Get the free Eastside Blanket Real Property Tax Abatement Application - indy

Show details

This application seeks tax abatement for real property under the Eastside Revitalization District, requiring submission of a completed form and a Statement of Benefits. Specific fees apply based on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign eastside blanket real property

Edit your eastside blanket real property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your eastside blanket real property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit eastside blanket real property online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit eastside blanket real property. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

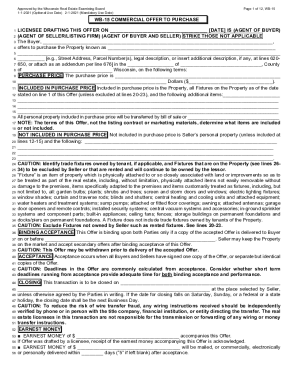

How to fill out eastside blanket real property

How to fill out Eastside Blanket Real Property Tax Abatement Application

01

Obtain the Eastside Blanket Real Property Tax Abatement Application form from the designated government website or office.

02

Carefully read the instructions provided at the beginning of the application form to ensure understanding of the requirements.

03

Fill out your personal information in the designated fields, including your name, address, contact number, and email.

04

Provide information about the property for which you are applying for tax abatement, including the address, parcel number, and any relevant property details.

05

Detail the reasons for applying for the tax abatement, including any upgrades, renovations, or improvements made to the property.

06

Attach any required documentation that supports your application, such as proof of income, property tax receipts, and any additional forms as specified.

07

Review the entire application for accuracy and completeness before submission.

08

Submit the application by the specified deadline through the recommended submission method (online or in-person).

Who needs Eastside Blanket Real Property Tax Abatement Application?

01

Property owners within the Eastside region who have made improvements to their properties and are seeking financial relief from property taxes.

02

Individuals or businesses looking to invest in property enhancements that contribute to community development.

03

Homeowners facing financial challenges due to rising property taxes and seeking assistance.

Fill

form

: Try Risk Free

People Also Ask about

How are tax abatements chosen?

Eligibility for a property tax abatement usually depends on the type of property, its location, and the intended improvements or usage. Requirements may include detailed plans for development and investment thresholds.

Who is exempt from paying property taxes in Kentucky?

In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive a homestead exemption.

How to apply for tax abatement?

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

How to get an abatement from the IRS?

How to request interest abatement. To request we reduce or waive interest due to an unreasonable error or IRS delay, you or your representative must submit: Form 843, Claim for Refund and Request for Abatement PDF or. A signed letter requesting that we reduce or adjust the overcharged interest.

Do senior citizens get a discount on property taxes in Nassau County?

The Senior Citizens exemption program provides tax relief to eligible homeowners aged 65 or older with limited income ($58,399 or less). This section includes forms, affidavits, and resources to assist seniors in applying for property tax reductions.

How do I apply for tax abatement?

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

What are the downsides of tax abatement?

It may also impact whether and how you can sell the property. For example, if the abatement period has ended and property taxes are $7,000 more a year than they were during the abatement period, you may have to lower your asking price to account for the tax expense the buyer will incur.

How do I file a property tax abatement in MA?

You can find abatement applications at any city and town assessor's office. For the state abatement application, State Tax Form 128, visit the Department of Revenue's website. An abatement cannot be approved unless you file a Department of Revenue tax abatement form by the deadline.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Eastside Blanket Real Property Tax Abatement Application?

The Eastside Blanket Real Property Tax Abatement Application is a form used by property owners in specific areas to apply for tax abatements on real property, which can reduce the amount of property tax owed.

Who is required to file Eastside Blanket Real Property Tax Abatement Application?

Property owners who are seeking tax abatement benefits for their real estate in the specified Eastside area are required to file the Eastside Blanket Real Property Tax Abatement Application.

How to fill out Eastside Blanket Real Property Tax Abatement Application?

To fill out the Eastside Blanket Real Property Tax Abatement Application, property owners must provide relevant property details, ownership information, and any necessary documentation supporting their eligibility for the tax abatement.

What is the purpose of Eastside Blanket Real Property Tax Abatement Application?

The purpose of the Eastside Blanket Real Property Tax Abatement Application is to facilitate the process for property owners to apply for tax relief on their real estate taxes, encouraging investment and development in the Eastside area.

What information must be reported on Eastside Blanket Real Property Tax Abatement Application?

The application requires information such as property address, ownership details, assessment values, intended use of the property, and any other relevant financial information necessary to evaluate the tax abatement request.

Fill out your eastside blanket real property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Eastside Blanket Real Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.