Get the free publication 596

Get, Create, Make and Sign publication 596

Editing publication 596 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out publication 596

How to fill out publication 596:

Who needs publication 596:

Instructions and Help about publication 596

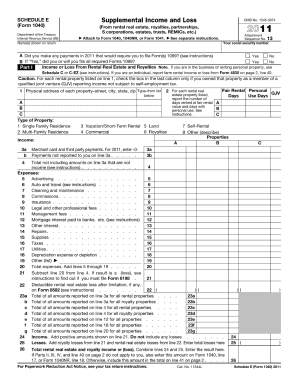

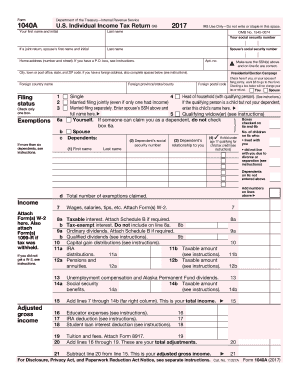

The United States federal Earned Income Tax Credit or earned income credit is a refundable tax credit for low to moderate income working individuals and couples particularly those with children the amount of at benefit depends on a recipient a euro unregistered trademark s income a number of children for a person or couple to claim one or more persons as their qualifying child requirements such as relationship age and shared residency must be met in the 2013 tax year working families if they have children with annual incomes below 30 7870 dot 250 1567 may be eligible for the federal ETC childless workers that have incomes below about 14,000 340 Canadian dollars receive a very small ETC benefit us tax forms 1040ez 1040a or 1040ez to claim ETC without qualifying children to claim the credit with qualifying children forms 1040a or 1040ez long with scheduled at attached EIC phases in slowly has a medium length plateau and then phases out more slowly than it was phased in since the credit phases out at twenty-one percent or sixteen percent it is always preferable to have one more dollar of actual salary or wages considering the at alone for tax year 2013 the maximum at benefit for a single person or couple filing without qualifying children is 487 the maximum at with one qualifying child is three thousand two hundred fifty dollars with two children it is 5370 to dot and with three or more qualifying children it is six thousand forty-four dollars these amounts are indexed annually for inflation on December for 2014 the Atlantic reported that the ETC will reduce revenue to the federal government by about seventy billion dollars in 2015 the earned income tax credit has been part of political debates in the United States regard whether raising the minimum wage or increasing ETC is a better idea overview enacted in 1975 the initial modesty I see has been expanded by tax legislation on a number of occasions including the widely publicized Tax Reform Act of 1986 and was further expanded in 1990 1993 2001 and 2009 regardless of whether the act in general raised taxes lower taxes or eliminated other deductions and credits today the at is one of the largest anti-poverty tools in the United States' most income measures including the poverty rate do not account for the credit a qualifying child can be a person's daughter son stepchild or any further descendant or a person's brother sister half-sister half-brother step-brother step-sister or any further descendant a qualifying child can also be in the process of being adopted provided he or she had been lawfully placed as well as an unrelated foster child who has been officially placed foster children also count provided either the child has been officially placed or as a member of On are unregistered trademark s extended family a younger single parent cannot claim e I see if he or she is also claimable as a qualifying child of their parent or another older relative which can happen in some extended family...

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send publication 596 to be eSigned by others?

How do I execute publication 596 online?

How do I edit publication 596 straight from my smartphone?

What is publication 596?

Who is required to file publication 596?

How to fill out publication 596?

What is the purpose of publication 596?

What information must be reported on publication 596?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.