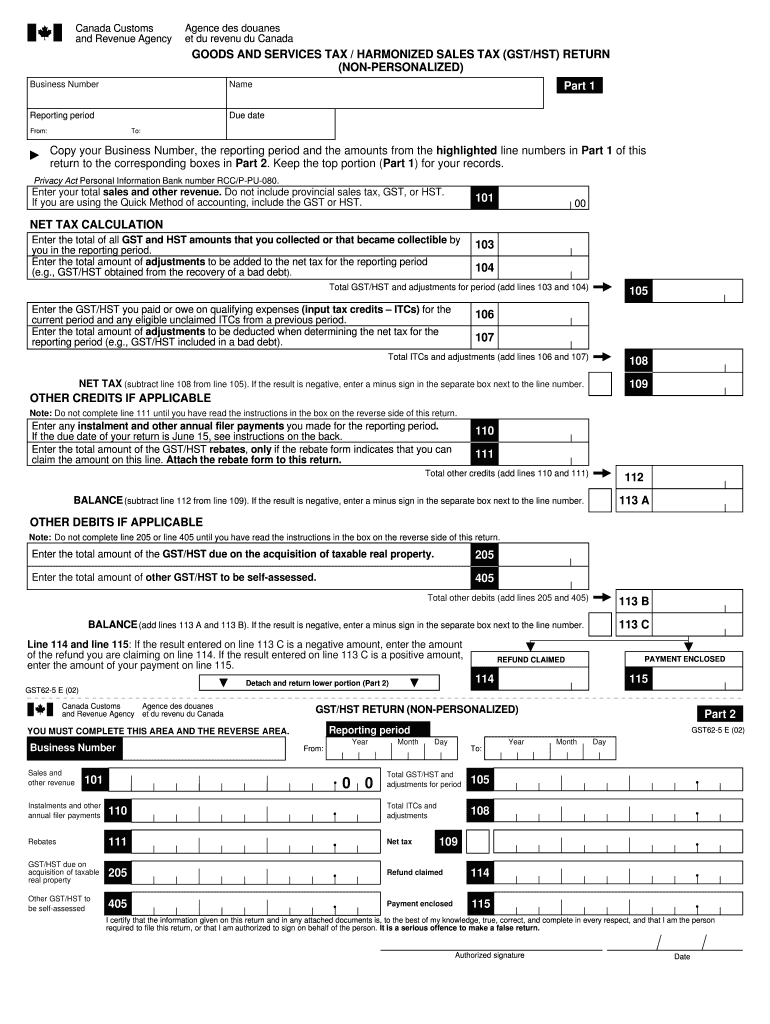

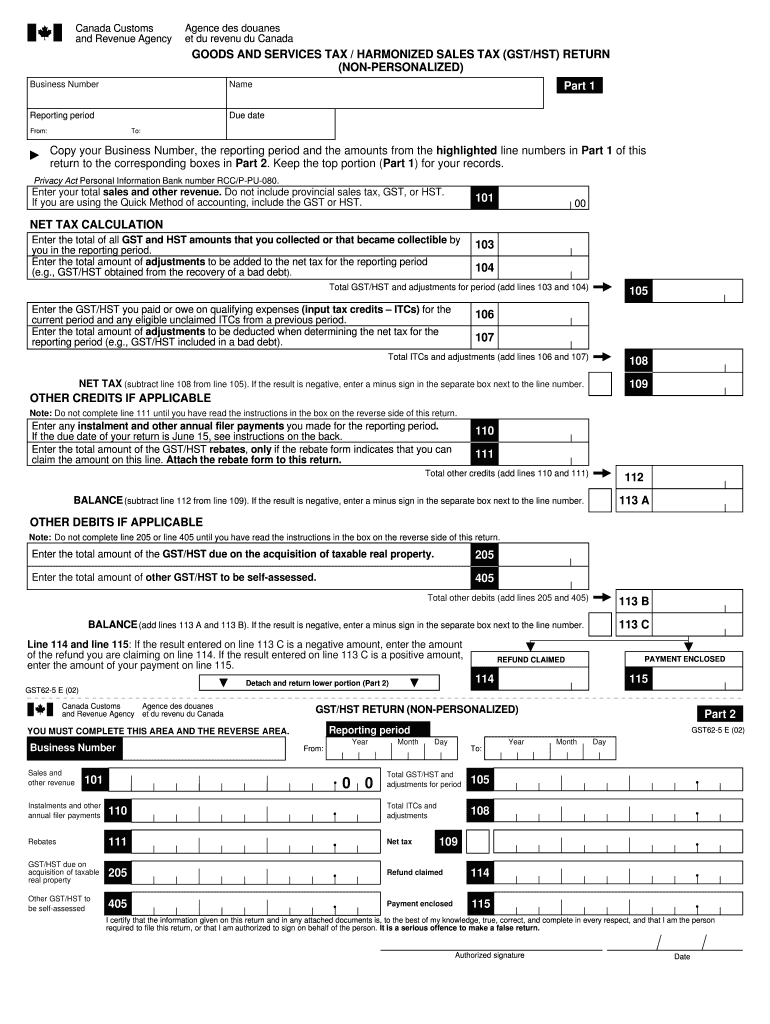

Get the free GST/HST RETURN (NON-PERSONALIZED)

Show details

Ce document est un retour pour la taxe sur les biens et services / taxe de vente harmonisée (TPS/TVH) pour les entreprises au Canada, destiné à aider les entreprises à déclarer les ventes, les

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gsthst return non-personalized

Edit your gsthst return non-personalized form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gsthst return non-personalized form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gsthst return non-personalized online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit gsthst return non-personalized. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gsthst return non-personalized

How to fill out GST/HST RETURN (NON-PERSONALIZED)

01

Obtain the appropriate GST/HST return form (e.g., GST34) from the Canada Revenue Agency (CRA) website.

