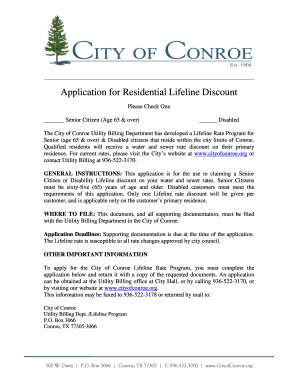

Get the free PAN Card Application Guidelines - indianembassy org

Show details

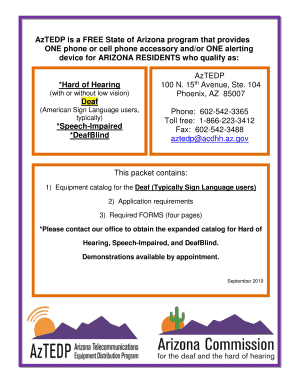

此指南适用于在印度境外居住的印度公民、外国公民、非个人(如:公司、信托等)申请永久性账号卡(PAN)的具体要求和流程。

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pan card application guidelines

Edit your pan card application guidelines form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

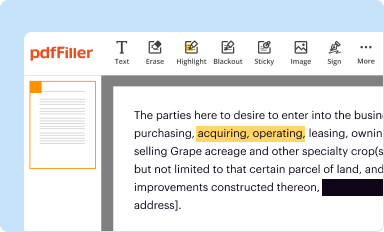

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pan card application guidelines form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing pan card application guidelines online

To use the professional PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pan card application guidelines. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pan card application guidelines

How to fill out PAN Card Application Guidelines

01

Visit the official PAN card application website.

02

Select the type of application (new PAN, modification, etc.).

03

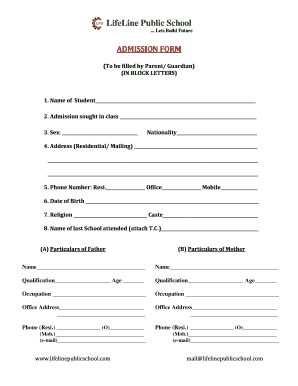

Fill in the required personal details such as name, date of birth, and address.

04

Upload identity and address proof documents as required.

05

Provide details of the income source.

06

Review the filled application for accuracy.

07

Pay the application fee online.

08

Submit the application and note the acknowledgment number for tracking.

Who needs PAN Card Application Guidelines?

01

Individuals earning taxable income.

02

Companies and businesses for tax-related purposes.

03

Non-resident Indians (NRIs) investing in India.

04

Individuals requiring to file tax returns.

Fill

form

: Try Risk Free

People Also Ask about

What is PAN number guidelines?

The first three characters (e.g., ABC) are random alphabets. The fourth character (e.g., T) identifies the PAN holder's status (T for Trust, P for Individual, C for Company, etc.). The fifth character (e.g., Y) is the first letter of the PAN holder's last name.

What are the rules for PAN card?

Before introducing the PAN Card, taxpayers were allocated a GIR number. 1) The full name of the cardholder. 2) The cardholder's father's name. 3) Pan number digits: it has a 10-digit alphanumeric permanent account number. 4) Sign of the cardholder. 5) Date of birth. 6) A photograph of the cardholder.

How do you play Panguingue?

Panguingue Rules The gameplay moves from each Player to the Player on their right, or counterclockwise. Each Player must pay the Ante in order to be dealt cards. The winning Player not only collects the pot of Tops paid in by each Player, but also receives an additional payout based on their hand.

What is the format of PAN card application number?

When applied through NSDL, the entity will generate a 15-digit PAN acknowledgment number, whereas UTIITSL will generate a 9-digit application coupon number. Courtesy of the number provided, an individual can track the status of the PAN application.

What are the rules for PAN card?

Before introducing the PAN Card, taxpayers were allocated a GIR number. 1) The full name of the cardholder. 2) The cardholder's father's name. 3) Pan number digits: it has a 10-digit alphanumeric permanent account number. 4) Sign of the cardholder. 5) Date of birth. 6) A photograph of the cardholder.

What are the rules for e pan?

Who Can Apply For An e-PAN Card? You must be an Indian resident. You must not already hold a PAN. You must have an Aadhaar Card. You must have an active mobile phone number linked with your Aadhaar. Your Aadhaar must have your updated and correct details.

What are the rules for PAN?

The aim is to go out first by melding all one's cards, with or without a final discard. Valid melds are sets and suit sequences of three or more cards. The lowest sequence is A-2-3, and the highest ends J-Q-K. (Many now count ace high or low but not both, which thus allows A-2-3 and Q-K-A but not K-A-2.)

How do you play the game pan?

The aim is to go out first by melding all one's cards, with or without a final discard. Valid melds are sets and suit sequences of three or more cards. The lowest sequence is A-2-3, and the highest ends J-Q-K. (Many now count ace high or low but not both, which thus allows A-2-3 and Q-K-A but not K-A-2.)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is PAN Card Application Guidelines?

The PAN Card Application Guidelines provide the necessary procedures and requirements for applying for a Permanent Account Number (PAN) in India.

Who is required to file PAN Card Application Guidelines?

Individuals, companies, and other entities who wish to conduct financial transactions, file income tax returns, or set up bank accounts in India are required to file for a PAN Card.

How to fill out PAN Card Application Guidelines?

To fill out the PAN Card Application, individuals must complete Form 49A or Form 49AA, provide necessary documents, and submit the application either online or through a designated center.

What is the purpose of PAN Card Application Guidelines?

The purpose of the PAN Card Application Guidelines is to ensure that the application process for obtaining a PAN is clear, efficient, and compliant with tax regulations.

What information must be reported on PAN Card Application Guidelines?

Applicants must provide personal information such as name, date of birth, address, along with identity and address proof documents, and relevant financial details.

Fill out your pan card application guidelines online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pan Card Application Guidelines is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.