Get the free med 1 form online - virginiaprimarycare

Show details

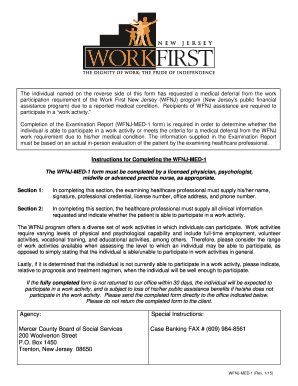

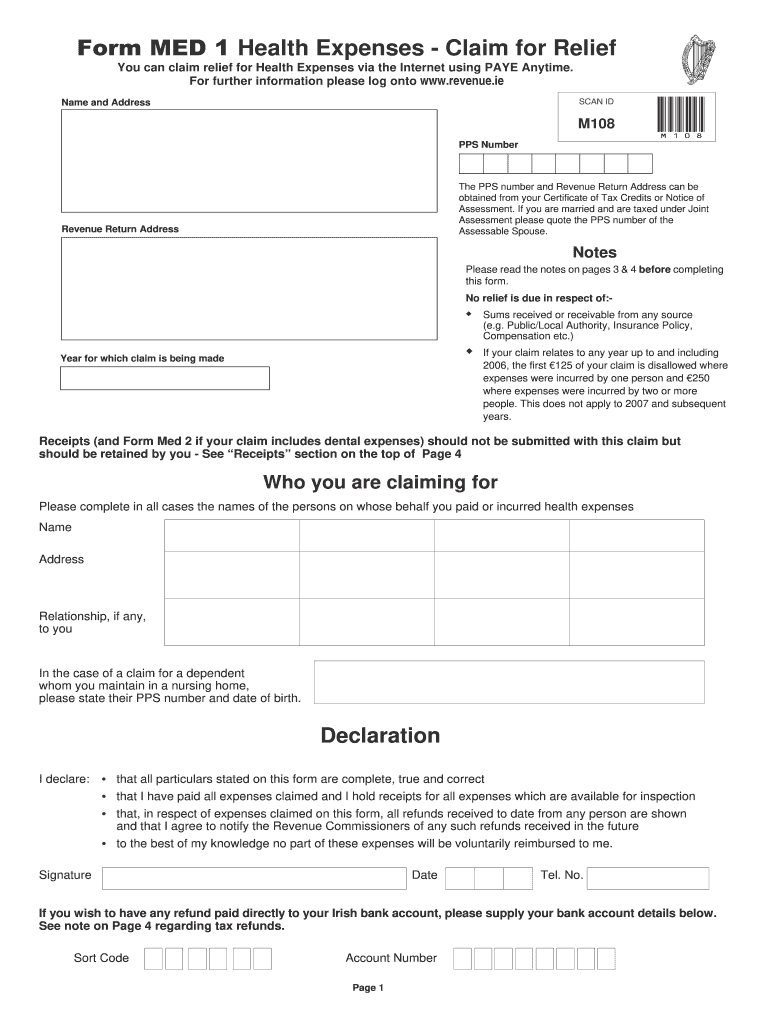

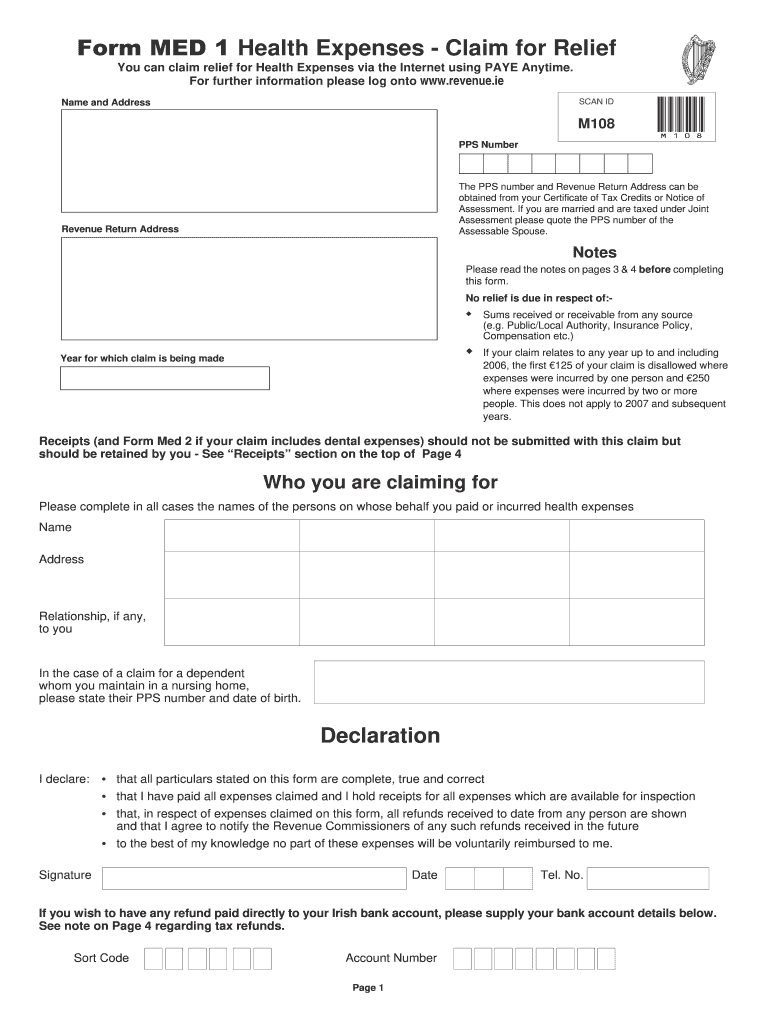

Form MED 1 Health Expenses - Claim for Relief You can claim relief for Health Expenses via the Internet using PAYE Anytime. For further information please log onto www. revenue. ie SCAN ID Name and Address M108 PPS Number The PPS number and Revenue Return Address can be obtained from your Certificate of Tax Credits or Notice of Assessment. If you are married and are taxed under Joint Assessment please quote the PPS number of the Assessable Spouse. Revenue Return Address Notes Please read the...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign med 1 form online

Edit your med 1 form online form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your med 1 form online form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit med 1 form online online

Follow the guidelines below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit med 1 form online. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Fill

form

: Try Risk Free

People Also Ask about

How do you calculate medical expenses tax offset?

Calculating Your Medical Expense Deduction You can get your deduction by taking your AGI and multiplying it by 7.5%. If your AGI is $50,000, only qualifying medical expenses over $3,750 can be deducted ($50,000 x 7.5% = $3,750). If your total medical expenses are $6,000, you can deduct $2,250 of it on your taxes.

How much do you get back from Revenue for medical expenses?

You generally receive tax relief for health expenses at your standard rate of tax (20%). Nursing home expenses are given at your highest rate of tax (up to 40%).

What percentage do you get back for medical expenses?

1) The Three Percent Rule From your total medical expenses, the eligible amount is 3% of your income or the set maximum for the tax year, which ever is less. For example, if your net income is $60,000, the first $1800 of medical expenses won't count toward a credit.

Do you get money back for medical expenses on taxes?

You may deduct only the amount of your total medical expenses that exceed 7.5% of your adjusted gross income. You figure the amount you're allowed to deduct on Schedule A (Form 1040).

Can you claim for glasses on Med 1?

1. Glasses & Contacts. Unfortunately, you can't claim tax back for routine eye care, such as vision tests or buying glasses or contact lenses. However, the good news is if you pay PRSI, you can get the cost of a sight test covered through the Treatment Benefit Scheme.

Where can I get a Med 1 form?

