IE Form CG1 2002 free printable template

Show details

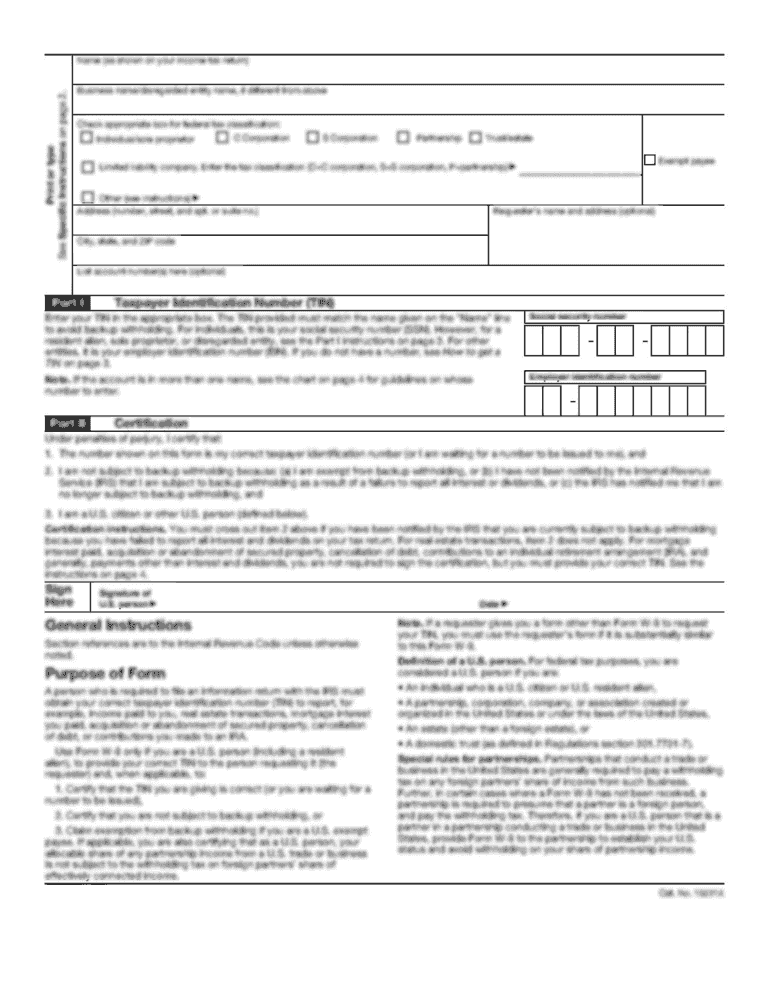

FORM CG1 2002 Capital Gains Tax Return MAIN Your PPS Number CD Please quote this number in all correspondence or when calling at your tax office Return Address Use any envelope and write Free post

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign IE Form CG1

Edit your IE Form CG1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IE Form CG1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing IE Form CG1 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit IE Form CG1. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IE Form CG1 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IE Form CG1

How to fill out IE Form CG1

01

Start by downloading the IE Form CG1 from the official website.

02

Fill in your personal information, including your name and contact details.

03

Provide the relevant identification numbers as required.

04

Complete the sections pertaining to your specific needs or purposes for applying.

05

Review the form for any errors or missing information.

06

Print the completed form.

07

Sign the form at the designated area.

08

Submit the form to the appropriate authority or office as indicated in the instructions.

Who needs IE Form CG1?

01

Individuals or organizations who are applying for a specific permit or license related to commerce or trade.

02

Persons seeking to undertake certain regulated activities that require formal approval.

Fill

form

: Try Risk Free

People Also Ask about

What documents do I need for capital gains tax?

What documents do you need for taxes if you sold a house? 1099-S form to report your capital gains. 1098 form as a record of your mortgage interest payments. Closing Statement, which is a receipt for your home sale. Records to determine your cost basis. Documents showing you had a work-related move.

What happens if you don't report capital gains?

Missing capital gains If you fail to report the gain, the IRS will become immediately suspicious. While the IRS may simply identify and correct a small loss and ding you for the difference, a larger missing capital gain could set off the alarms.

How does the IRS know if you have capital gains?

Whether your small business focuses on real estate or sold unneeded property during the tax year, a copy of form 1099-S, which is sent to both you and the IRS by the closing attorney or real estate official, reports the gross proceeds from the sale.

Do I have to pay capital gains tax immediately?

You only pay the capital gains tax after you sell an asset. Let's say you bought your home 2 years ago and it's increased in value by $10,000. You don't need to pay the tax until you sell the home.

What is a CG1?

Form CG1 – Capital Gains Tax Return 2022.

Do you have to report capital gains to the IRS?

While all capital gains are taxable and must be reported on your tax return, only capital losses on investment or business property are deductible.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send IE Form CG1 for eSignature?

Once your IE Form CG1 is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I edit IE Form CG1 on an iOS device?

Create, modify, and share IE Form CG1 using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Can I edit IE Form CG1 on an Android device?

With the pdfFiller Android app, you can edit, sign, and share IE Form CG1 on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is IE Form CG1?

IE Form CG1 is a form used for reporting income and expenses related to certain business activities in order to comply with tax regulations.

Who is required to file IE Form CG1?

Individuals or businesses engaged in specified activities that generate income are required to file IE Form CG1.

How to fill out IE Form CG1?

To fill out IE Form CG1, you'll need to provide details of your business income, deduct any allowable expenses, and complete the identification sections accurately.

What is the purpose of IE Form CG1?

The purpose of IE Form CG1 is to ensure that taxpayers report their business income and expenses for income tax assessment.

What information must be reported on IE Form CG1?

On IE Form CG1, you must report your total income, allowable expenses, net profit or loss, and pertinent identification information such as your name and business details.

Fill out your IE Form CG1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IE Form cg1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.