Canada RC66SCH 2017 free printable template

Show details

Refer to Info Source at cra.gc.ca/gncy/tp/nfsrc/nfsrc-eng. html Personal Information Bank CRA PPU 063. If you need more space use a separate sheet of paper and attach it to this form. Document 1 Start date Expiry date RC66 SCH E 17 Ce formulaire est disponible en fran ais. Part F Certification I certify that the information given on this form and in any attached documents is correct and complete. Note If you are an Indian within the meaning of the Indian Act do not report the portion of...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada RC66SCH

Edit your Canada RC66SCH form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada RC66SCH form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Canada RC66SCH online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada RC66SCH. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada RC66SCH Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada RC66SCH

How to fill out Canada RC66SCH

01

Obtain the Canada RC66SCH form from the Canada Revenue Agency (CRA) website.

02

Fill in your personal information, including your name, address, and social insurance number (SIN).

03

Indicate the period for which you are applying for the Canada Child Benefit.

04

Provide information about your spouse or common-law partner, if applicable.

05

List the children's names, dates of birth, and check the applicable eligibility criteria for each child.

06

Sign and date the form to confirm that the information provided is accurate.

07

Submit the completed form to the CRA either by mail or online through your CRA account.

Who needs Canada RC66SCH?

01

Parents or guardians of children under the age of 18 who want to apply for or update their Canada Child Benefit.

02

Individuals who have recently had a child or changed their marital status and need to register for benefits.

03

Those who are new to Canada and are applying for benefits related to their dependent children.

Fill

form

: Try Risk Free

People Also Ask about

Can I get child tax credit if I live abroad?

What about the child care/dependent tax credit requirements? Yes, expats are also able to claim this credit for a qualifying child or dependent. The normal child care tax credit requirements apply even if you're abroad.

How do I check my Canadian child tax benefit?

You can check the status of your benefits by logging into your CRA My Account. Contact the CRA if debt repayment causes you financial hardship. Call 1-888-863-8662 for benefit debt or, 1-888-863-8657 for tax return debt. Learn more at Canada.ca/balance-owing.

What is the BC child Opportunity benefit?

If your adjusted family net income for the 2021 taxation year is $82,578 or more, the maximum benefit you can receive is: $108.33 per month for your first child. $106.67 per month for your second child. $105 per month for each additional child.

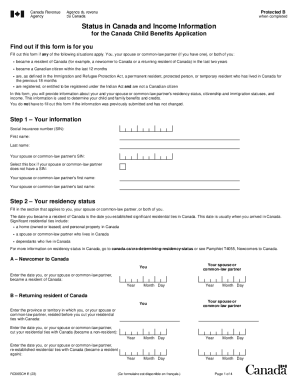

What is RC66SCH status in Canada?

What is the RC66SCH form? When you file your income tax you may use form RC66SCH to state your status in Canada if you are a new Canadian citizen, became a resident in the last 2 years, or a permanent resident, and you want to apply for the Canada Child Benefit (CCB).

What is the 183-day rule in Canada?

If you sojourned in Canada for 183 days or more (the 183-day rule) in the tax year, do not have significant residential ties with Canada, and are not considered a resident of another country under the terms of a tax treaty between Canada and that country, see Deemed residents of Canada for the rules that apply to you.

Can I get child benefit if I live abroad Canada?

If you are eligible to receive the Canada child benefit (CCB), you will continue to receive it and any related provincial or territorial benefits that you are eligible for during your absence from Canada. However, you will have to file a return each year so that the CRA can calculate your CCB .

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my Canada RC66SCH directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign Canada RC66SCH and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit Canada RC66SCH online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your Canada RC66SCH to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit Canada RC66SCH straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing Canada RC66SCH.

What is Canada RC66SCH?

Canada RC66SCH is a form used by the Canada Revenue Agency (CRA) to apply for or update information regarding the Canada Child Benefit (CCB) for families with children.

Who is required to file Canada RC66SCH?

Parents or guardians who are applying for the Canada Child Benefit for the first time, or who need to update their information related to their children, are required to file the Canada RC66SCH.

How to fill out Canada RC66SCH?

To fill out Canada RC66SCH, individuals need to provide personal information such as their name, address, date of birth, and social insurance number, as well as information about their children including their names, dates of birth, and residency details.

What is the purpose of Canada RC66SCH?

The purpose of Canada RC66SCH is to determine eligibility for the Canada Child Benefit and to ensure that the correct amount of benefits is issued based on the family's circumstances.

What information must be reported on Canada RC66SCH?

The information that must be reported on Canada RC66SCH includes personal identification details of the applicant, information about the applicant's spouse or common-law partner, and details about the children such as their identities and residency status.

Fill out your Canada RC66SCH online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada rc66sch is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.