Get the free Publication 1346 - irs

Show details

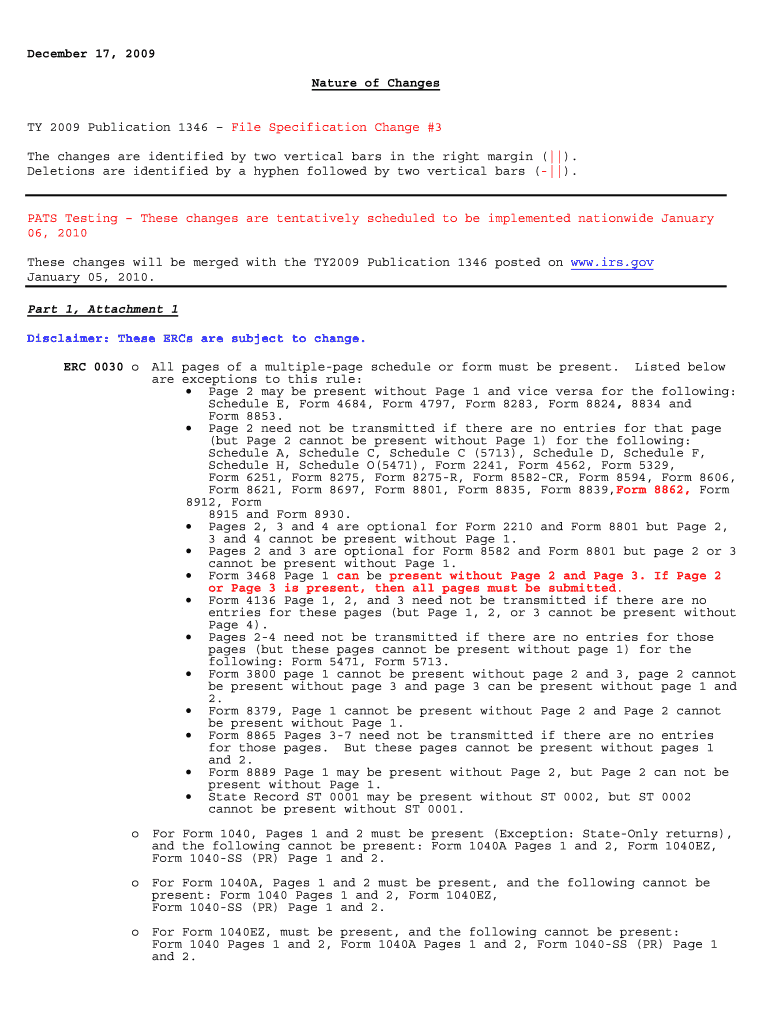

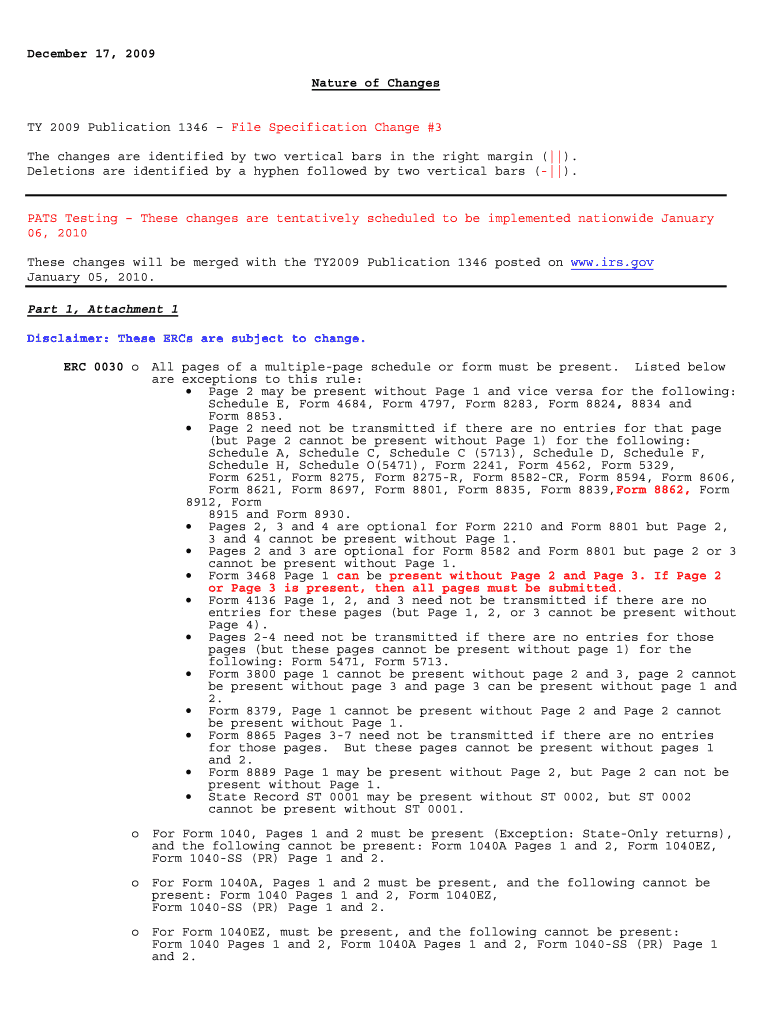

This document outlines changes to the TY 2009 Publication 1346 related to file specifications, including exceptions for multiple-page forms, relevant guidelines for tax forms, definitions, and various

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign publication 1346 - irs

Edit your publication 1346 - irs form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publication 1346 - irs form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit publication 1346 - irs online

Follow the steps below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit publication 1346 - irs. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out publication 1346 - irs

How to fill out Publication 1346

01

Obtain a copy of Publication 1346 from the IRS website or local IRS office.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill in your personal information at the top of the form including your name, address, and taxpayer identification number.

04

Complete the relevant sections by providing details about the specific tax years and entries related to your situation.

05

Review all information entered to ensure accuracy.

06

Sign and date the form before submitting it to the appropriate mailing address provided in the instructions.

07

Keep a copy of the completed form for your records.

Who needs Publication 1346?

01

Taxpayers who have made adjustments to their returns and need to notify the IRS.

02

Individuals seeking to claim a tax refund due to changes or corrections on previous filings.

03

Those who have received a notice from the IRS regarding changes in their tax circumstances.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS short ID?

The Short ID is a unique 8-10 alphanumeric code that is systemically assigned when an IRS account is established.

What time does the IRS close for calls?

For individual tax returns, call 1-800-829-1040, 7 AM - 7 PM Monday through Friday local time. The wait time to speak with a representative may be long. This option works best for less complex questions.

What is the cut-off time for efile?

15th day of the 6th month after the original due date of the return. Rejected timely-filed returns are given 5 calendar days past all return due dates to be retransmitted and considered timely. When the due date falls on a weekend or holiday, the deadline is extended to the next business day.

