Get the free CLAIM FOR HOME CARER’S TAX CREDIT - revenue

Show details

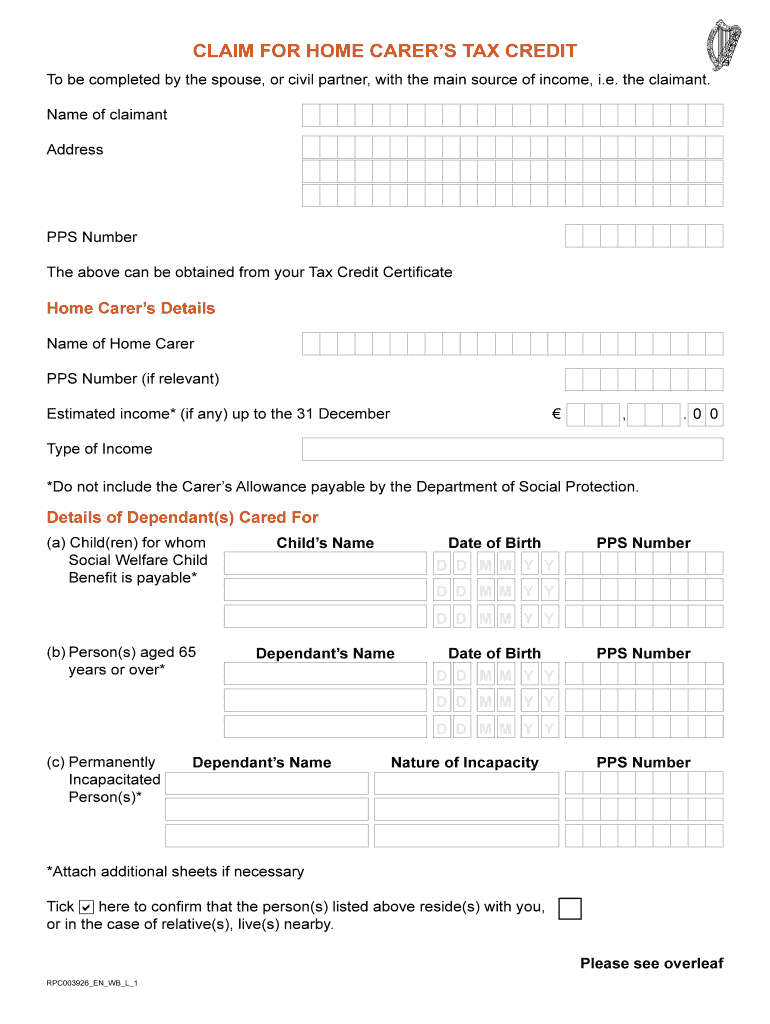

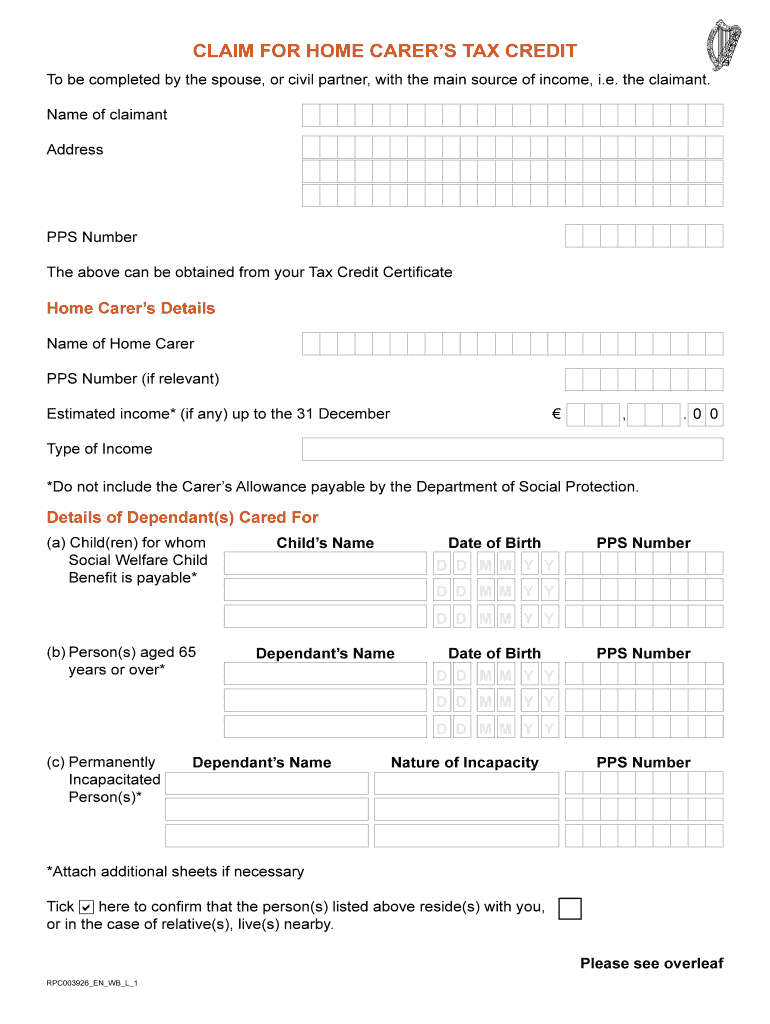

This document is used to claim a tax credit for home carers, providing necessary details about the claimant, home carer's income, dependants cared for, and bank details for refunds.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for home carers

