Get the free Schedule PE - revenue wi

Show details

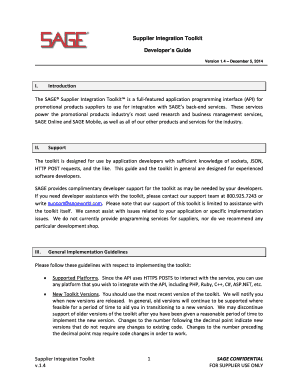

Use Schedule PE to claim the postsecondary education credit available to businesses that reimburse individuals for tuition expenses incurred at qualified postsecondary institutions. This schedule

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule pe - revenue

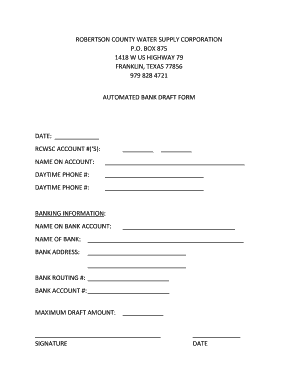

Edit your schedule pe - revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule pe - revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule pe - revenue online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit schedule pe - revenue. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule pe - revenue

How to fill out Schedule PE

01

Obtain the Schedule PE form from the IRS website or through tax software.

02

Review the instructions provided with the form to understand the requirements.

03

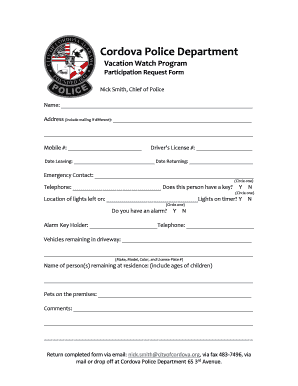

Fill in your name, Social Security number, and other identifying information at the top of the form.

04

Report your income and expenses related to your rental activities in the appropriate sections.

05

Include any carryover amounts from previous years if applicable.

06

Calculate your total income or loss from rental properties.

07

Complete the necessary additional forms, if required, to support your entries.

08

Review the filled-out form for accuracy and completeness.

09

Submit the Schedule PE along with your federal tax return.

Who needs Schedule PE?

01

Individuals who own rental properties and are reporting income or losses from those properties.

02

Taxpayers who are subject to the Passive Activity Loss rules.

03

Persons who have rental activity and want to report it on their tax return for that tax year.

Fill

form

: Try Risk Free

People Also Ask about

What is the hardest state to get a PE in?

What Is the Hardest State To Get a PE In? ing to applicants and PE conversations on platforms like Reddit, Florida, Alaska, and California are generally considered the most difficult states in which to obtain licenses due to the extra sections included in their standard PE exam.

Is 2 months enough to study for the PE exam?

You'll hear several tips repeatedly for the PE Exam, including studying 200-300 hours over three to six months. However, some engineers have passed the exam after just glancing at a practice exam the day before. Others took more than three attempts and over 300 hours of studying. Most will fall somewhere in between.

What is the 80/20 rule for the PE exam?

ing to the Pareto 80/20 rule, you can conclude that 80% of your study routine is complete or irrelevant, and unnecessary activities only produce 80% of productivity for your exam preparation. Alternatively, 20% of your study routine involves actions and practices that can make up 80% of the results.

What is the hardest state to get a PE in?

What Is the Hardest State To Get a PE In? ing to applicants and PE conversations on platforms like Reddit, Florida, Alaska, and California are generally considered the most difficult states in which to obtain licenses due to the extra sections included in their standard PE exam.

How often is the PE exam offered?

Most PE exams are currently offered in pencil-and-paper format and available once or twice per year depending on the examinee population. Pass rates are updated after results are released—typically in May for the April exams and in December for the October exams.

What does PE mean in construction?

Which PE Exam is the Hardest? ing to NCEES® stats, the structural depth and geotechnical exams are the hardest of civil PE exams. Only 64% and 55% of students managed to clear it in the first attempt. You will have to consistently prepare for the PE exam for 3 to 6 months to clear it, no matter which exam.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule PE?

Schedule PE is a tax form used by partnerships and pass-through entities to report their income, deductions, and other tax-related information.

Who is required to file Schedule PE?

Entities that are classified as partnerships or S corporations are required to file Schedule PE to report income allocated to partners or shareholders.

How to fill out Schedule PE?

To fill out Schedule PE, entities must enter relevant financial information, including income, deductions, and partner-specific data on the form, following the instructions provided by the IRS.

What is the purpose of Schedule PE?

The purpose of Schedule PE is to enable the IRS to track income distribution among partners or shareholders of pass-through entities for tax purposes.

What information must be reported on Schedule PE?

Schedule PE must report partner or shareholder identification information, income and loss items, contributions, distributions, and tax credits related to the partners or shareholders.

Fill out your schedule pe - revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule Pe - Revenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.