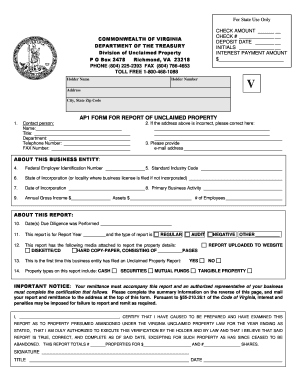

VA AP1 Form free printable template

Get, Create, Make and Sign virginia ap1 unclaimed property form

How to edit va treasury ap1 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out virginia form unclaimed

How to fill out VA AP1 Form

Who needs VA AP1 Form?

Video instructions and help with filling out and completing virginia form unclaimed property

Instructions and Help about virginia unclaimed property ap 1 form

Hi, I’m John Francis, the owner of Northern Virginia Roofing and Exteriors a 51-year-old family owned and operated home improvement company and in this video we’ll talk about property liens or more commonly known as Mechanics Liens. What are mechanics liens? What can you do to prevent them and what to do if you get one. I also give away a Lien Release Form at the end of this video so stay tuned! A lien is a legal notice attached to your property approved by your local municipality informing everyone that you owe a creditor money. There are a few different types of liens that can be filed against your home. First, a Mechanics Lien can be filed by an unpaid contractor that did work on your home also referred to as a construction lien. Secondly, a Laborer's Lien is filed by a subcontractor or crew that did work on your home. The last one, is a Material man's Lien or supplier's lien, and it is filed by the supplier who provided materials for your home. The lien is recorded with the county recorder's office. Since this is a legal binding notice enforced by the county, you can’t sell the house because the title is clouded, or refinance it, and you might have a hard time getting any credit approved until the lien is satisfied. To satisfy the lien, you will have to pay the amount of the lien to the person who placed the lien on your home. So, why would a contractor, subcontractor or supplier place a lien on your property? Simply put they place liens on a property because they haven't’t been paid. Whether it is justified or not? It doesn't matter. This is the one tool a contractor, subcontractor or supplier has to collect the money without the expense of a lawsuit. Here are some “best practices” for you as a homeowner to follow to greatly reduce the possibility of a lien being placed on your home. The most important thing you can do to avoid all these problems is to hire a Qualified Local Contractor or QC. A QC will strive to maintain excellent customer relationships by working with their clients to resolve problems, perform quality work, always pay their subcontractors and vendors, and conduct themselves professionally with the goal of building a successful business. Finding a Qualified Local Contractor will take some work on your part, but it will potentially save you a lot of time, money and headaches. Click here to learn how to find a Qualified Local Contractor. Here are some other recommendations Hire only licensed contractors and check the contractor's license status. You can find the links to Virginia, Maryland and DC contractor license agencies in the description below. Make sure your contractor hires only licensed subcontractors or crews, and check their licenses. Check your contractor's reputation for paying subcontractors and material suppliers, and check for lawsuits at the local courthouse. Get a list of all the subcontractors the crews, the laborers, and material suppliers to be used by your direct contractor. After you hire a contractor,...

People Also Ask about virginia form unclaimed fill

What is a Virginia form 760?

Who must file a Virginia non resident tax return?

What is a 763 form in Virginia?

What is the Virginia form R 5 for?

What is a Virginia form VA 6?

Who needs to file VA 5?

Our user reviews speak for themselves

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send va ap1 unclaimed to be eSigned by others?

Where do I find va ap1 report unclaimed?

How do I edit va ap1 form unclaimed in Chrome?

What is VA AP1 Form?

Who is required to file VA AP1 Form?

How to fill out VA AP1 Form?

What is the purpose of VA AP1 Form?

What information must be reported on VA AP1 Form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.