Get the free Proposed Rule on Exchange-Traded Funds - sec

Show details

The Securities and Exchange Commission is proposing a new rule under the Investment Company Act of 1940 that exempts exchange-traded funds from certain provisions of the Act. It aims to reduce regulatory

We are not affiliated with any brand or entity on this form

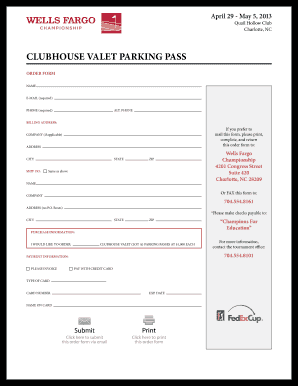

Get, Create, Make and Sign proposed rule on exchange-traded

Edit your proposed rule on exchange-traded form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your proposed rule on exchange-traded form via URL. You can also download, print, or export forms to your preferred cloud storage service.

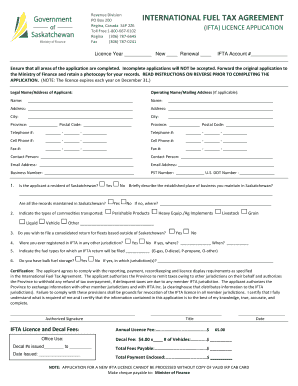

Editing proposed rule on exchange-traded online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit proposed rule on exchange-traded. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out proposed rule on exchange-traded

How to fill out Proposed Rule on Exchange-Traded Funds

01

Begin by reviewing the Proposed Rule on Exchange-Traded Funds to understand its purpose and requirements.

02

Gather all necessary documentation and data required to support your submission.

03

Complete any required forms or sections specified in the Proposed Rule.

04

Ensure clarity and accuracy in your responses, providing detailed explanations where needed.

05

Submit your completed form through the designated channels, ensuring you meet any specified deadlines.

06

Keep a copy of your submission for your records.

Who needs Proposed Rule on Exchange-Traded Funds?

01

Investment fund managers seeking to create or modify Exchange-Traded Funds.

02

Regulatory bodies and agencies to ensure compliance with financial regulations.

03

Investors looking for structured investment products in the form of ETFs.

04

Financial advisors who need to guide their clients on ETF options.

Fill

form

: Try Risk Free

People Also Ask about

What is the 3:5-10 rule for ETF?

It suggests that 10% of your portfolio should be allocated to high-risk, high-reward investments, 5% to medium-risk investments, and 3% to low-risk investments. By following this rule, you can spread your investment risk across different asset classes and investment types, such as stocks, bonds, real estate, and cash.

What is the SEC ETF rule?

If you buy substantially identical security within 30 days before or after a sale at a loss, you are subject to the wash sale rule. This prevents you from claiming the loss at this time.

What is the 3 5 10 rule for ETFs?

Specifically, a fund is prohibited from: acquiring more than 3% of a registered investment company's shares (the “3% Limit”); investing more than 5% of its assets in a single registered investment company (the “5% Limit”); or. investing more than 10% of its assets in registered investment companies (the “10% Limit”).

What is the new ETF rule?

The ETF rule enables any fund sponsor to offer ETFs that satisfy certain conditions (e.g., daily disclosure of all portfolio holdings, net asset value [NAV], market price, premium or discount, and bid-ask spread; as well as written policies and procedures regarding basket construction) without the expense and delay of

Which ETF does Warren Buffett recommend?

But investors need to know the "wash sale rule," which blocks the tax break if you buy “substantially identical” assets within the 30-day window before or after the sale. If you want to stay invested, exchange-traded funds, or ETFs, can help avoid the wash sale rule, experts say.

Does the 30 day wash rule apply to ETFs?

A 70/30 portfolio allocates 70% of its dollars to stocks and 30% to fixed income. An investor who uses this strategy might have 70% of their money invested in individual stocks, equity-focused mutual funds and equity-focused exchange-traded funds (ETFs).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Proposed Rule on Exchange-Traded Funds?

The Proposed Rule on Exchange-Traded Funds is a regulatory framework suggesting changes to the creation, management, and trading of exchange-traded funds to enhance investor protection and market transparency.

Who is required to file Proposed Rule on Exchange-Traded Funds?

Filing the Proposed Rule on Exchange-Traded Funds is typically required for fund sponsors, asset managers, or any organization involved in the establishment or management of Exchange-Traded Funds.

How to fill out Proposed Rule on Exchange-Traded Funds?

To fill out the Proposed Rule on Exchange-Traded Funds, entities must complete the prescribed form, providing relevant details about the fund structure, investment strategy, risks, and compliance measures as specified by the regulatory authority.

What is the purpose of Proposed Rule on Exchange-Traded Funds?

The purpose of the Proposed Rule on Exchange-Traded Funds is to provide a clear regulatory framework designed to improve market integrity, protect investors, and ensure that ETFs operate in a transparent and fair manner.

What information must be reported on Proposed Rule on Exchange-Traded Funds?

Required information typically includes fund objectives, strategies, risks, underlying assets, fees, performance metrics, and compliance practices, as well as any additional disclosures mandated by the regulatory body.

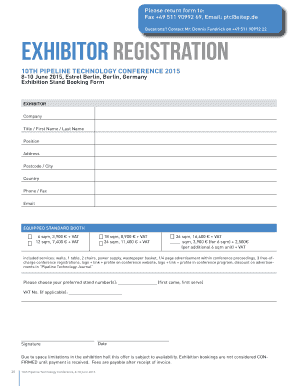

Fill out your proposed rule on exchange-traded online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Proposed Rule On Exchange-Traded is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.