NZ IR595 2012 free printable template

Show details

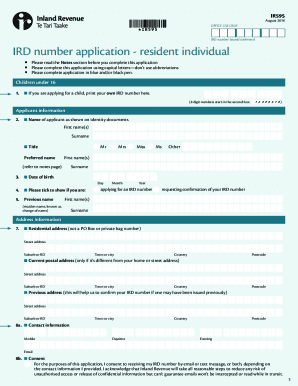

IR 595 December 2009 IRD number application individual To apply for an IRD number for you or for a child in your care 1. Complete the form on page 3 and sign the declaration on page 4. Take it with

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign NZ IR595

Edit your NZ IR595 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NZ IR595 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NZ IR595 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NZ IR595. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NZ IR595 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NZ IR595

How to fill out NZ IR595

01

Download the NZ IR595 form from the official New Zealand Inland Revenue website.

02

Carefully read the instructions provided on the first page of the form.

03

Fill in your personal details including your name, IRD number, and contact information in the designated fields.

04

Provide information regarding your income sources as requested in the form.

05

Indicate your tax residency status and any relevant exemptions.

06

Complete the sections regarding your annual income and deductions accurately.

07

Review your completed form for any errors or omissions.

08

Submit the form through the specified method (online or paper submission) as directed.

Who needs NZ IR595?

01

Individuals who are required to file a tax return in New Zealand.

02

Tax residents or non-residents earning income in New Zealand.

03

Anyone claiming tax credits or deductions for the tax year.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my first IRD number?

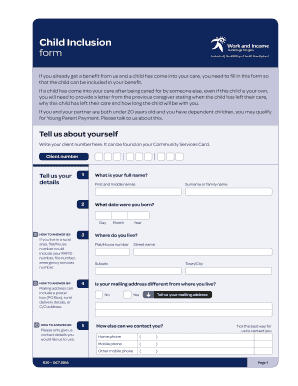

Applying for your child's IRD number You can get an IRD number for your baby when you register their birth. Your child will need an IRD number if they: earn income from any source. get interest from a bank account or investment.

Can I apply for IRD number online?

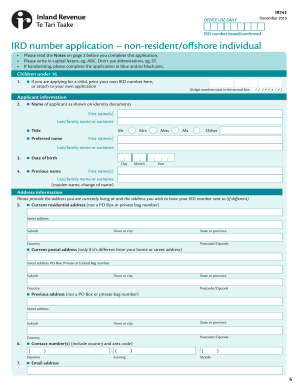

Apply online You'll need to apply for an IRD number as 'living in New Zealand and not a new arrival' if: you're applying in New Zealand after your visa travel date. you're a New Zealand citizen applying for your child's IRD number. you prefer using the paper forms, which are an option for that process.

Can I file I online?

File online File your California tax return electronically (e-file) Filing online (e-file) is a secure, accurate, fast, and easy option to file your tax return.

What do I need to apply for IRD number?

Gather your identification documents your passport details. your Immigration New Zealand Application Number. your most recent overseas tax number (if you have one) an NZ bank account, showing your name and account number, or customer due diligence (CDD), if you have one.

Can you get an IRD number without a bank account?

You need a current New Zealand bank account before you apply for an IRD number.

How can I directly speak to someone at the IRS?

Contact an IRS customer service representative to correct any agency errors by calling 800-829-1040 (see telephone assistance for hours of operation).

How long does it take for IRD to reply?

If you do not have your refund yet You can check your details in myIR or call us. We'll process your assessment within 10 weeks of receiving it. If you do not have yours by then, let us know.

Do you need an IRD number to open a bank account in New Zealand?

The only way that a person with a current IRD number can be required to provide a bank account is if they are a non-individual and become an offshore person on or after 1 October (for example, if New Zealand shareholders of a New Zealand-registered company sell their shares to offshore individuals).

How long does it take to get an IRD number in NZ?

Once the AA driver licensing agent has verified your documents, you'll get your IRD number by text or email within 10 working days if you apply online, and 12 working day if you fill out the paper form.

How do I apply for an IRD?

You can apply online or complete a paper application if you have a NZ resident, student or work visa or an Australian passport.

How long does it take to apply for IRD?

Once the AA driver licensing agent has verified your documents, you'll get your IRD number by text or email within 10 working days if you apply online, and 12 working day if you fill out the paper form.

How do I set up an IRD number?

Apply for an IRD number If you're an NZ citizen. You can apply online or complete a paper application. If you have a resident visa or a student or work visa. You can apply online or complete a paper application if you have a NZ resident, student or work visa or an Australian passport. If you live outside NZ.

Can you fill out IRD forms online?

You can submit information to us using our online forms. If you're providing information on an online form, you must complete all required details, and confirm the information is true and correct before submitting it to us.

Where can I get my IRD?

You can also find your IRD number: in myIR. on payslips. on letters or statements we've sent you. on your KiwiSaver statement. on income details from your employer. by calling us.

How long does it take to get an IRD number?

Once the AA driver licensing agent has verified your documents, you'll get your IRD number by text or email within 10 working days if you apply online, and 12 working day if you fill out the paper form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete NZ IR595 online?

pdfFiller makes it easy to finish and sign NZ IR595 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit NZ IR595 online?

With pdfFiller, the editing process is straightforward. Open your NZ IR595 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I fill out the NZ IR595 form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign NZ IR595. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

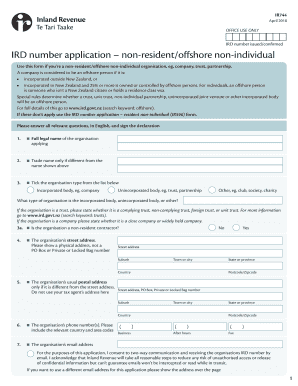

What is NZ IR595?

NZ IR595 is a tax form used in New Zealand for reporting income earned from overseas investments and foreign income.

Who is required to file NZ IR595?

Individuals who earn foreign income or have overseas investments that exceed certain thresholds are required to file NZ IR595.

How to fill out NZ IR595?

To fill out NZ IR595, gather required information about your foreign income, follow the guidelines provided by the New Zealand Inland Revenue, and accurately complete each section of the form.

What is the purpose of NZ IR595?

The purpose of NZ IR595 is to ensure that New Zealand residents report their foreign income and comply with tax obligations related to overseas earnings.

What information must be reported on NZ IR595?

Information that must be reported on NZ IR595 includes details of foreign income, foreign tax credits, and any overseas investments held, along with their earnings.

Fill out your NZ IR595 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NZ ir595 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.