Get the free Claim for relief under Section 825C Taxes Consolidation Act 1997 - revenue

Show details

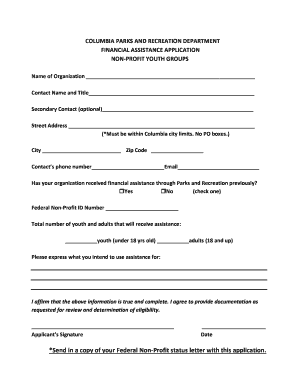

This document is a claim form for relief under the Special Assignee Relief Programme, intended for employees who are assigned to work in the State and outlines the necessary information required to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for relief under

Edit your claim for relief under form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for relief under form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit claim for relief under online

Follow the steps down below to benefit from a competent PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit claim for relief under. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for relief under

How to fill out Claim for relief under Section 825C Taxes Consolidation Act 1997

01

Begin by downloading the Claim for Relief form from the official revenue website.

02

Fill in your personal details including your name, address, and contact information.

03

Provide your tax identification number and any relevant financial information.

04

Clearly state the tax year for which you are claiming relief under Section 825C.

05

Detail the specific circumstances under which you are eligible for tax relief.

06

Include any necessary supporting documentation that substantiates your claim.

07

Review your completed form for accuracy and completeness.

08

Submit the claim form to the relevant tax authority either online or via mail.

Who needs Claim for relief under Section 825C Taxes Consolidation Act 1997?

01

Individuals or entities who have incurred losses due to certain qualifying factors.

02

Taxpayers seeking to relieve their tax liabilities under the provisions of Section 825C.

03

Individuals who are involved in specific business activities that are affected by economic changes.

Fill

form

: Try Risk Free

People Also Ask about

What is a profit participating note?

This is a type of debt security whereby the security holder receives a share of the profits of the issuer in return for the provision of principal.

What is a 110 company?

An Irish Section 110 special purpose vehicle (SPV) or section 110 company is an Irish tax resident company, which qualifies under Section 110 of the Irish Taxes Consolidation Act 1997 (TCA) for a special tax regime that enables the SPV to attain "tax neutrality": i.e. the SPV pays no Irish taxes, VAT, or duties.

What is Section 110 of the Taxes Consolidated Act 1997?

Section 110 of the Taxes Consolidation Act (TCA), 1997 provides for the taxation of certain special purpose companies. In order to avail of this regime, a company must, amongst other conditions, notify an 'authorised officer' in Revenue that: it is, or intends to be, a 'qualifying company'

What is Section 110 of Income Tax Act?

Where there is included in the total income of an assessee any income on which no income-tax is payable under the provisions of this Act, the assessee shall be entitled to a deduction, from the amount of income-tax with which he is chargeable on his total income, of an amount equal to the income-tax calculated at the

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Claim for relief under Section 825C Taxes Consolidation Act 1997?

The Claim for relief under Section 825C of the Taxes Consolidation Act 1997 provides taxpayers with a mechanism to seek relief from certain tax liabilities, typically related to losses or allowances that can be deducted from taxable income.

Who is required to file Claim for relief under Section 825C Taxes Consolidation Act 1997?

Taxpayers who are seeking to claim relief for specific allowances or losses, as outlined in Section 825C of the Taxes Consolidation Act 1997, are required to file this claim.

How to fill out Claim for relief under Section 825C Taxes Consolidation Act 1997?

To fill out the Claim for relief under Section 825C, taxpayers must provide detailed information regarding their income, deductions, and any losses being claimed, along with completing the relevant forms as specified by the tax authority.

What is the purpose of Claim for relief under Section 825C Taxes Consolidation Act 1997?

The purpose of the Claim for relief under Section 825C is to allow taxpayers to reduce their overall tax burden by recognizing and applying losses or deductions that can offset taxable income.

What information must be reported on Claim for relief under Section 825C Taxes Consolidation Act 1997?

Claimants must report information such as their personal and business details, the nature and amount of losses or allowances being claimed, and any relevant financial data that supports their claim.

Fill out your claim for relief under online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Relief Under is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.