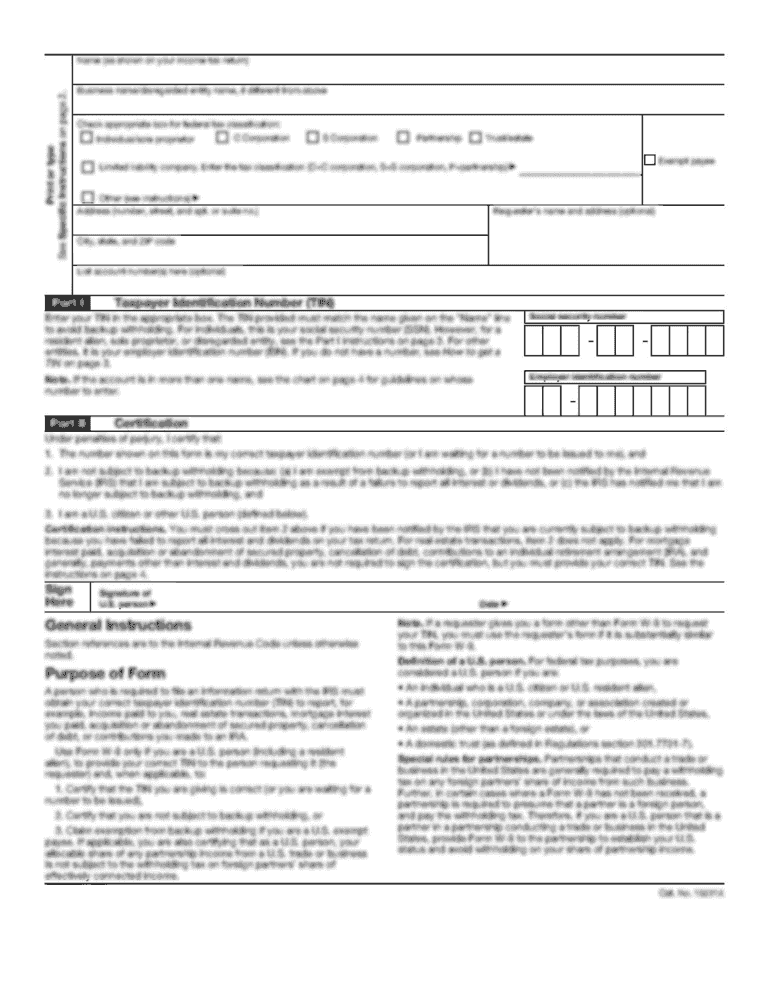

Get the free FORM OF FINANCIAL STATEMENTS (NON-PROFIT ORGANISATIONS) - ncte-india

Show details

This document outlines the financial statements for non-profit organizations as per the National Council for Teacher Education. It includes schedules related to accounting policies, contingent liabilities,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form of financial statements

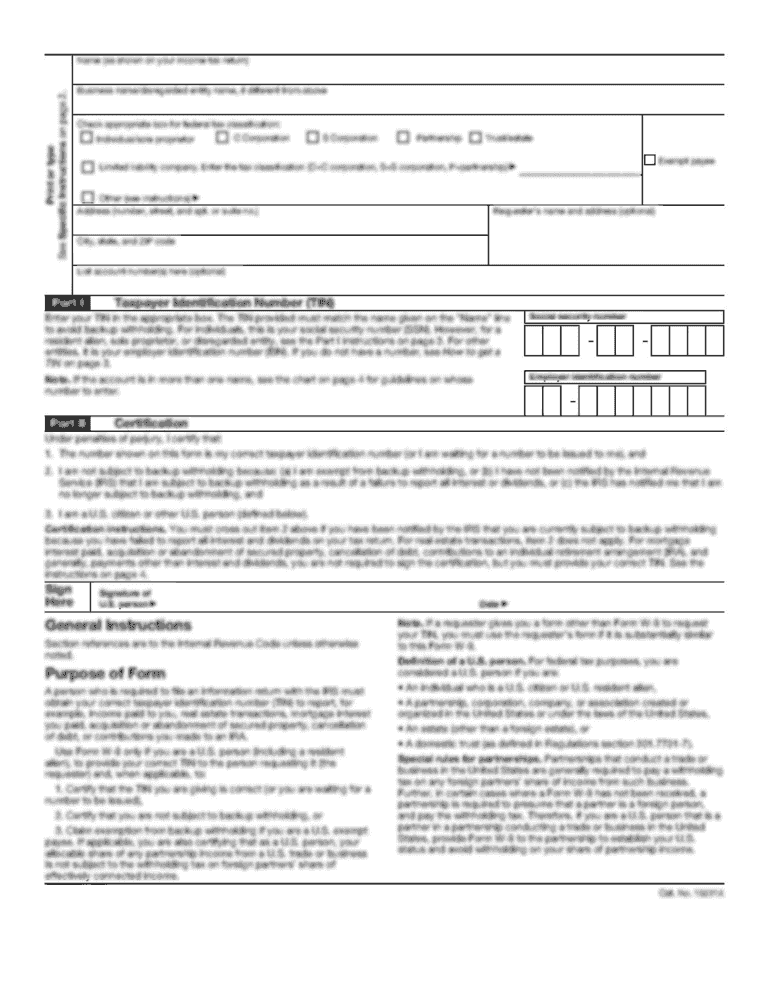

Edit your form of financial statements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form of financial statements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form of financial statements online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form of financial statements. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form of financial statements

How to fill out FORM OF FINANCIAL STATEMENTS (NON-PROFIT ORGANISATIONS)

01

Gather necessary financial data: Collect all relevant financial records, including income, expenses, assets, and liabilities.

