Get the free RCT46 - offaly

Show details

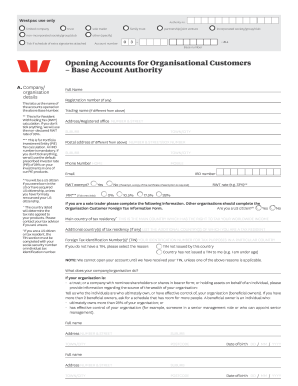

This form is used by principal contractors to apply for a Relevant Payments Card on behalf of subcontractors, including their details and relevant contract information, and outlines the requirements

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rct46 - offaly

Edit your rct46 - offaly form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rct46 - offaly form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing rct46 - offaly online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rct46 - offaly. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rct46 - offaly

How to fill out RCT46

01

Obtain the RCT46 form from the appropriate authority.

02

Read the instructions provided with the form carefully.

03

Fill out your personal details, including your name, address, and contact information.

04

Provide the necessary financial information as required in the form.

05

Attach any supporting documents that are requested.

06

Review your completed form for accuracy and completeness.

07

Submit the form by the specified deadline through the indicated method.

Who needs RCT46?

01

Individuals applying for tax credits.

02

Taxpayers seeking to claim specific deductions.

03

Persons reporting certain types of income.

04

Anyone required to provide financial information for government programs.

Fill

form

: Try Risk Free

People Also Ask about

What is the RCT payment deduction?

RCT is a withholding tax that applies to certain payments by principal contractors to subcontractors in the construction, forestry and meat-processing industries. The rates of tax are 0%, 20% and 35%. All RCT compliance, filing and payments, is conducted online using the Revenue Online Service (ROS).

How to claim RCT?

To claim a refund of RCT, you must complete: Form IC1, if you are an individual subcontractor. Form IC3, if you are a company subcontractor. RCT questionnaire relating to each contract you have accepted.

Is RCT the same as VAT?

Value-Added Tax (VAT) is normally charged by the person supplying the goods or services. However, under RCT, the person receiving the goods or services (the principal contractor) calculates VAT and pays it directly to Revenue.

What is the RCT payment deduction?

RCT is a withholding tax that applies to certain payments by principal contractors to subcontractors in the construction, forestry and meat-processing industries. The rates of tax are 0%, 20% and 35%. All RCT compliance, filing and payments, is conducted online using the Revenue Online Service (ROS).

What does RCT mean in accounting?

RCT stands for “Retro Cost Transfer” and refers to the correcting of a financial transaction that has already taken place. You will sometimes hear it referred to by different names - simply a “Retro,” or “retro reallocation of costs,” or “retro costing,” or perhaps a “CTR” which stands for Cost Transfer Request. 2.

What is the SIN number in Ireland?

The SIN is a system-generated identifying number which is applied to the location or locations where relevant operations are due to take place under a particular contract.

How to get RCT back?

Revenue will automatically credit your tax record with any Relevant Contracts Tax (RCT) that the principal has deducted. Once a tax return is filed and the liability falls due, our system will automatically offset RCT credits against these liabilities.

How to claim RCT?

To claim a refund of RCT, you must complete: Form IC1, if you are an individual subcontractor. Form IC3, if you are a company subcontractor. RCT questionnaire relating to each contract you have accepted.

How to set up for RCT?

RCT Contractors Register you with Revenue as a contractor. Verify your subcontractors with Revenue. Ensure you pay your subcontractors correctly within the scheme. Supply deduction statements to the subcontractors. Keep your records in good order and supply Revenue with monthly returns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is RCT46?

RCT46 is a form used by businesses in certain jurisdictions to report information related to their corporate structure and activities for tax purposes.

Who is required to file RCT46?

Entities such as corporations, partnerships, and other organizations conducting business in the jurisdiction are typically required to file RCT46.

How to fill out RCT46?

To fill out RCT46, businesses need to provide specific details about their ownership structure, financial activities, and compliance with local regulations as per the guidelines provided by the relevant tax authority.

What is the purpose of RCT46?

The purpose of RCT46 is to ensure that businesses provide accurate information regarding their operations and tax obligations, aiding in regulatory compliance and tax collection.

What information must be reported on RCT46?

RCT46 requires information such as the entity's name, registration details, ownership structures, financial statements, and any other relevant information as prescribed by the tax authority.

Fill out your rct46 - offaly online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

rct46 - Offaly is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.