02

Gather all relevant documents, such as sales records, purchase invoices, and expense receipts for the reporting period.

03

Calculate your total sales and total taxable supplies.

04

Determine the amount of GST/HST collected from your sales.

05

Calculate the amount of input tax credits (ITCs) you are eligible to claim for the purchases made during the reporting period.

06

Subtract the total ITCs from the total GST/HST collected to determine if you owe tax or will receive a refund.

07

Complete each section of the return form accurately, ensuring all calculations are correct.

08

Review the completed return for any errors or omissions.

09

Sign and date the return.

10

Submit the returned form to the CRA by the due date, either electronically through the CRA website or by mailing a paper copy.

Who needs GST/HST RETURN (NON-PERSONALIZED)?

01

Businesses that make taxable sales in Canada.

02

Self-employed individuals who are registered for GST/HST.

03

Partnerships that earn revenue from taxable activities.

04

Corporations operating in Canada that are registered for GST/HST.

05

Any individual or entity required to remit GST/HST as part of their business operations.

Fill

form

: Try Risk Free

People Also Ask about

Is GST return filing mandatory?

Return filing is mandatory under GST. Even if there is no transaction, you must file a Nil return. There are few points to note: You cannot file a return if you do not file the previous month/quarter's return.

What is GST and HST Canada?

GST is a federal tax applied across Canada at a rate of 5%. HST is a combined tax merging GST with PST, applied in certain provinces with varying rates. PST is a provincial tax administered separately by each province that imposes it.

What is GST tax in the USA?

The generation-skipping transfer (GST) tax is imposed on transfers to grandchildren and more remote descendants that exceed the exemption limits so transferors cannot avoid transfer taxes on the next generation by "skipping" a generation.

What is GST return filing in English?

A GST return is a document containing details of all income/sales and/or expenses/purchases that a GST-registered taxpayer (every GSTIN) is required to file with the tax administrative authorities. This is used by tax authorities to calculate net tax liability.

What is the GST HST payment in Canada?

The goods and services tax/harmonized sales tax (GST/HST) credit is a tax-free quarterly payment that helps individuals and families with low and modest incomes offset the GST or HST that they pay. It may also include payments from provincial and territorial programs.

Who is eligible for the $300 federal payment in Canada?

The $300 federal payment depends on several rules of proving specific needs intended to deliver help to those groups of people who need it the most. As a rule, the payment is designed for low and moderate-income households with a special focus the families with children, seniors and the population relying on welfare.

What is a GST HST return?

Harmonized sales tax, or HST, is a consumption tax paid by local consumers and businesses in many Canadian provinces. Once a year, any business that pays GST or HST needs to file a return to collect, report, and remit their due taxes to the CRA.

Who is eligible for GST payment in Canada?

To qualify for the GST/HST credit, your adjusted net family income must be below a certain threshold, which for the 2023 tax year ranges from $54,704 to $72,244, depending on your marital status and how many children you have.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is GST/HST RETURN (NON-PERSONALIZED)?

The GST/HST RETURN (NON-PERSONALIZED) is a standardized form used by businesses in Canada to report their Goods and Services Tax (GST) or Harmonized Sales Tax (HST) collected and paid for a specific reporting period.

Who is required to file GST/HST RETURN (NON-PERSONALIZED)?

Businesses that have registered for GST/HST and have collected or paid GST/HST during the reporting period are required to file the GST/HST RETURN (NON-PERSONALIZED). This includes small, medium, and large enterprises.

How to fill out GST/HST RETURN (NON-PERSONALIZED)?

To fill out the GST/HST RETURN (NON-PERSONALIZED), businesses must provide details such as total sales, GST/HST collected, input tax credits claimed, and any adjustments for the reporting period. Accurate figures should be provided in the designated fields.

What is the purpose of GST/HST RETURN (NON-PERSONALIZED)?

The purpose of the GST/HST RETURN (NON-PERSONALIZED) is to report the amount of GST/HST collected or paid and to calculate the net tax owed or refundable to the Canada Revenue Agency (CRA). It helps to ensure compliance with tax regulations.

What information must be reported on GST/HST RETURN (NON-PERSONALIZED)?

The information that must be reported on the GST/HST RETURN (NON-PERSONALIZED) includes total sales, the total amount of GST/HST collected, input tax credits claimed, other adjustments, any amounts owed or refundable, and the period of the reporting.

Fill out your gsthst return non-personalized online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gsthst Return Non-Personalized is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.