Get the free FTSE® 100 Tracker Fund Non-ISA Application

Show details

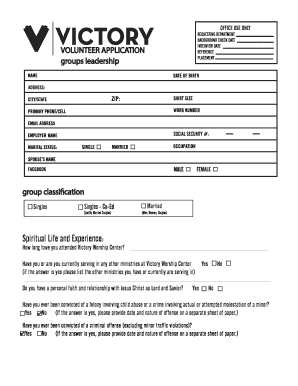

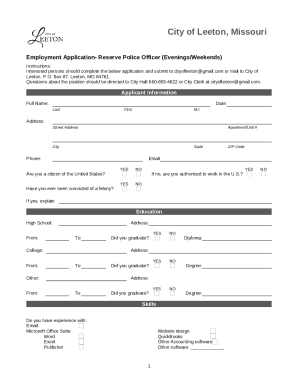

This document is an application form for the FTSE® 100 Tracker Fund provided by RBS Collective Investment Funds Ltd, requiring personal and investment details from applicants. It outlines how to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ftse 100 tracker fund

Edit your ftse 100 tracker fund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ftse 100 tracker fund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ftse 100 tracker fund online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ftse 100 tracker fund. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ftse 100 tracker fund

How to fill out FTSE® 100 Tracker Fund Non-ISA Application

01

Obtain the FTSE® 100 Tracker Fund Non-ISA Application form from the fund's official website or your financial advisor.

02

Fill in your personal details including your name, address, and contact information in the designated sections.

03

Provide information regarding your financial situation, including income, existing investments, and expenses, as required.

04

Choose the amount you wish to invest in the FTSE® 100 Tracker Fund and specify the investment method (lump sum or regular contributions).

05

Review the terms and conditions associated with the fund, ensuring you understand the risks and fees.

06

Sign and date the application form to confirm your agreement to the fund's terms.

07

Submit the completed application form along with any required identification documents to the fund provider.

Who needs FTSE® 100 Tracker Fund Non-ISA Application?

01

Investors looking for a cost-effective way to gain exposure to the UK stock market.

02

Individuals seeking long-term investment options for retirement or savings goals.

03

People who prefer a passive investment strategy that tracks the performance of the FTSE 100 index.

04

Anyone who is not using an ISA but still wants to invest in a tax-efficient manner.

Fill

form

: Try Risk Free

People Also Ask about

What is the best FTSE 100 tracker fund?

Return comparison of all FTSE 100 ETFs ETF2025 in %2021 in % Vanguard FTSE 100 UCITS ETF (GBP) Accumulating + 7.80% +18.29% HSBC FTSE 100 UCITS ETF GBP + 7.55% +18.33% Xtrackers FTSE 100 UCITS ETF 1C + 6.78% +18.25% iShares Core FTSE 100 UCITS ETF GBP (Acc) + 6.72% +18.28%7 more rows

Is there a FTSE 100 Index Fund?

Fund aim. The investment objective of the fund is to track the performance of the FTSE 100 Index (less withholding tax where applicable) to within +/-0.25% p.a. for two years out of three.

How to invest in FTSE 100 from the USA?

Yes, American investors can invest in the FTSE 100. The best way to do this is to invest in exchange-traded funds. There are funds that focus on replicating, tracking, and shorting the companies of the index. Examples include iShares Core FTSE 100 UCITS, Vanguard FTSE 100 UCITS, and HSBC FTSE 100 UCITS.

How to invest in FTSE 100 tracker?

Perhaps the most direct way to invest in the FTSE 100 is to buy individual shares of FTSE 100 companies on a share dealing platform. If the shares you buy go up in value, you'll make a profit when you sell them. Shareholders also usually receive regular dividends, linked to the profits made by the company.

How to invest in a FTSE 100 tracker?

How to invest in FTSE tracker funds with ii Open an account. It only takes a few minutes to get started. Choose your index tracker fund(s) We've included several FTSE tracker funds in our Super 60 investment list. Choose how you want to invest. We've made it simple:

What is the FTSE 100 Index ISA?

When you invest in a FTSE 100 index tracker ISA, your money will be instantly spread across the underlying shares in the index. This means that your investment is diversified and you will be less vulnerable to large swings in the value of individual companies compared to if you invested in them directly.

Which is the best FTSE 100 tracker?

Return comparison of all FTSE 100 ETFs ETF2025 in %2021 in % Vanguard FTSE 100 UCITS ETF (GBP) Accumulating + 7.80% +18.29% HSBC FTSE 100 UCITS ETF GBP + 7.55% +18.33% Xtrackers FTSE 100 UCITS ETF 1C + 6.78% +18.25% iShares Core FTSE 100 UCITS ETF GBP (Acc) + 6.72% +18.28%7 more rows

How to invest in FTSE 100 from the USA?

Yes, American investors can invest in the FTSE 100. The best way to do this is to invest in exchange-traded funds. There are funds that focus on replicating, tracking, and shorting the companies of the index. Examples include iShares Core FTSE 100 UCITS, Vanguard FTSE 100 UCITS, and HSBC FTSE 100 UCITS.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FTSE® 100 Tracker Fund Non-ISA Application?

The FTSE® 100 Tracker Fund Non-ISA Application is a financial document used by investors to apply for investment in the FTSE 100 Tracker Fund outside of an Individual Savings Account (ISA). It allows investors to gain exposure to the performance of the FTSE 100 Index.

Who is required to file FTSE® 100 Tracker Fund Non-ISA Application?

Individuals or entities wanting to invest in the FTSE 100 Tracker Fund outside of a tax-advantaged ISA are required to file this application.

How to fill out FTSE® 100 Tracker Fund Non-ISA Application?

To fill out the FTSE 100 Tracker Fund Non-ISA Application, applicants need to provide personal identification details, confirm their eligibility, specify the amount they wish to invest, and sign the form to authorize the investment.

What is the purpose of FTSE® 100 Tracker Fund Non-ISA Application?

The purpose of the FTSE 100 Tracker Fund Non-ISA Application is to formally initiate the process for investing in the FTSE 100 Index through the Tracker Fund, enabling investors to diversify their portfolios and participate in the performance of leading UK companies.

What information must be reported on FTSE® 100 Tracker Fund Non-ISA Application?

The information that must be reported includes personal identification details (such as name, address, and date of birth), tax residency status, the amount intended for investment, and any relevant financial information to ensure compliance with regulatory requirements.

Fill out your ftse 100 tracker fund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ftse 100 Tracker Fund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.