Get the free st3 form

Show details

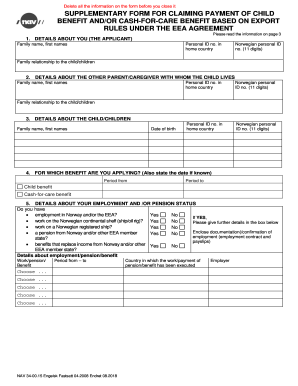

Applicants must be registered for sales tax in order to apply. You must apply for and receive approval and MCDP from the on Form ST3. Fact Sheet 107 Interstate Motor Carriers. or electronically delivered computer software that is made available for use in more than one taxing jurisdiction at the same time. Purchaser is responsible for apportioning and remitting the tax due to each taxing jurisdiction. for advertising materials for use outside Min...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign st3 form

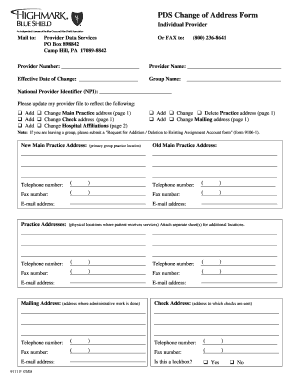

Edit your st3 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st3 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit st3 form online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit st3 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

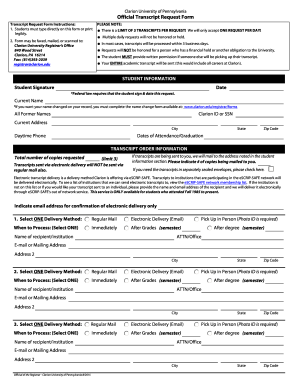

How to fill out st3 form

How to fill out form st 3:

01

Fill in your personal information, including your full name, address, and contact details.

02

Provide details about your business, such as the name, address, and tax identification number.

03

Indicate the period for which you are filing the form, specifying the start and end dates.

04

Report the total sales made during the specified period, including both taxable and nontaxable sales.

05

Deduct any taxable sales made to customers who are exempt from paying sales tax, and calculate the net taxable sales amount.

06

Calculate the amount of sales tax owed by multiplying the taxable sales by the applicable tax rate.

07

Report any tax exemptions or credits that apply to your business.

08

Summarize the total tax due by adding the sales tax owed and any penalties or interest.

09

Sign and date the form, and submit it to the relevant tax authority by the specified deadline.

Who needs form st 3:

01

Businesses that are required to collect and remit sales tax to the state tax authority.

02

Individuals operating as sole proprietors or self-employed individuals with taxable sales.

03

Any organization or entity making taxable sales in a specific jurisdiction.

Fill

form

: Try Risk Free

People Also Ask about

What is an ST3 form NJ?

Form ST-3 Instructions Completing the Certificate. To claim an exemption from Sales Tax on the purchase of taxable property or services, the purchaser must provide a fully completed exemption cer- tificate to the seller. Otherwise, the seller must collect the tax.

How long does a Minnesota sales tax exemption certificate last?

Exemption certificates do not expire unless the information on the certificate changes. But we recommend updating exemption certificates every three to four years.

How do I fill out a ST3 form in NJ?

How to Fill Out NJ Sales Tax Exempt Form ST-3? Name the seller of the merchandise, enter the seller's address, and the actual date of the transaction. Provide your taxpayer registration number. Describe the nature of goods or services you sell in an ordinary course of business.

What is the difference between St-3 and St 4 in NJ?

Some of the Resale Certificates you might use are: Form ST-3: Used for in-state suppliers. Form ST-3NR: Used for out-of-state suppliers. Form ST-4: Used for tax exemption on production machinery and packaging supplies.

Who is exempt from MN sales tax?

When an item is exempt from sales or use tax by law, the seller does not have to show why no tax was charged, but must indicate the item was food, clothing, drugs, or another exempt good. The seller does not have to collect sales tax if the purchaser gives them a completed Form ST3, Certificate of Exemption.

What is Minnesota Form ST3?

A completed Form ST3 is provided by colleges, universities, and the System Office to vendors to exempt most official expenditures from Minnesota sales tax. The exemption does not apply to purchases of meals, lodging, waste disposal services, and motor vehicles.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit st3 form from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including st3 form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I send st3 form for eSignature?

st3 form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit st3 form online?

With pdfFiller, the editing process is straightforward. Open your st3 form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

What is st3 form?

The ST3 form is a tax document used in some jurisdictions for the reporting of sales tax for specific transactions.

Who is required to file st3 form?

Businesses or individuals who are involved in sales or transactions that are subject to sales tax are typically required to file the ST3 form.

How to fill out st3 form?

To fill out the ST3 form, one should provide necessary details such as the business name, tax identification number, total sales, amount of tax collected, and any relevant transaction details.

What is the purpose of st3 form?

The purpose of the ST3 form is to report sales tax collected from customers and ensure compliance with tax regulations.

What information must be reported on st3 form?

Information typically reported on the ST3 form includes seller details, buyer details (if applicable), specific items sold, total sales amount, and total sales tax collected.

Fill out your st3 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

st3 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.