Freedom School Zero Your Account Now 2007-2025 free printable template

Show details

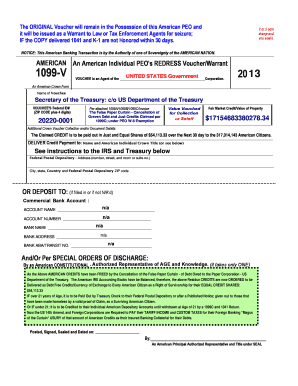

Zero your account NOW! Stop being a tax delinquent FUGITIVE!

1 Latest revision March 18, 2007. NOTICE: We are not attorneys nor are we acting in any capacity as legal counsel. The information provided

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign zero out your account pdf form

Edit your zero your form fill form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your zero out the account form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit zero your account now pdf online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit zero out your account form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out zero the account form

How to fill out Freedom School Zero Your Account Now

01

Visit the Freedom School Zero website.

02

Locate the 'Sign Up' or 'Create Account' button on the homepage.

03

Fill in the required personal information, including your name, email address, and password.

04

Review and accept the terms and conditions.

05

Confirm your email address by clicking on the link sent to your registered email.

06

Log in to your new account using your credentials.

Who needs Freedom School Zero Your Account Now?

01

Parents looking for educational resources for their children.

02

Students seeking additional learning opportunities.

03

Educators wanting to share materials or connect with others.

04

Community members interested in supporting local education initiatives.

Video instructions and help with filling out and completing zero your account

Instructions and Help about dom School Zero Your Account Now

Fill

form

: Try Risk Free

People Also Ask about

Does the IRS have access to all my bank accounts?

The Short Answer: Yes. Share: The IRS probably already knows about many of your financial accounts, and the IRS can get information on how much is there.

Can the IRS touch my savings account?

It can garnish wages, take money in your bank or other financial account, seize and sell your vehicle(s), real estate and other personal property. If you receive an IRS bill titled Final Notice of Intent to Levy and Notice of Your Right to A Hearing, contact us right away.

What bank account can the IRS not touch?

In fact, there is not a type of bank accounts the IRS can't touch. So, the answer to the following three often-asked questions about the seizure of properties by IRS a definite YES.

Do I owe federal income tax liabilities?

Generally, you have a tax liability when you earn income or generate profits by selling an investment or other asset. It is possible to have no income tax liability if you don't meet the income requirements to file taxes.

What makes you owe federal taxes?

But at the end of the day, a tax bill boils down to simple math: You owe more taxes than you paid throughout the year. That usually means you didn't have enough money withheld from your paycheck to cover taxes.

Do I owe federal income tax?

Determining if you owe back taxes may be as simple as filing or amending a previous year's tax return. Contact the IRS at 800-829-1040. You can also call the IRS to get more information on your outstanding tax bill.

How can I avoid owing federal taxes?

What's the best way to avoid an underpayment penalty? Your tax withholding must be equal to at least 90% of your current year's tax liability—or 100% of your previous year's tax liability (110% if your adjusted gross income [AGI] was $150,000 or more)—whichever number is less.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send dom School Zero Your Account Now for eSignature?

Once you are ready to share your dom School Zero Your Account Now, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I get dom School Zero Your Account Now?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the dom School Zero Your Account Now in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for signing my dom School Zero Your Account Now in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your dom School Zero Your Account Now right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is Freedom School Zero Your Account Now?

Freedom School Zero Your Account Now is an educational initiative aimed at promoting financial literacy and self-management skills for individuals, particularly focusing on the principles of personal finance and budgeting.

Who is required to file Freedom School Zero Your Account Now?

Individuals participating in the Freedom School program, especially those managing their finances or seeking financial education, are encouraged to complete the Freedom School Zero Your Account Now filing as part of their learning process.

How to fill out Freedom School Zero Your Account Now?

To fill out the Freedom School Zero Your Account Now, participants need to gather their financial information, follow the provided guidelines in the program manual, and submit their completed forms through the designated channels outlined by the Freedom School.

What is the purpose of Freedom School Zero Your Account Now?

The purpose of Freedom School Zero Your Account Now is to educate participants on managing their finances effectively, ensuring they understand their financial status, and empowering them to make informed financial decisions.

What information must be reported on Freedom School Zero Your Account Now?

The information that must be reported includes personal financial details such as income, expenses, savings, debts, and any other relevant financial data that can provide a comprehensive overview of the individual's financial situation.

Fill out your dom School Zero Your Account Now online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dom School Zero Your Account Now is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.