Get the free tax registration cancellation notification - revenue

Show details

Tax Registration Cancellation Notification Details of Customer TRCN1 Type of Business Reference No. Name of Customer Private Address Business Address if different to private address Phone Number Mobile

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax registration cancellation notification

Edit your tax registration cancellation notification form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax registration cancellation notification form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax registration cancellation notification online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax registration cancellation notification. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

How do I contact Ros Ireland?

The ROS Helpdesk (01 738 36 99) will answer any ROS related queries you may have.

How do I contact income tax?

Contact Us 1800 103 0025. 1800 419 0025. 1800 103 0344. 1800 309 0130. 1800 2033 5435. Outbound Numbers (Taxpayer will receive calls from Demand Facilitation Center from numbers below)

How do I get through to revenue Ireland?

Call (01) 858 9843 between the hours of 9.30am to 1.30pm, Monday to Friday.

How long does it take revenue to respond to a query?

The Revenue Technical Service provides advice on technical queries. We will reply to complex technical queries within 20 working days. If a full reply cannot be issued within 20 days, we will indicate when you can expect a detailed reply.

How do I deregister from income tax portal?

To deactivate taxpayer Login to Quicko. Navigate to your Profile from the upper right corner. Click on Deactivate Tax Payer. Type CONFIRM. Click on Submit.

How long does it take for Revenue to reply to Enquiries?

The Revenue Technical Service provides advice on technical queries. We will reply to complex technical queries within 20 working days.

How do you stop self-employment on ROS?

To access ROS eRegistration: login to ROS, then on the My Services page, go down to “Manage Tax Registrations”. This will display a list of tax types. If you are already registered for a particular tax type, you will have the option to “Cease Registration”.

How do I de register as self-employed UK?

You can call HMRC on 0300 200 3310 and inform them you're no longer self-employed, or many have found the simplest way to do it is to de-register as self-employed online. You'll need the following to hand: Your National Insurance Number. Unique Tax Reference (UTR).

How do I deregister from income tax?

To deactivate taxpayer Login to Quicko. Navigate to your Profile from the upper right corner. Click on Deactivate Tax Payer. Type CONFIRM. Click on Submit.

Can an individual deregister for income tax?

Once all the formalities are concluded and approved, and there is no further taxable income or assets in SA, then the taxpayer can move ahead with the deregistration process. Unfortunately, deregistration is a lengthy process and can take anything between 3 to 18 months to complete.

How do I speak to someone at Revenue Ireland?

Call (01) 858 9843 between the hours of 9.30am to 1.30pm, Monday to Friday.

How do I contact revenue Ireland?

Call (01) 858 9843 between the hours of 9.30am to 1.30pm, Monday to Friday.

How do I get into my Revenue account?

You can register for myAccount or you can access it using your MyGovID verified account. Revenue will never send emails which require you to send personal information via email or pop-up windows. Your myAccount password allows access to your records.

How do I deregister as self-employed?

You can call HMRC on 0300 200 3310 and inform them you're no longer self-employed, or many have found the simplest way to do it is to de-register as self-employed online. You'll need the following to hand: Your National Insurance Number. Unique Tax Reference (UTR).

How do I stop being self employed in Ireland?

Stopping self-employment If you are self-employed (a sole trader), the process is quite straightforward. You simply stop trading and tell your clients and suppliers that you are no longer in business. You need to retain financial and other records for 6 years following closure.

How long does it take deregister self-employed?

De-registering for VAT As with de-registering for self-employment, it's straightforward to de-register for VAT online. It usually takes about three weeks for HMRC to confirm your cancellation and provide the official cancellation date of your VAT registration.

How do I track my Irish tax return?

sign in to myAccount and complete the Two-Factor Authentication (2FA) click the 'Review your tax 2018 -2021' link in PAYE Services.

How do I stop SARS tax residency?

If a taxpayer ceased to be a tax resident of South Africa, the taxpayer should inform SARS through the Registration, Amendments And Verification Form (RAV01) on eFiling by capturing the date on which the taxpayer ceased to be a tax resident under the Income Tax Liability Details section.

How do I tell HMRC I no longer need to complete a self assessment?

If you think you do not need to submit a tax return, for example because all your income is taxed under PAYE and you have no additional tax liability, you can phone HMRC on 0300 200 3310 and ask for the tax return to be withdrawn. If HMRC agrees, this will means that you no longer have to file a return.

How do I deregister from SARS income tax?

Use the deregistration function on eFiling; Send a written notification and EMP123/EMP123T form to SARS. You can send the notification and form via email, post or fax to the region where the entity is registered.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax registration cancellation notification directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your tax registration cancellation notification and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Where do I find tax registration cancellation notification?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific tax registration cancellation notification and other forms. Find the template you need and change it using powerful tools.

How do I edit tax registration cancellation notification online?