The Med 1 is no longer available. Health expenses are claimed through your Income Tax Return. If you are a Pay As You Earn (PAYE) taxpayer, you also have the option to claim relief in real time during the year. You can claim relief on health expenses through myAccount or Revenue Online Service (ROS).

How do I claim dental expenses online?

For dental expenses, you dentist should complete Form Med 2 (pdf) for you to use as a receipt. You can claim tax relief online using Revenue's myAccount service. Revenue's myAccount service includes a receipts tracker service which allows you to store your receipt details online.

How much do medical expenses save on taxes?

How to claim medical expense deductions Filing Status2022 Standard DeductionSingle$12,950Married Filing Jointly$25,900Married Filing Separately$12,950Head of Household$19,400 Feb 13, 2023

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my med 1 form online in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your med 1 form online and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Can I create an electronic signature for the med 1 form online in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your med 1 form online in seconds.

How do I complete med 1 form online on an Android device?

Complete med 1 form online and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is med 1 form online?

The med 1 form online is a digital version of the Med 1 form, which is used for claiming tax relief on certain medical expenses in Ireland.

Who is required to file med 1 form online?

Any individual who has incurred qualifying medical expenses in Ireland and wishes to claim tax relief on those expenses must file the med 1 form online.

How to fill out med 1 form online?

To fill out the med 1 form online, you need to visit the Revenue Online Service (ROS) website and navigate to the relevant section for tax relief on medical expenses. You will be required to provide personal information, details of the medical expenses, and supporting documentation.

What is the purpose of med 1 form online?

The purpose of the med 1 form online is to facilitate the claiming of tax relief on qualifying medical expenses incurred by individuals in Ireland.

What information must be reported on med 1 form online?

On the med 1 form online, you must report personal information such as your name, address, and PPS number. Additionally, you need to provide details of the medical expenses incurred, including the nature of the expenses, the amount paid, and the date of payment. Supporting documentation must also be submitted.

Fill out your med 1 form online online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Med 1 Form Online is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.