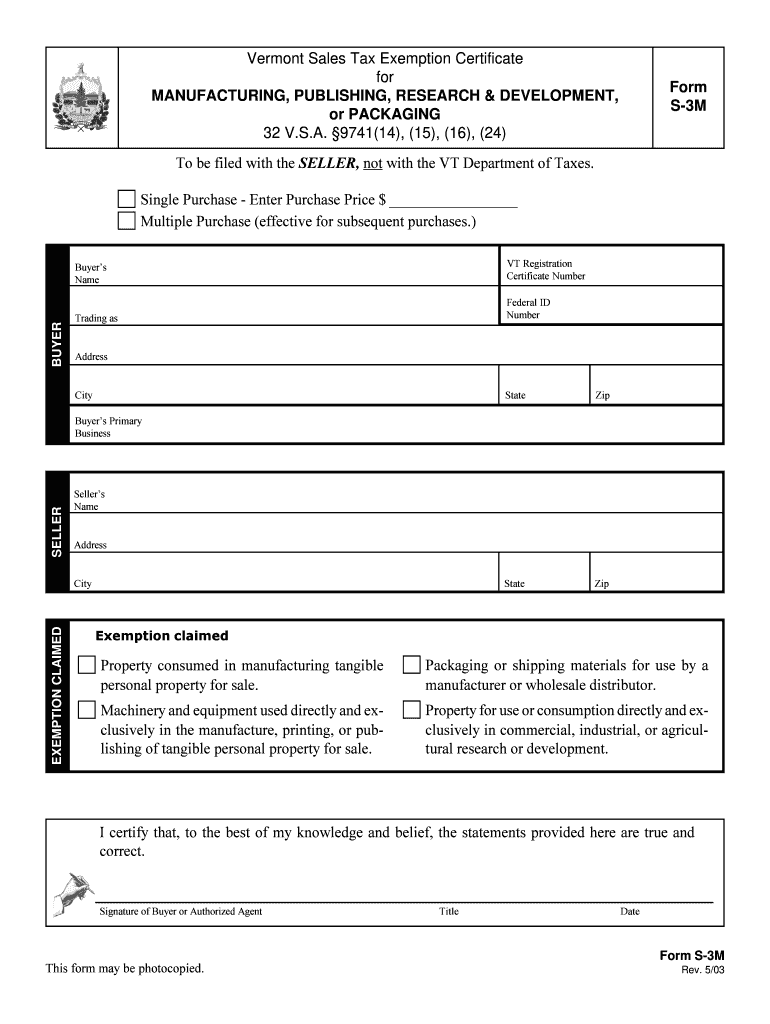

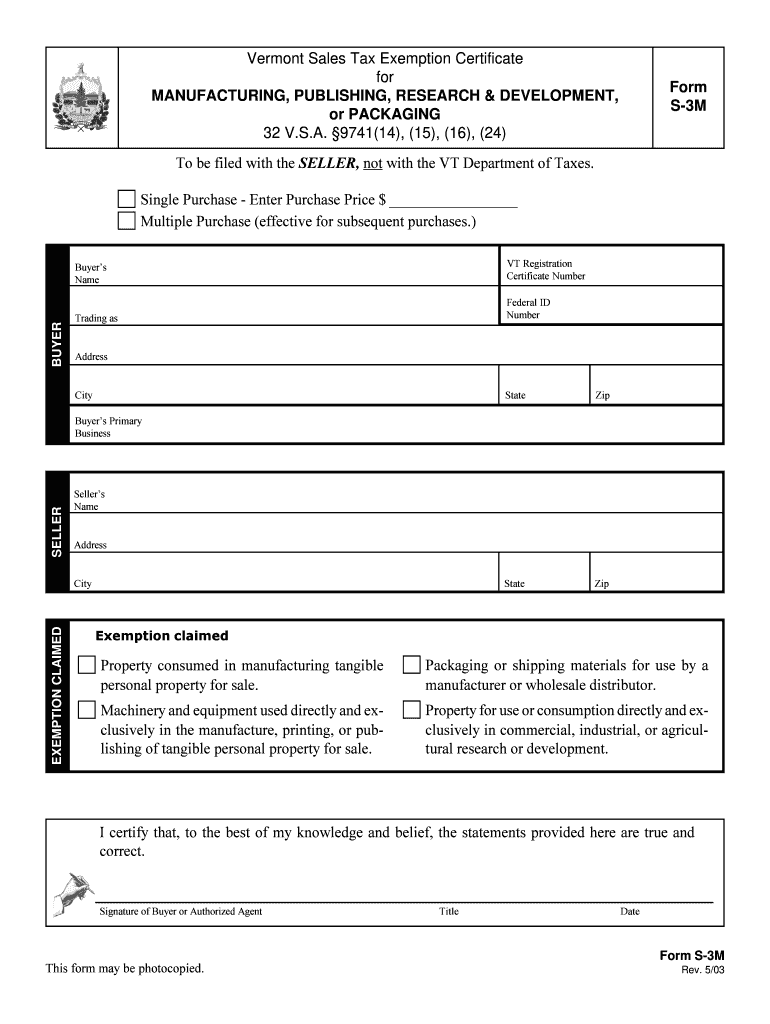

VT S-3M 2003 free printable template

Get, Create, Make and Sign vermont tax exemption

Editing vermont tax exemption online

Uncompromising security for your PDF editing and eSignature needs

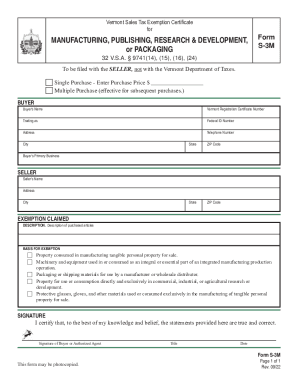

VT S-3M Form Versions

How to fill out vermont tax exemption

How to fill out VT S-3M

Who needs VT S-3M?

Instructions and Help about vermont tax exemption

We×39’re going to show yoinstallationooffof the heat shrinkable 3 core 11 KV XLve joint make sure you study the installation instructions supplied in the kit and using table 1 figure 1 mark out the outer cable jacket using suitable tool score the outer jacket now mark the armor wires score the hacksaw×39’ve been back the r-mo eyes ready Tobit the armored support ring mark happy in a bedding and remove the fillers to this point remove the backing paper from the mastic tape apply to the inner bedding this will stop moisture traveling down underneath the armories lay the copper earth straps onto the copper tape screens securing with the constant force roll spring supplied apply further mastic over the braids the earth braid swill be clamped down at a later stage along with the armored wires do this at both sides now the joint has alongside and a short side the alongside is for parking the connector insulation tubes onto the courses owe're now marking out the shorts we now need to remove the copper tape screen so the best method of doing thesis to fit a roll spring on the core peel back the copper tape screen to the edge of the roll spring carefully make small cut peel against the edge of the spring once we've done that on all three tools make a mark on the semiconductivelayer and this will be our screen point client PVC tape sticky side up so snot to leave any residue on to the core and the best method of removing the easy strip type semiconductive screen is busing a round file or commonly known ASA rat tail file around the core airshow until you see the white primary insulation beneath