Canada RC66 E 2011 free printable template

Show details

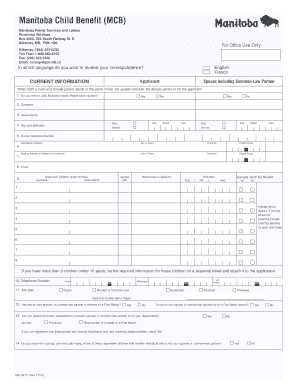

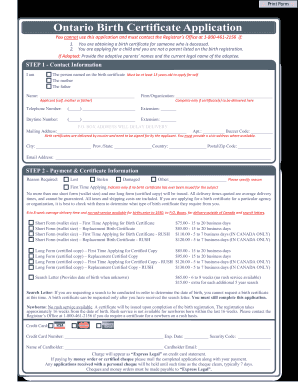

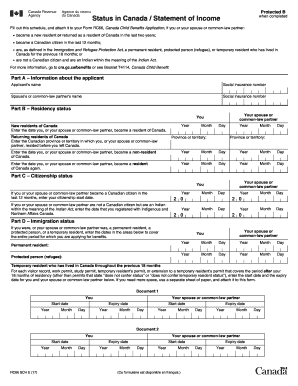

Yes No Have you been a Canadian citizen for the last 12 months You must also attach a completed Schedule RC66SCH if you or your spouse or common-law partner became a new resident or returned as a resident of Canada in the last 2 years or are as defined in the Immigration and Refugee Protection Act a permanent resident protected person refugee or temporary resident who has lived in Canada for the previous 18 months. Canada Child Benefits Application Who should use this form Use this form to...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada RC66 E

Edit your Canada RC66 E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada RC66 E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada RC66 E online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Canada RC66 E. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada RC66 E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada RC66 E

How to fill out Canada RC66 E

01

Download the RC66 E form from the Canada Revenue Agency (CRA) website.

02

Read the instructions provided with the form carefully.

03

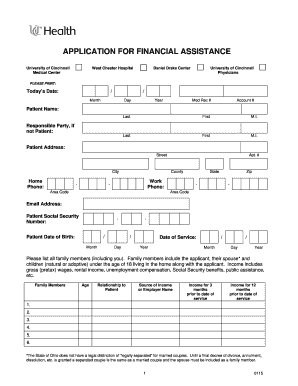

Fill out your personal information in the appropriate sections, including your name, address, and social insurance number (SIN).

04

Indicate your relationship status and any dependent children.

05

Provide the necessary documentation to support your claims, such as proof of income and identification for dependents.

06

Review the completed form for accuracy and ensure all required signatures are present.

07

Submit the form online through your CRA My Account or mail it to the designated address.

Who needs Canada RC66 E?

01

Individuals who wish to apply for the Canada Child Benefit (CCB) must submit the RC66 E form.

02

Parents or guardians who are either new to the CCB program or are reporting changes in their marital status or number of children.

03

Those who have recently moved to Canada and are eligible for the CCB.

Fill

form

: Try Risk Free

People Also Ask about

Can I get child tax credit if I live abroad?

What about the child care/dependent tax credit requirements? Yes, expats are also able to claim this credit for a qualifying child or dependent. The normal child care tax credit requirements apply even if you're abroad.

How do I check my Canadian child tax benefit?

You can check the status of your benefits by logging into your CRA My Account. Contact the CRA if debt repayment causes you financial hardship. Call 1-888-863-8662 for benefit debt or, 1-888-863-8657 for tax return debt. Learn more at Canada.ca/balance-owing.

What is the BC child Opportunity benefit?

If your adjusted family net income for the 2021 taxation year is $82,578 or more, the maximum benefit you can receive is: $108.33 per month for your first child. $106.67 per month for your second child. $105 per month for each additional child.

What is RC66SCH status in Canada?

What is the RC66SCH form? When you file your income tax you may use form RC66SCH to state your status in Canada if you are a new Canadian citizen, became a resident in the last 2 years, or a permanent resident, and you want to apply for the Canada Child Benefit (CCB).

What is the 183-day rule in Canada?

If you sojourned in Canada for 183 days or more (the 183-day rule) in the tax year, do not have significant residential ties with Canada, and are not considered a resident of another country under the terms of a tax treaty between Canada and that country, see Deemed residents of Canada for the rules that apply to you.

Can I get child benefit if I live abroad Canada?

If you are eligible to receive the Canada child benefit (CCB), you will continue to receive it and any related provincial or territorial benefits that you are eligible for during your absence from Canada. However, you will have to file a return each year so that the CRA can calculate your CCB .

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get Canada RC66 E?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the Canada RC66 E in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for the Canada RC66 E in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your Canada RC66 E in minutes.

Can I edit Canada RC66 E on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign Canada RC66 E. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is Canada RC66 E?

Canada RC66 E is a form used to apply for the Canada Child Benefit (CCB) and/or the Child Disability Benefit (CDB).

Who is required to file Canada RC66 E?

Individuals who want to apply for the Canada Child Benefit or Child Disability Benefit, typically parents or guardians of qualifying children.

How to fill out Canada RC66 E?

To fill out Canada RC66 E, you must provide personal information such as your name, address, and Social Insurance Number, as well as details about your children that qualify for the benefits.

What is the purpose of Canada RC66 E?

The purpose of Canada RC66 E is to determine eligibility and facilitate the application process for financial support through the Canada Child Benefit program.

What information must be reported on Canada RC66 E?

You must report personal identification information, details of your marital status, and information on your children, including their names, dates of birth, and any disabilities if applicable.

Fill out your Canada RC66 E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada rc66 E is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.