Canada RC66 E 2003 free printable template

Show details

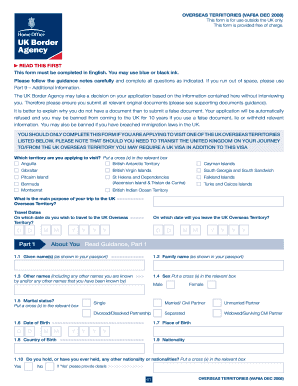

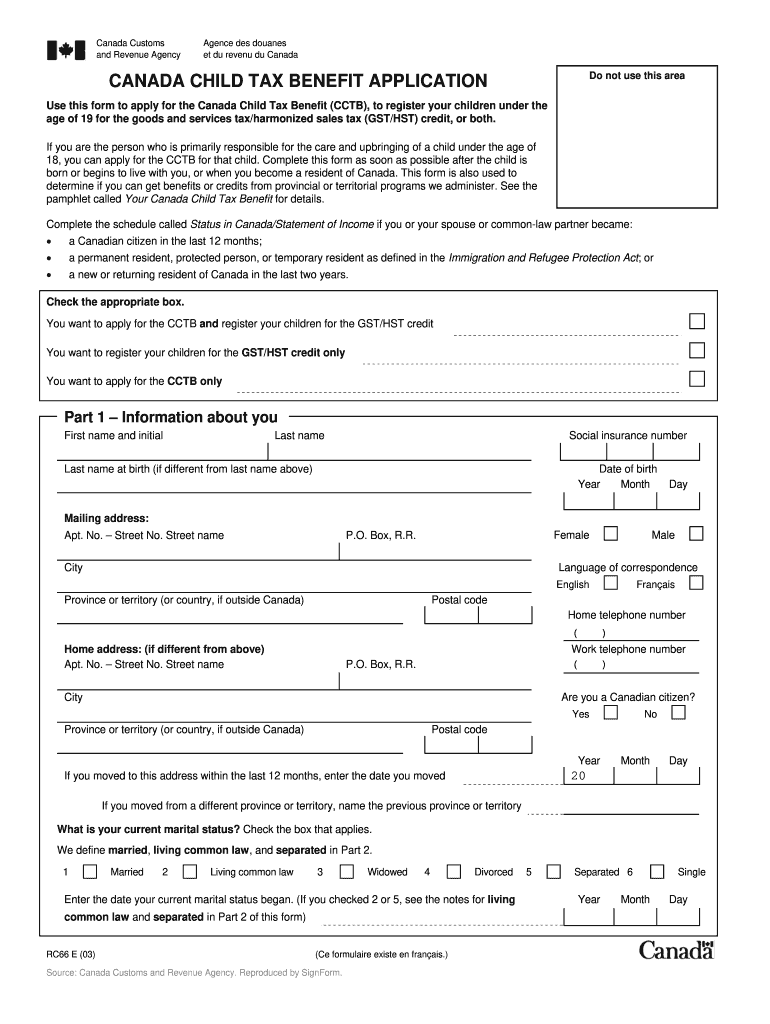

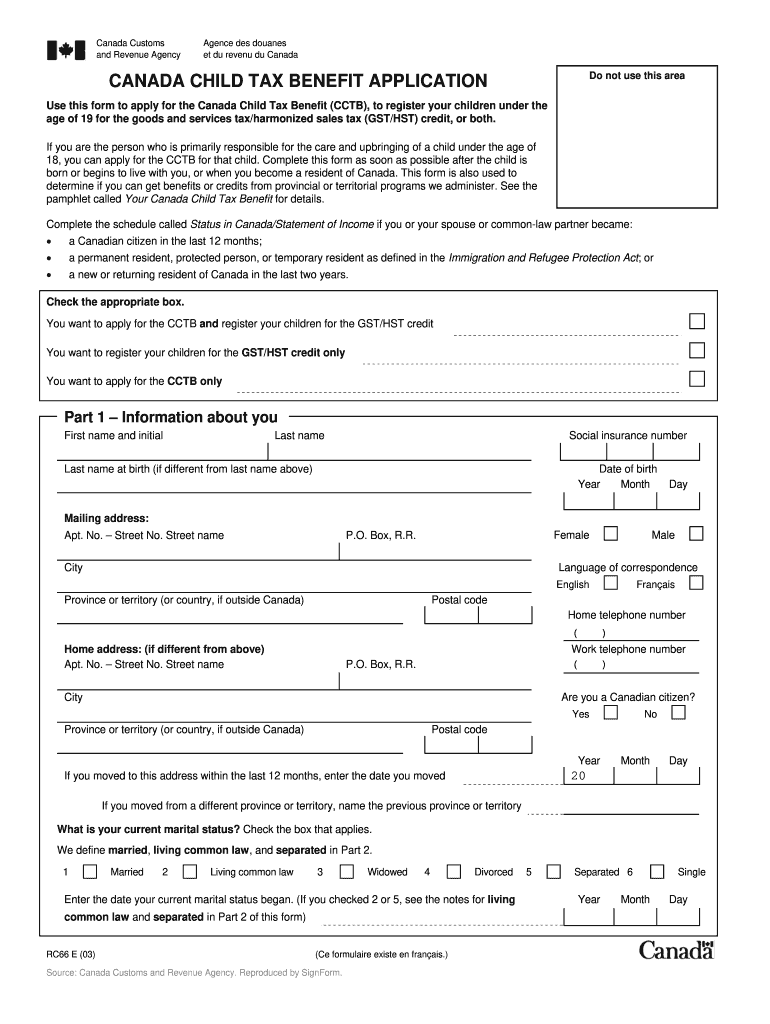

Canada Customs and Revenue Agency Agence des douanes et du revenu du Canada Do not use this area CANADA CHILD TAX BENEFIT APPLICATION Use this form to apply for the Canada Child Tax Benefit CCTB to register your children under the age of 19 for the goods and services tax/harmonized sales tax GST/HST credit or both. Ccra.gc.ca/tso or in the pamphlet called Your Canada Child Tax Benefit. This application is used to register your child ren under 19 years of age for the GST/HST credit. If you did...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada RC66 E

Edit your Canada RC66 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada RC66 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada RC66 E online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit Canada RC66 E. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada RC66 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada RC66 E

How to fill out Canada RC66 E

01

Obtain the Canada RC66 E form from the Canada Revenue Agency (CRA) website.

02

Fill in your personal information such as your name, address, and Social Insurance Number (SIN).

03

Indicate your marital status, including details about your spouse or partner if applicable.

04

Provide information about your children, including their names, dates of birth, and SINs.

05

Complete any relevant sections indicating your eligibility for benefits.

06

Review the form for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form to the CRA either electronically or by mail.

Who needs Canada RC66 E?

01

Individuals who are applying for the Canada Child Benefit (CCB) or the Eligibility for the CCB.

02

Parents or guardians of children under the age of 18.

03

Families experiencing changes in marital status or the birth/adoption of a child.

Fill

form

: Try Risk Free

People Also Ask about

What is RC66 form ontario?

What is Form RC66? Form RC66 is the Canada Revenue Agency (CRA) form you need to fill out if you intend to apply for the Canada Child Benefit (CCB), or the GST/HST tax credit for your child, when completing your tax return. Both benefits are covered with this single form.

How to fill status in Canada and income information?

You can provide this information by filling out Form CTB9, Income of Non-Resident Spouse or Common-Law Partner. Mail it to the tax centre that serves your area or submit it electronically using My Account at canada.ca/my-cra -account. You can also call 1-800-387-1193 to provide the information.

What is RC66SCH status in Canada?