do not use a sharp knife or Stanley knife to do this thesis a very, very critical part of the joint all termination scoring tools are available with a blade that is set appoint four millimeters, so this doesn't×39;score the core beneath make three or four tram lines down the length of thecoreand this will make it easier to remove there is no need to use glass to do this if you×39’ve got a bondesemiconductor glare then there are specialist tools to-do this again don't use glass now we×39’re fittinmasticic crutch wedge to help prevent moisture that may be existent in the cable we×39’re now going to fitmedium-voltage mechanical connectors the advantage of these is they will suit copper or aluminum conductors and will cover a wide cable range so mark out the primary insulation to half the length of the connector plus five millimeters thesis a primary insulation removal toolkit makes the process of removing the insulation quick and easy now score thesemiconductive layer over the conductor Music it×39’s really important cleat here primarily insulation layer use the tissues provided or a suitable solvent all carbon traces must be removed from the primary insulation now take the yellowstress-relieving mastic apply with thin edge stretch and extend onto the primary installation by 10 millimeters back onto the semi conductive layer adjust catch the copper tape screens to keep...

People Also Ask about

What is a E 595E form?

How do I get a tax exempt number in Vermont?

What is Vermont Form 112?

What is the income limit for homestead declaration in Vermont?

How do I claim exemption on my tax form?

How much is capital gains tax in Vermont?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the vermont tax exemption in Chrome?

How can I fill out vermont tax exemption on an iOS device?

How do I fill out vermont tax exemption on an Android device?

What is VT S-3M?

Who is required to file VT S-3M?

How to fill out VT S-3M?

What is the purpose of VT S-3M?

What information must be reported on VT S-3M?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.