Get the free Switzerland – 2010 Investment Management Market Report – Growth opportunities for as...

Show details

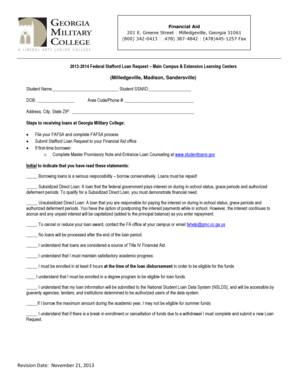

This document is an order form for subscribing to the 2010 I&F-Lusenti survey regarding growth opportunities for asset managers in Switzerland. It includes details for submission and pricing information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign switzerland 2010 investment management

Edit your switzerland 2010 investment management form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your switzerland 2010 investment management form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit switzerland 2010 investment management online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit switzerland 2010 investment management. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out switzerland 2010 investment management

How to fill out Switzerland – 2010 Investment Management Market Report – Growth opportunities for asset managers

01

Obtain the Switzerland – 2010 Investment Management Market Report from a reliable source.

02

Review the executive summary to understand key findings.

03

Identify sections relevant to growth opportunities for asset managers.

04

Collect data on current market trends in asset management within Switzerland.

05

Analyze demographic information to assess potential client bases.

06

Note regulations that impact asset management in Switzerland.

07

Explore case studies or examples of successful asset managers in the report.

08

Summarize actionable insights for your own asset management strategies.

09

Prepare a presentation of findings for stakeholders or team members.

Who needs Switzerland – 2010 Investment Management Market Report – Growth opportunities for asset managers?

01

Asset management firms looking to expand in the Swiss market.

02

Financial analysts studying investment opportunities.

03

Institutional investors seeking insights on market trends.

04

Regulatory bodies interested in asset management dynamics.

05

Consultants advising clients on asset positioning in Switzerland.

Fill

form

: Try Risk Free

People Also Ask about

Who is the No. 1 asset manager?

Largest companies RankFirm/companyAssets Under Management (billion USD) 1 BlackRock 10,473 2 Vanguard Group 9,300 3 Fidelity Investments 5,303 4 State Street Global Advisors 4,34016 more rows

Who is the largest asset manager in Switzerland?

Leading Swiss headquartered asset managers 2023, by assets under management. UBS was the leading asset manager headquartered in Switzerland as of December 31, 2023, by global assets under management (AUM).

Who are the top 5 global asset managers?

Managers ranked by total worldwide institutional assets under management #Name2022 1 Vanguard Group $5,024,824 2 BlackRock $4,834,449 3 State Street Global $2,414,580 4 Fidelity Investments $1,731,5996 more rows

What is the growth rate of the asset management market?

The global asset management market size was estimated at USD 458.02 billion in 2023 and is projected to grow at a CAGR of 36.4% from 2024 to 2030. The market's growth is increasing owing to rapid digital change, technological advances, and the efforts of test asset management in the industry.

Who is the No. 1 asset manager?

Largest companies RankFirm/companyAssets Under Management (billion USD) 1 BlackRock 10,473 2 Vanguard Group 9,300 3 Fidelity Investments 5,303 4 State Street Global Advisors 4,34016 more rows

Why don t more asset managers invest in ESG strategies?

The next-biggest factors were an apparent lack of demand from clients and the recent anti-ESG politicization, Fox said. But for others, greenwashing is also a concern, he said. Meanwhile, asset managers have obviously toned down marketing efforts around sustainable investing on the retail side of business, he said.

Who are the big 3 asset managers?

As the largest asset management firms in the world, the Big Three (BlackRock, Vanguard, and State Street Global Advisors) are at the heart of this debate.

Who is the best asset manager in the world?

RankProfileRegion 1. BlackRock North America 2. Vanguard North America 3. Fidelity Management & Research North America 4. Forethought Investment Management Inc. North America94 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Switzerland – 2010 Investment Management Market Report – Growth opportunities for asset managers?

The Switzerland – 2010 Investment Management Market Report provides an analysis of the investment landscape in Switzerland, highlighting growth opportunities for asset managers in various sectors, including equity, fixed income, and alternative investments.

Who is required to file Switzerland – 2010 Investment Management Market Report – Growth opportunities for asset managers?

Asset managers and investment firms operating in Switzerland are required to file the report to comply with regulatory obligations and maintain transparency within the financial market.

How to fill out Switzerland – 2010 Investment Management Market Report – Growth opportunities for asset managers?

The report can be filled out by providing accurate financial data, investment strategies, market trends, and client demographics, based on the prescribed format and guidelines provided by the regulatory authorities.

What is the purpose of Switzerland – 2010 Investment Management Market Report – Growth opportunities for asset managers?

The purpose of the report is to assess the current market conditions, identify growth opportunities within the investment management sector, and provide insights to help asset managers make informed decisions.

What information must be reported on Switzerland – 2010 Investment Management Market Report – Growth opportunities for asset managers?

The report must include information such as assets under management, investment performance metrics, risk assessment, client profiles, regulatory compliance status, and strategic growth plans.

Fill out your switzerland 2010 investment management online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Switzerland 2010 Investment Management is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.