Get the free Estimated Health Care Center Tax Payment Coupon

Show details

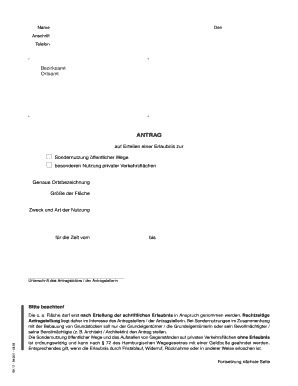

This document serves as an estimated tax payment coupon for health care centers in Connecticut for the calendar year. It details the percentage of tax to be paid in installments and provides instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign estimated health care center

Edit your estimated health care center form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your estimated health care center form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit estimated health care center online

In order to make advantage of the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit estimated health care center. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out estimated health care center

How to fill out Estimated Health Care Center Tax Payment Coupon

01

Obtain the Estimated Health Care Center Tax Payment Coupon form from the appropriate tax authority or website.

02

Fill in your name, address, and contact information at the top of the coupon.

03

Enter your taxpayer identification number (TIN) or Social Security number in the designated field.

04

Calculate your estimated tax liability by reviewing your prior year's health care taxes and making necessary adjustments if your situation has changed.

05

Enter the calculated estimated tax amount in the designated box on the coupon.

06

Indicate the payment period for which you are making the estimated payment (e.g., quarterly).

07

Review the completed coupon for accuracy and completeness.

08

Make a payment via check, money order, or electronic means as instructed on the form.

09

Keep a copy of the coupon and payment for your records.

Who needs Estimated Health Care Center Tax Payment Coupon?

01

Taxpayers or businesses that are liable for health care center taxes and are required to make estimated tax payments.

02

Individuals or entities that anticipate a tax liability based on their health care operations.

Fill

form

: Try Risk Free

People Also Ask about

Are IRS estimated tax payments mandatory?

Answer: Generally, you must make estimated tax payments for the current tax year if both of the following apply: You expect to owe at least $1,000 in tax for the current tax year after subtracting your withholding and refundable credits.

Does APTC need to be repaid?

If your APTC was more than your actual PTC ended up being (generally meaning that you earned more than you projected), the federal government paid excess APTC on your behalf for the previous year. You'll have to repay some or all of that excess amount to the Internal Revenue Service (IRS) when you file your tax return.

Why am I getting estimated tax vouchers?

Why did I get 1040 ES ? TurboTax will automatically include four quarterly 1040-ES vouchers with your printout if you didn't withhold or pay enough tax this year. You may get these vouchers if you're self-employed or had an uncharacteristic spike in your income this year.

Why do I have to pay back my health insurance tax credit?

When you file your taxes, if your income is less than what you told us on your application, you may receive a credit or refund. If your income is more than what you told us on your application, you may have to repay some or all of the advanced premium tax credits that you got.

Do I really need to make estimated tax payments?

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Can I opt out of estimated tax payments?

Estimated tax payments are typically due on April 15, June 15, and September 15 of the current year and then January 15 of the following year. You can skip the final (January 15) estimated tax payment if you will file your return and pay all the tax due by February 1.

Can I choose not to pay estimated taxes?

Do you expect your federal income tax withholding to amount to at least 90 percent of the total tax that you will owe for this tax year? If so, then you're in the clear, and you don't need to make estimated tax payments.

Is it worth it to pay estimated taxes?

If you are in business for yourself, you generally need to make estimated tax payments. Estimated tax is used to pay not only income tax, but other taxes such as self-employment tax and alternative minimum tax. If you don't pay enough tax through withholding and estimated tax payments, you may have to pay a penalty.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Estimated Health Care Center Tax Payment Coupon?

The Estimated Health Care Center Tax Payment Coupon is a form used by healthcare centers to make estimated tax payments related to their operational earnings and tax obligations.

Who is required to file Estimated Health Care Center Tax Payment Coupon?

Healthcare centers that are subject to tax obligations under the health care center tax law are required to file the Estimated Health Care Center Tax Payment Coupon.

How to fill out Estimated Health Care Center Tax Payment Coupon?

To fill out the Estimated Health Care Center Tax Payment Coupon, provide the healthcare center's name, address, identification number, estimated tax liability, and payment amount in the designated fields on the coupon.

What is the purpose of Estimated Health Care Center Tax Payment Coupon?

The purpose of the Estimated Health Care Center Tax Payment Coupon is to facilitate timely tax payments by healthcare centers to ensure compliance with tax obligations.

What information must be reported on Estimated Health Care Center Tax Payment Coupon?

The information that must be reported includes the healthcare center's name, address, identification number, the taxable year, estimated tax amount, and any previous payments made.

Fill out your estimated health care center online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Estimated Health Care Center is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.