With pdfFiller, it's easy to make changes. Open your tax registration cancellation notification in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

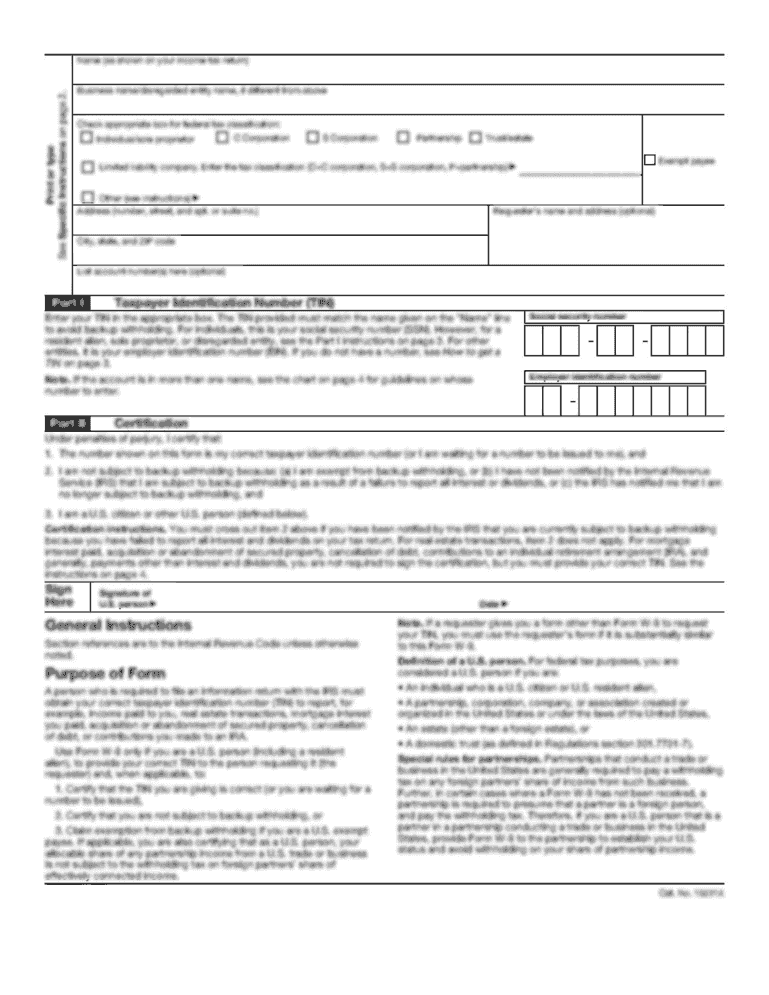

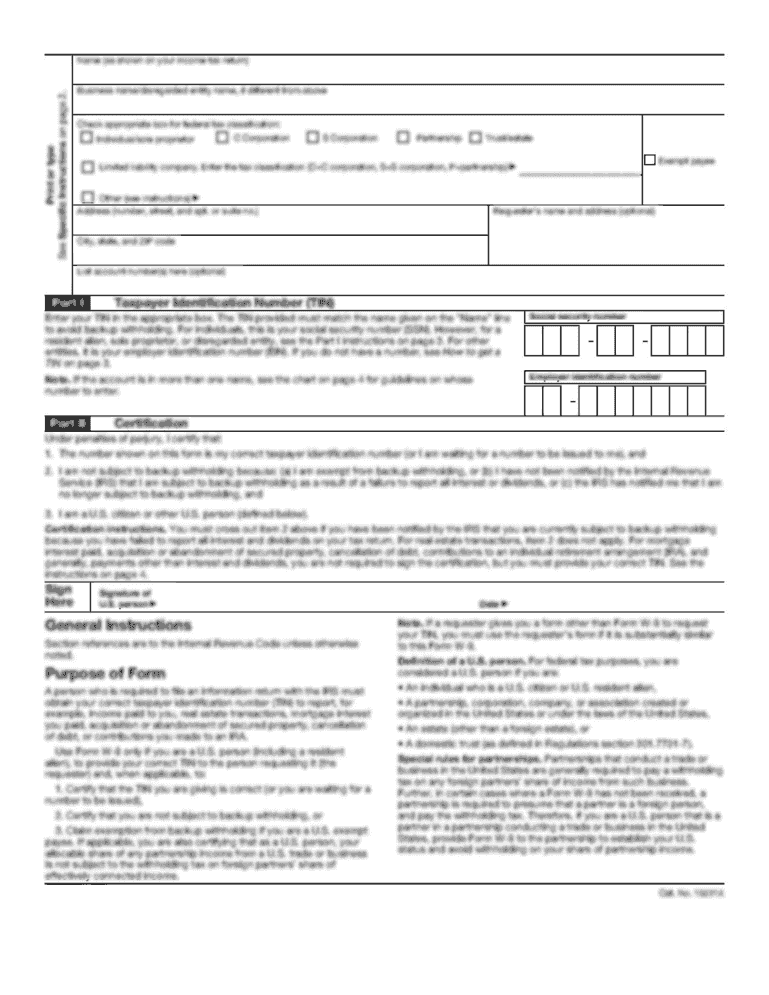

What is tax registration cancellation notification?

The tax registration cancellation notification is a document that notifies the tax authorities that a taxpayer intends to cancel their tax registration.

Who is required to file tax registration cancellation notification?

Any taxpayer who wishes to cancel their tax registration is required to file the tax registration cancellation notification.

How to fill out tax registration cancellation notification?

To fill out the tax registration cancellation notification, the taxpayer must provide their relevant details such as taxpayer identification number, name, address, and reason for cancellation.

What is the purpose of tax registration cancellation notification?

The purpose of the tax registration cancellation notification is to inform the tax authorities about the taxpayer's intention to cancel their tax registration and comply with the necessary procedures.

What information must be reported on tax registration cancellation notification?

The tax registration cancellation notification must include the taxpayer's identification number, name, address, and a valid reason for cancellation.

Fill out your tax registration cancellation notification online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Registration Cancellation Notification is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.