Get the free CHILD CARE PROVIDER LOAN FORGIVENESS FORBEARANCE FORM - ifap ed

Show details

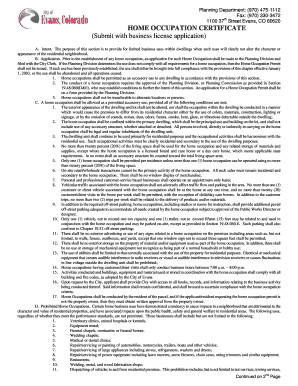

This forbearance form is intended for individuals who have received loan forgiveness under the Child Care Provider Loan Forgiveness Program and are seeking additional forbearance. It outlines the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign child care provider loan

Edit your child care provider loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your child care provider loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing child care provider loan online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit child care provider loan. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out child care provider loan

How to fill out CHILD CARE PROVIDER LOAN FORGIVENESS FORBEARANCE FORM

01

Obtain the Child Care Provider Loan Forgiveness Forbearance Form from your loan servicer or the appropriate website.

02

Fill in your personal information including your name, contact details, and Social Security number.

03

Provide details about your child care business, including its name, address, and EIN (Employer Identification Number) if applicable.

04

Indicate the reason for requesting forbearance, such as economic hardship or a temporary break from operating your child care services.

05

Attach any required documentation that supports your claim for forbearance, such as business financial statements or proof of enrollment in a child care program.

06

Review the form for accuracy and completeness before signing.

07

Submit the completed form to your loan servicer, either electronically or via mail, following their specific submission guidelines.

Who needs CHILD CARE PROVIDER LOAN FORGIVENESS FORBEARANCE FORM?

01

Child care providers who are struggling to meet loan payments due to financial challenges or temporary business interruptions.

02

Individuals or entities that operate licensed child care facilities and have federally backed student loans.

03

Those seeking loan forgiveness options related to their child care services as part of government programs.

Fill

form

: Try Risk Free

People Also Ask about

Is there a form I need to fill out for student loan forgiveness?

If you're working toward Public Service Loan Forgiveness (PSLF), complete and submit the Public Service Loan Forgiveness (PSLF) & Temporary Expanded PSLF (TEPSLF) Certification & Application (PSLF) form annually or when you change employers. If you've made 120 qualifying payments, fill out and submit this same form.

Is there a form to fill out for loan forgiveness?

After you make your 120th qualifying monthly payment for PSLF, you'll need to submit the PSLF form to receive loan forgiveness. You must be working for a qualifying employer at the time you submit the PSLF form.

What is the child care provider loan forgiveness demonstration program?

The Child Care Provider Loan Forgiveness Program is a demonstration program that is intended to bring more highly trained individuals into the early child care profession and to retain them in the profession.

Can daycare workers get student loan forgiveness?

Student Loans Forgiveness for Childcare Workers The Dept of Education is exploring expanding the existing Public Service Loan Forgiveness program to childcare workers who work for for-profit companies. Currently PSLF is only available to people who work for qualified non-profit or government employers.

What do I have to do to claim my student loan forgiveness?

After you Make 120 Qualifying Monthly Payments for PSLF After you make your 120th qualifying monthly payment for PSLF, you'll need to submit the PSLF form to receive loan forgiveness. You must be working for a qualifying employer at the time you submit the PSLF form.

When can I apply for a student loan forgiveness program?

If you have loans that have been in repayment for more than 20 or 25 years, those loans may immediately qualify for forgiveness. Borrowers who have reached 20 or 25 years (240 or 300 months) worth of eligible payments for IDR forgiveness will see their loans forgiven as they reach these milestones.

Will my loans be forgiven if they are in forbearance?

No, if you are currently in a SAVE administrative forbearance period, any payments you make will not count towards Public Service Loan Forgiveness (PSLF) as forbearance periods do not qualify for PSLF credit; essentially, you cannot make progress towards PSLF while in forbearance.

Will I get a 1099-C for student loan forgiveness?

The amount forgiven is typically includable in your gross income and subject to income taxes unless a tax law specifically exclude it from taxable income. Your student loan lender will report a forgiven balance on Form 1099-C, Cancellation of Debt.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CHILD CARE PROVIDER LOAN FORGIVENESS FORBEARANCE FORM?

The CHILD CARE PROVIDER LOAN FORGIVENESS FORBEARANCE FORM is a document used by eligible childcare providers to apply for forbearance on their student loans while seeking loan forgiveness. It allows them to suspend loan payments temporarily without accruing interest, provided they meet specific eligibility criteria under federal loan forgiveness programs.

Who is required to file CHILD CARE PROVIDER LOAN FORGIVENESS FORBEARANCE FORM?

Childcare providers who are seeking forbearance on their student loans while qualifying for loan forgiveness benefits under childcare provider-specific programs need to file the form. This includes individuals working in licensed childcare facilities or related settings that are eligible for federal loan relief.

How to fill out CHILD CARE PROVIDER LOAN FORGIVENESS FORBEARANCE FORM?

To fill out the CHILD CARE PROVIDER LOAN FORGIVENESS FORBEARANCE FORM, applicants should complete the necessary sections with their personal and employment information, detailing their childcare provider status. They must provide documentation of their employment, the nature of their childcare services, and certify that they meet the eligibility requirements for forbearance and forgiveness.

What is the purpose of CHILD CARE PROVIDER LOAN FORGIVENESS FORBEARANCE FORM?

The purpose of the CHILD CARE PROVIDER LOAN FORGIVENESS FORBEARANCE FORM is to allow childcare providers to temporarily pause their student loan payments while they are working towards meeting the criteria for loan forgiveness. It ensures that providers can focus on their services without the burden of loan payments affecting their financial stability.

What information must be reported on CHILD CARE PROVIDER LOAN FORGIVENESS FORBEARANCE FORM?

The information that must be reported on the form includes the borrower’s name, Social Security number, employment details, the childcare facility name and address, and a statement of eligibility for forbearance. Additional documentation may be required to verify employment in an eligible childcare setting.

Fill out your child care provider loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Child Care Provider Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.