Get the free P11D 2000/2001 - revenue

Show details

Este formulario se requiere para la devolución de beneficios, emolumentos no en efectivo y pagos no sujetos a PAYE proporcionados a directores y ciertos empleados para el año que finalizó el 5

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign p11d 20002001 - revenue

Edit your p11d 20002001 - revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your p11d 20002001 - revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit p11d 20002001 - revenue online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit p11d 20002001 - revenue. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out p11d 20002001 - revenue

How to fill out P11D 2000/2001

01

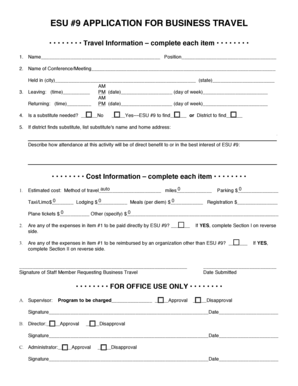

Gather all necessary information about employee benefits and expenses.

02

Identify the specific benefits each employee has received during the tax year.

03

Use the P11D form to list each employee's benefits and expenses in the appropriate sections.

04

Ensure the correct amount is reported for each benefit, following HMRC guidelines.

05

Complete the relevant parts of the form, including personal details and company information.

06

Review the filled P11D for accuracy and completeness.

07

Submit the P11D form to HMRC by the deadline (typically 6 July following the end of the tax year).

08

Keep a copy of the submitted P11D for records.

Who needs P11D 2000/2001?

01

Employers who provide benefits or reimbursements to employees.

02

Companies required to report employee benefits for taxation purposes.

03

Any organization that meets the criteria for providing P11D disclosures to employees.

Fill

form

: Try Risk Free

People Also Ask about

What is a taxable benefit in kind in the UK?

What is a benefit-in-kind? A BIK is a non-cash offering made to an employee that you need to cover as their employer. While non-cash, these employee benefits still hold monetary value, which means you'll need to report some of these as taxable income.

What is a P11D in the UK?

A P11D is a form used to report benefits given by employers. It must be submitted to HMRC by the employer every year for each member of staff (including directors) that receives certain taxable benefits and expenses. This could include company cars or vans, private healthcare or season ticket loans, for example.

What is P11D in the UK?

A P11D is a form used to report benefits given by employers. It must be submitted to HMRC by the employer every year for each member of staff (including directors) that receives certain taxable benefits and expenses. This could include company cars or vans, private healthcare or season ticket loans, for example.

What is a P60 in the UK?

Your P60 shows the tax you've paid on your salary in the tax year (6 April to 5 April). You get a separate P60 for each of your jobs every tax year. There's a separate guide to getting P60s if you're an employer. If you're working for an employer on 5 April they must give you a P60.

How to journal P11D?

Select 'Add New Journal Entries' in the top-right. Next, create the following journal entries for the amount due to HMRC: Explaining the payment of Class 1A NI to HMRC. Choose the relevant bank account from the list. Select the transaction that relates to the NI payment. Select 'Payment' from the 'Type' drop-down menu.

Is national insurance tax deductible in the UK?

National Insurance contributions are not deductible when working out your taxable income for either the employed or self-employed. Some expenses which may be deductible for tax purposes might not be deductible for National Insurance purposes (for example, certain employment expenses).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is P11D 2000/2001?

P11D 2000/2001 is a form used in the UK to report benefits and expenses provided to employees that are not included in their salary. This form is specifically for the tax year 2000/2001.

Who is required to file P11D 2000/2001?

Employers who provide benefits or expenses to employees that exceed a specific threshold are required to file the P11D 2000/2001 for each employee who received such benefits.

How to fill out P11D 2000/2001?

To fill out the P11D 2000/2001, employers must provide details of the employee, specify the type and value of the benefits and expenses, and ensure all information is accurate and complete before submission.

What is the purpose of P11D 2000/2001?

The purpose of P11D 2000/2001 is to report and assess any tax liabilities on benefits and expenses, ensuring that employees are taxed correctly on non-cash perks provided by their employers.

What information must be reported on P11D 2000/2001?

Information that must be reported on the P11D 2000/2001 includes the employee's details, a description of the benefits and expenses provided, their cash equivalent value, and any applicable deductions.

Fill out your p11d 20002001 - revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

p11d 20002001 - Revenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.