What is the RC66SCH form? When you file your income tax you may use form RC66SCH to state your status in Canada if you are a new Canadian citizen, became a resident in the last 2 years, or a permanent resident, and you want to apply for the Canada Child Benefit (CCB).

Do you need to attach Schedule RC66SCH status in Canada Statement of income?

Complete schedule RC66SCH, Status in Canada/Statement of Income, if it applies to you or to your spouse or common-law partner and attach it with your application. Sign and date the application form. If you are married or living common-law, your spouse or common-law partner also needs to sign the form.

Where do I send my RC66?

When you need to provide additional documents Provide supporting documents for. For a complete list of all supporting documents, go to canada.ca/child-benefits-supporting-documents. Mail all supporting documents and Form RC66, Canada Child Benefits Application to your tax centre.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit Canada RC66 E online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your Canada RC66 E to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit Canada RC66 E in Chrome?

Canada RC66 E can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out the Canada RC66 E form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign Canada RC66 E and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is Canada RC66 E?

Canada RC66 E is a form used to apply for the Canada Child Benefit (CCB) and related parental benefits. It is specifically designed for individuals who have children under the age of 18.

Who is required to file Canada RC66 E?

Individuals who are responsible for the care and upbringing of a child under the age of 18, and wish to receive the Canada Child Benefit (CCB), are required to file the Canada RC66 E form.

How to fill out Canada RC66 E?

To fill out Canada RC66 E, applicants need to provide personal information including their name, address, date of birth, and Social Insurance Number (SIN). They also need to provide information about the children for whom they are applying, including names and dates of birth.

What is the purpose of Canada RC66 E?

The purpose of Canada RC66 E is to apply for the Canada Child Benefit (CCB), which provides financial assistance to eligible families with children to help cover the costs of raising children.

What information must be reported on Canada RC66 E?

The information that must be reported on Canada RC66 E includes the applicant's personal details, information about the child or children, including their names and dates of birth, and the applicant's marital status, all of which are essential to determine eligibility for the benefit.

Fill out your Canada RC66 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada rc66 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.