02

Identify the reporting period: Determine the time frame for the financial statements (e.g., monthly, quarterly, annually).

03

Complete the Statement of Financial Position: List all assets, liabilities, and net assets to provide a snapshot of the organization's financial position at the end of the reporting period.

04

Fill out the Statement of Activities: Document all revenues and expenses for the reporting period to show how resources were used and what was generated.

05

Prepare the Statement of Cash Flows: Outline cash inflows and outflows to track the organization’s liquidity and cash management.

06

Include notes to the financial statements: Provide any necessary explanations or additional information to clarify items in the financial statements.

07

Ensure compliance with accounting standards: Follow the applicable accounting principles and guidelines for non-profit organizations.

08

Review and finalize: Double-check all entries for accuracy and completeness before finalizing the document.

Who needs FORM OF FINANCIAL STATEMENTS (NON-PROFIT ORGANISATIONS)?

01

Non-profit organizations looking to report their financial status to stakeholders, including donors, board members, and regulatory bodies.

02

Grant applicants required to submit financial statements to fulfill grant application requirements.

03

Organizations seeking to maintain transparency with the public and ensure trust with their contributors.

04

Entities needing to comply with local, state, or federal reporting regulations for non-profits.

Fill

form

: Try Risk Free

People Also Ask about

What is the format for accounting for a non-profit organization?

Depending on your nonprofit's size and designation, you may need to complete Form 990-N (small organizations), Form 990-EZ (mid-sized nonprofits), the full Form 990 (large organizations), or Form 990-PF (private foundations of all sizes), so check with your accountant to ensure you file the correct form.

How to prepare a balance sheet for a non-profit organization?

It outlines three primary areas: the organization's assets (such as cash, investments, property and equipment), liabilities (such as payroll, loans and other expenses) and net assets (the value of its assets minus its liabilities, which would be called owner's equity on a for-profit balance sheet).

What is the accounting system for a non-profit organization?

Nonprofit organizations have specific accounting requirements for tracking donations and expenses, known as fund accounting. Under fund accounting, money from different sources, such as donations, memberships, grants or investment revenues, is separated into different accounts, or funds, based on its intended use.

What is the accounting standard for a non-profit organization?

The GAAP is a set of business and nonprofit accounting standards that detail their legal obligations. The U.S. law requires businesses (and nonprofits) to follow their guidelines.

What is the chart of accounts for a nonprofit organization?

A Chart of Accounts (COA) is a list of financial accounts that helps nonprofits keep track of their transactions. This list does not include all financial transactions. Instead, it breaks these accounts into categories like assets, liabilities, income, expenses, and equity.

What accounting method do nonprofits use?

Accrual-basis accounting is also necessary for nonprofits' compliance with U.S. Generally Accepted Accounting Principles (GAAP) and is recommended for meeting IRS reporting requirements. Nonprofits can choose cash- or accrual-basis accounting to track their income and expenses, just like for-profit businesses.

What financial statements are required for a non-profit organization?

Let's walk through the structure and purpose of each of these four reports in more detail. Statement of Activities. The statement of activities is the nonprofit parallel to the for-profit income statement. Statement of Financial Position. Statement of Cash Flows. Statement of Functional Expenses.

Which financial statements are maintained by non-profit Organisation?

(NOT FOR PROFIT ORGANISATION) They also maintain books of account to record them and also prepare financial statements at the close of the year. These statements are Receipts and Payments Account, Income and Expenditure Account and Balance Sheet.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FORM OF FINANCIAL STATEMENTS (NON-PROFIT ORGANISATIONS)?

The FORM OF FINANCIAL STATEMENTS for non-profit organizations is a structured report that provides an overview of the financial status and activities of a non-profit entity. It typically includes balance sheets, income statements, and statements of cash flows, detailing revenue, expenses, and assets.

Who is required to file FORM OF FINANCIAL STATEMENTS (NON-PROFIT ORGANISATIONS)?

Non-profit organizations that are required to file FORM OF FINANCIAL STATEMENTS typically include those that are registered as tax-exempt entities under the Internal Revenue Code, as well as organizations that receive a certain level of funding, grants, or public support. Specific requirements can vary by jurisdiction.

How to fill out FORM OF FINANCIAL STATEMENTS (NON-PROFIT ORGANISATIONS)?

To fill out the FORM OF FINANCIAL STATEMENTS, non-profit organizations should gather financial data, including income, expenses, assets, and liabilities. Then, follow the provided template or guidelines to accurately classify and report this information, ensuring compliance with accounting standards and regulations.

What is the purpose of FORM OF FINANCIAL STATEMENTS (NON-PROFIT ORGANISATIONS)?

The purpose of FORM OF FINANCIAL STATEMENTS is to give stakeholders, including donors, grantors, and regulatory bodies, a clear understanding of the organization’s financial health and accountability. It helps in assessing the organization’s performance, sustainability, and compliance with applicable laws.

What information must be reported on FORM OF FINANCIAL STATEMENTS (NON-PROFIT ORGANISATIONS)?

Information that must be reported includes total revenues, total expenses, net assets, sources of revenue, functional expenses, and any program-specific information relevant to the organization's mission. Additionally, organizations must disclose any significant accounting policies and notes to the financial statements to provide context.

Fill out your form of financial statements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Of Financial Statements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.