Get the free Foundation for Vested Pension Benefits - liberty-pension

Show details

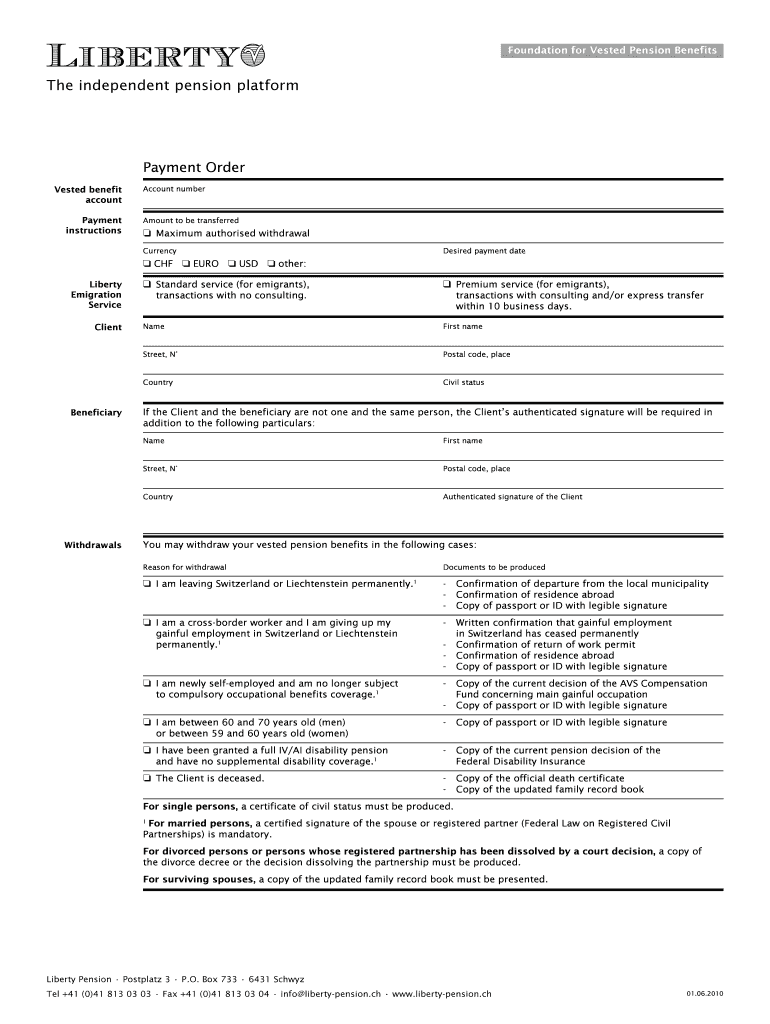

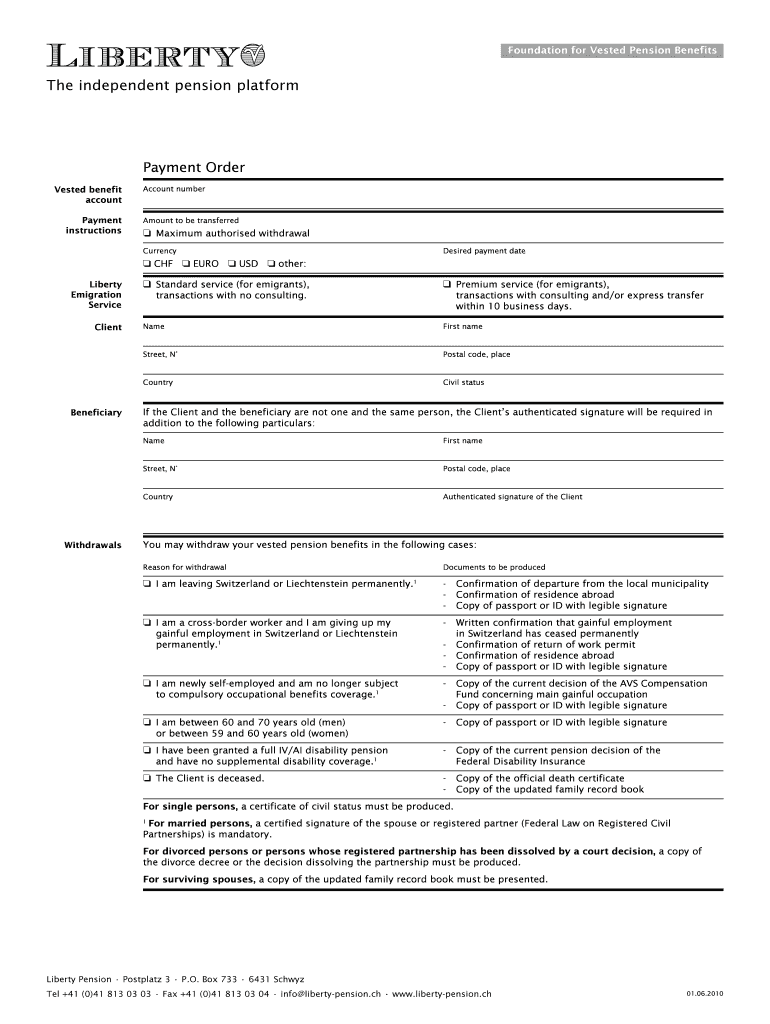

This document serves as a payment order for vested pension benefits, detailing withdrawal instructions, beneficiary information, required documents, and signatures needed for withdrawals.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign foundation for vested pension

Edit your foundation for vested pension form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your foundation for vested pension form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit foundation for vested pension online

Use the instructions below to start using our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit foundation for vested pension. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out foundation for vested pension

How to fill out Foundation for Vested Pension Benefits

01

Obtain the Foundation for Vested Pension Benefits form from your employer or pension plan administrator.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill in your personal information, including your name, address, and social security number.

04

Indicate your employment details, such as your job title, department, and dates of employment.

05

Provide information regarding your pension plan, including the name of the plan and any identification numbers.

06

If applicable, include any past pension plans you may have participated in.

07

Review all the information you've entered to ensure accuracy.

08

Sign and date the form to certify that the information is correct.

09

Submit the completed form to the designated address as stated in the instructions.

Who needs Foundation for Vested Pension Benefits?

01

Employees who have earned pension benefits but have not yet retired.

02

Individuals who are transitioning jobs and want to know about their vested pension benefits.

03

People seeking to understand their retirement options based on their pension plans.

04

Anyone who has questions regarding the status of their vested pension benefits.

Fill

form

: Try Risk Free

People Also Ask about

What is a vested pension benefit?

“Vesting” in a retirement plan means ownership. This means that each employee will vest, or own, a certain percentage of their account in the plan each year. An employee who is 100% vested in his or her account balance owns 100% of it and the employer cannot forfeit, or take it back, for any reason.

What is the difference between vested and non vested benefits?

A vested benefits account can be regarded as a kind of parking space where your personal retirement savings are kept until you have a new employer. Your vested pension capital thus remains secure until you have found a new professional challenge.