What time does IRS efile close?

IRS annual e-file closures information: Return typeIRS closesIntuit closes Individual (1040) November 30, 2024 8:59 PM November 30, 2024 5:00 PM Business (All others) December 26, 2024 8:59 AM December 21, 2024 6:00 PM

Is the efile deadline at midnight?

The filing deadline for 1040 individual income tax returns is April 15th. Federal individual income tax returns filed by midnight April 15, will be considered timely filed by the IRS.

Is the IRS efile closed?

IRS annual e-file closures information: E-Filing for all 2021 business returns was shut down on December 26, 2024. Tax year 2022 and 2023 individual returns will not be able to be e-filed during the shut down but will resume on January 27, 2025.

What does "irs" mean in English?

: abbreviation for Internal Revenue Service: the U.S. government department that is responsible for calculating and collecting taxes: The IRS grants tax exemptions for charities and community organizations.

What is the IRS helpline for tax preparers?

855-889-7959, or by regular mail.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Publication 1346?

Publication 1346 is a document published by the IRS that provides guidelines and instructions for taxpayers regarding the reporting and filing of certain tax information.

Who is required to file Publication 1346?

Taxpayers who have certain types of income or financial transactions that fall under the reporting requirements specified in Publication 1346 are required to file it.

How to fill out Publication 1346?

To fill out Publication 1346, taxpayers need to follow the instructions provided in the publication, which typically include providing specific information about income, deductions, and any relevant financial activities.

What is the purpose of Publication 1346?

The purpose of Publication 1346 is to ensure taxpayers clearly understand their reporting obligations and the necessary steps to comply with IRS regulations.

What information must be reported on Publication 1346?

The information that must be reported on Publication 1346 typically includes details about income earned, taxes withheld, and other relevant financial data specific to the individual's tax situation.

Fill out your publication 1346 - irs online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Publication 1346 - Irs is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.