Edit your claim for home carers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for home carers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing claim for home carers online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit claim for home carers. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for home carers

How to fill out CLAIM FOR HOME CARER’S TAX CREDIT

01

Obtain the CLAIM FOR HOME CARER’S TAX CREDIT form from the Revenue website or your local tax office.

02

Fill out your personal details, including your name, address, and PPS Number.

03

Indicate your spouse or partner’s details if applicable, including their name and PPS Number.

04

Provide information about the person for whom you are caring, including their name and relationship to you.

05

Complete the section regarding the care provided, specifying the hours or time spent caring.

06

Compile any necessary documentation, such as medical certificates or evidence confirming your caregiving role.

07

Review the form for accuracy and completeness.

08

Sign and date the form, ensuring all information is correct.

09

Submit the completed form to the Revenue office through the designated method (online or by post).

Who needs CLAIM FOR HOME CARER’S TAX CREDIT?

01

Individuals who are a primary carer for a dependent person, such as a child or elderly relative.

02

Those who earn a limited income while providing care and wish to claim tax credits to offset their tax liability.

03

People who are in a caregiving role and meet the eligibility criteria set by the tax authorities.

Fill

form

: Try Risk Free

People Also Ask about

What is the 1700 tax credit?

If you qualify, you can receive a refundable portion, known as the additional child tax credit, which is worth up to $1,700 per child. Some families can also receive monthly payments instead of waiting until tax time.

What is the difference between carers' allowance and carer's benefit?

Carer's Allowance is means-tested, and Carer's Benefit is more based on having sufficient PRSI contribution. If you qualify for both the Carer's Allowance and Carer's Benefit, always take Carer's Allowance.

What is the carer's allowance supplement?

How much is Carer's Allowance Supplement? Carer's Allowance Supplement in 2024 is £293.50 – this is paid twice a year. The first payment will be in June 2025. You'll get this if you were eligible for Carer's Allowance on 14 April 2025.

What are credits for carers allowance?

Credits for carers If you give up work to care for someone and get Carer's Allowance or Carer's Benefit, you will be automatically awarded credits. If you take unpaid statutory carer's leave from work and do not get Carer's Allowance or Benefit, you can still be awarded credits for up to 104 weeks.

How much Universal Credit will I get if I get carer's allowance?

Your Universal Credit payment will be reduced by an amount equal to your Carer's Allowance payment. You may get an extra amount of Universal Credit for caring for someone who gets a disability-related benefit (whether you get Carer's Allowance or not). Report a change on your Universal Credit account.

What is the maximum you can earn to get tax credits?

This means, if your household income for tax credit purposes is less than £7,955, you will receive the maximum amount of tax credits. If your household income is above this amount, the maximum tax credits award is reduced by 41p for every £1 of income above the £7,955 threshold.

What are carer's credits?

Carer's Credit is a National Insurance credit that helps with gaps in your National Insurance record. Your State Pension is based on your National Insurance record. Your income, savings or investments will not affect eligibility for Carer's Credit.

What is the federal tax credit for caregivers?

For each taxable year beginning on or after January 1, 2021, and before January 1, 2026, this bill, under the PITL, would allow a credit equal to 50 percent of the amount paid or incurred by a family caregiver during the taxable year for eligible expenses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CLAIM FOR HOME CARER’S TAX CREDIT?

The Home Carer's Tax Credit is a tax relief provided to individuals who care for a dependent person, typically in their home, allowing them to reduce their tax liability.

Who is required to file CLAIM FOR HOME CARER’S TAX CREDIT?

Any individual who is a home carer and wants to claim the Home Carer's Tax Credit must file a claim, generally the person who has the primary responsibility for caring for the dependent.

How to fill out CLAIM FOR HOME CARER’S TAX CREDIT?

To fill out the claim, individuals must complete the appropriate form, providing details such as the dependent's information, the carer's personal information, and any relevant tax details required by the tax authorities.

What is the purpose of CLAIM FOR HOME CARER’S TAX CREDIT?

The purpose of the Home Carer's Tax Credit is to provide tax relief to those who take on the responsibility of caring for dependents, thus supporting families and encouraging home care.

What information must be reported on CLAIM FOR HOME CARER’S TAX CREDIT?

The claim must report information such as the carer's personal details, the dependent's details (like age and the nature of dependency), and any other relevant financial information required to assess eligibility.

Fill out your claim for home carers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Home Carers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.