Get the free Application for Self-Insurance - dol

Show details

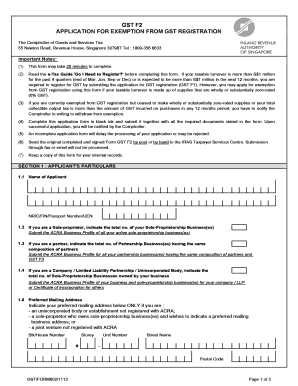

This application allows employers to request permission from the Office of Workers' Compensation Programs to become self-insured under the Longshore and Harbor Workers' Compensation Act. It includes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for self-insurance

Edit your application for self-insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for self-insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for self-insurance online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit application for self-insurance. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for self-insurance

How to fill out Application for Self-Insurance

01

Obtain the Application for Self-Insurance form from the relevant governing body or website.

02

Fill in the applicant's contact information accurately, including name, address, and phone number.

03

Provide details about the business, including its type, structure, and years in operation.

04

Describe the types of insurance coverage currently held, if any.

05

Include information about the number of employees and their roles within the company.

06

Provide financial statements or relevant documents that demonstrate the company's fiscal stability.

07

Specify the reasons for seeking self-insurance and the risks associated with the business.

08

Review the application for completeness and accuracy before submission.

09

Submit the completed application to the appropriate regulatory authority, along with any required fees.

Who needs Application for Self-Insurance?

01

Businesses or organizations that want to self-insure instead of purchasing traditional insurance policies.

02

Employers who have a significant number of employees and want to manage their own workers' compensation claims.

03

Large companies with sufficient financial resources to cover potential losses without relying on conventional insurance.

Fill

form

: Try Risk Free

People Also Ask about

Is self-insurance a good idea?

If you're self-insured, you're not paying an insurance company every year to carry the risk of replacing your income if something happens to you. That's a huge benefit to you because you're saving money! And we're all about saving money where we can—especially on insurance premiums.

What is an example of self-insurance?

In the United States, self-insurance applies especially to health insurance and may involve, for example, an employer providing certain benefits—like health benefits or disability benefits—to employees and funding claims from a specified pool of assets rather than through an insurance company.

How to set up self-insurance?

If you're self-insured, you're not paying an insurance company every year to carry the risk of replacing your income if something happens to you. That's a huge benefit to you because you're saving money! And we're all about saving money where we can—especially on insurance premiums.

What is considered self-insured coverage?

Self-insurance is also called a self-funded plan. This is a type of plan in which an employer takes on most or all of the cost of benefit claims. The insurance company manages the payments, but the employer is the one who pays the claims.

What is a self-insurance example?

For example, the owners of a building situated atop a hill adjacent to a floodplain may opt against paying costly annual premiums for flood insurance. Instead, they choose to set aside money for repairs to the building if in the relatively unlikely event floodwaters rose high enough to damage their building.

How do I know if I am self-insured?

Based on the logo, it can be hard to tell from your insurance card if you have a self- insured plan. But there may be language on the card that says something like, “this insurance company provides claims processing only and assumes no financial risk for claims.” That is a sign that it is a self-insured plan.

What is a letter of self-insurance?

A model letter for use by executive branch federal agencies when responding to requests for proof of insurance or proposed contract clauses that require proof of insurance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Self-Insurance?

An Application for Self-Insurance is a formal request submitted by an entity seeking permission to manage its own risk by covering potential losses without transferring the risk to an insurance provider.

Who is required to file Application for Self-Insurance?

Entities that wish to self-insure their risks, typically organizations with substantial assets or financial resources, are required to file an Application for Self-Insurance. This may include certain businesses, employers, or individuals depending on local regulations.

How to fill out Application for Self-Insurance?

To fill out an Application for Self-Insurance, an applicant must provide accurate and detailed information about their financial status, risk management practices, and the types of risks they intend to self-insure, usually following a specific format provided by the governing body.

What is the purpose of Application for Self-Insurance?

The purpose of an Application for Self-Insurance is to assess whether the applicant has the financial capability and risk management strategies to absorb potential losses, thus allowing them to legally forgo traditional insurance.

What information must be reported on Application for Self-Insurance?

The information required on an Application for Self-Insurance typically includes details about the applicant's financial statements, risk management policies, types of coverage being requested, previous insurance history, and a description of the business operations.

Fill out your application for self-insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Self-Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.