How long does it take to be fully vested in pension?

If you're like most public workers, you probably have to work five to seven years before you can qualify for any pension benefits — reaching this threshold is known as vesting. Before vesting, no pension benefits have been guaranteed.

What is a vested benefits foundation?

The purpose of the vested benefits foundation is to preserve the pension assets accumulated in the area of occupational pension provision. Once you start a new job you are legally required to transfer your vested benefits to the pension fund to which your new employer is affiliated.

What does vested benefit mean?

A vested benefit is a financial package granted to employees who have met the requirements to receive a full, instead of partial, benefit. Vested benefits include cash, employee stock options (ESO), health insurance, 401(k) plans, retirement plans, and pensions.

What is the fee for UBS vested benefits account?

The account maintenance fee for the vested benefits account is CHF 3 per month.

What is the meaning of vesting benefits?

If you were 55 or older on T-day but transferred to a new fund after T-day, your T-day vested benefit is your retirement savings up to the date of your transfer to the new fund. Your T-day non-vested benefit is all your retirement savings in the new fund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Foundation for Vested Pension Benefits?

The Foundation for Vested Pension Benefits is an organization that oversees and manages financial resources for vested pension benefits to ensure that employees receive the retirement compensation they are entitled to.

Who is required to file Foundation for Vested Pension Benefits?

Employers who offer pension plans are typically required to file with the Foundation for Vested Pension Benefits to report the status and funding of their pension plans.

How to fill out Foundation for Vested Pension Benefits?

To fill out the Foundation for Vested Pension Benefits, employers need to gather necessary financial documentation, complete the required forms detailing plan specifics, fund status, and submit it by the prescribed deadlines.

What is the purpose of Foundation for Vested Pension Benefits?

The purpose of the Foundation for Vested Pension Benefits is to protect the interests of employees entitled to pension benefits and ensure that companies fulfill their pension obligations.

What information must be reported on Foundation for Vested Pension Benefits?

Employers must report information such as the total number of participants, funding status, contributions made, and any changes to the pension plan provisions.

Fill out your foundation for vested pension online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Foundation For Vested Pension is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.