Get the free Income Levy Refund Claim Form - revenue

Show details

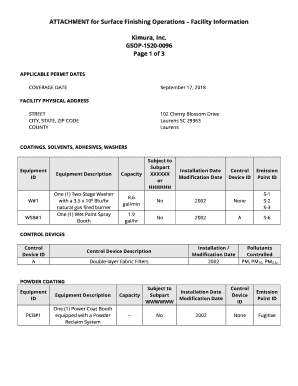

This form is to be submitted to your local Revenue office to claim a refund for income levy for PAYE employees and pensioners, detailing personal information, income details, and enabling refunds

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income levy refund claim

Edit your income levy refund claim form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income levy refund claim form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing income levy refund claim online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit income levy refund claim. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out income levy refund claim

How to fill out Income Levy Refund Claim Form

01

Obtain the Income Levy Refund Claim Form from the official website or relevant authority.

02

Fill in your personal information, including your name, address, and contact details.

03

Provide your tax identification number or Social Security number as required.

04

Indicate the specific periods for which you are claiming a refund.

05

Detail the income that was subjected to levies during those periods.

06

Attach any necessary supporting documentation, such as pay stubs or tax returns.

07

Review the completed form for accuracy and completeness.

08

Sign and date the form as required.

09

Submit the form according to the provided instructions, either electronically or by mail.

Who needs Income Levy Refund Claim Form?

01

Individuals or businesses that have had income levied by tax authorities.

02

Taxpayers seeking a refund on levied income due to overpayment or errors.

03

Anyone who has resolved disputes regarding levies and is eligible for a refund.

Fill

form

: Try Risk Free

People Also Ask about

How do I contact the IRS to release a levy?

Contact us toll-free at 800-829-7650 or 800-829-3903 to resolve the issue by paying the tax bill, entering into an installment agreement, or proposing an Offer in Compromise. Please do not contact the BFS, OPM, SSA, or any other federal agency.

What happens when the IRS puts a levy on you?

An IRS levy permits the legal seizure of your property to satisfy a tax debt. It can garnish wages, take money in your bank or other financial account, seize and sell your vehicle(s), real estate and other personal property.

What is the form 3911 for tax refund?

Form 3911 is completed by the taxpayer to provide the Service with information needed to trace the nonreceipt or loss of the already issued refund check.

Who will need to file form 1310 to claim a refund?

If a tax refund is due, the person claiming the refund must fill out IRS Form 1310: Statement of Person Claiming Refund Due to Deceased Taxpayer unless the person is a surviving spouse filing a joint return or a court-appointed personal representative.

What is a tax levy release?

The IRS is required to release a levy if it determines that: You paid the amount you owe and no longer have a balance. The period the IRS can collect the tax ended before the levy was issued. Release of the levy will help you pay your taxes.

What is the IRS levy release form?

When all the tax shown on the levy is paid in full, the IRS will issue a Form 668-D, Release of Levy/Release of Property from Levy. The IRS may also release a levy if the taxpayer makes other arrangements to pay their tax debt.

How do I remove an IRS levy?

Contact the IRS immediately to resolve your tax liability and request a levy release. The IRS can also release a levy if it determines that the levy is causing an immediate economic hardship. If the IRS denies your request to release the levy, you may appeal this decision.

How to fill out an 843 form?

How do I complete IRS abatement form 843? Line 1 is the tax year the abatement is for. Line 2 is the total fees/penalties you are asking the IRS to remove. Line 3 is generally going to be Income (tax). Line 4 is the Internal Revenue Code section. Line 5a is the reason you are requesting the abatement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Income Levy Refund Claim Form?

The Income Levy Refund Claim Form is a document used by individuals to request a refund of income levies that were mistakenly applied or in cases where the levy amount exceeds the owed tax liability.

Who is required to file Income Levy Refund Claim Form?

Individuals who have had income levies applied to their earnings or who believe they are eligible for a refund due to overpayment or error in the levy application are required to file this form.

How to fill out Income Levy Refund Claim Form?

To fill out the Income Levy Refund Claim Form, you need to provide personal identification information, details regarding the income levies received, the reason for the claim, and supporting documentation of the overpayment.

What is the purpose of Income Levy Refund Claim Form?

The purpose of the Income Levy Refund Claim Form is to facilitate the process for individuals to reclaim funds that have been incorrectly levied from their income.

What information must be reported on Income Levy Refund Claim Form?

The form requires personal information such as name and address, details of the income levies including amounts and dates, the reason for the refund request, and any relevant supporting documents.

Fill out your income levy refund claim online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Levy Refund Claim is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.