested benefit is your retirement savings up to the date of your transfer to the new fund. Your T-day non-vested benefit is all your retirement savings in the new fund.

What is the difference between vested and non vested benefits?

A vested benefits account can be regarded as a kind of parking space where your personal retirement savings are kept until you have a new employer. Your vested pension capital thus remains secure until you have found a new professional challenge.

What is a vested benefits foundation?

The purpose of the vested benefits foundation is to preserve the pension assets accumulated in the area of occupational pension provision. Once you start a new job you are legally required to transfer your vested benefits to the pension fund to which your new employer is affiliated.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Foundation for Vested Pension Benefits?

The Foundation for Vested Pension Benefits is an organization or initiative focused on ensuring that individuals receive their legally entitled pension benefits when they reach retirement age, particularly for vested pensions.

Who is required to file Foundation for Vested Pension Benefits?

Employers who maintain pension plans and are required to report on vested benefits for their employees must file with the Foundation for Vested Pension Benefits.

How to fill out Foundation for Vested Pension Benefits?

To fill out the Foundation for Vested Pension Benefits form, an employer should gather relevant information regarding the pension plan, including details of vested benefits, participating employees, and any necessary financial data before completing the specific sections of the form as instructed.

What is the purpose of Foundation for Vested Pension Benefits?

The purpose of the Foundation for Vested Pension Benefits is to provide a framework for the protection and distribution of pension benefits to eligible individuals, ensuring they receive what they are entitled to upon retirement.

What information must be reported on Foundation for Vested Pension Benefits?

The Foundation for Vested Pension Benefits requires reporting information such as the name of the pension plan, details of vested benefits, identification of participating employees, and financial disclosures relevant to the pension program.

Fill out your foundation for vested pension online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foundation For Vested Pension is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.