Get the free SECURED CREDITOR’S VALUATION AND CLAIM FORM - norrismanagement co

Show details

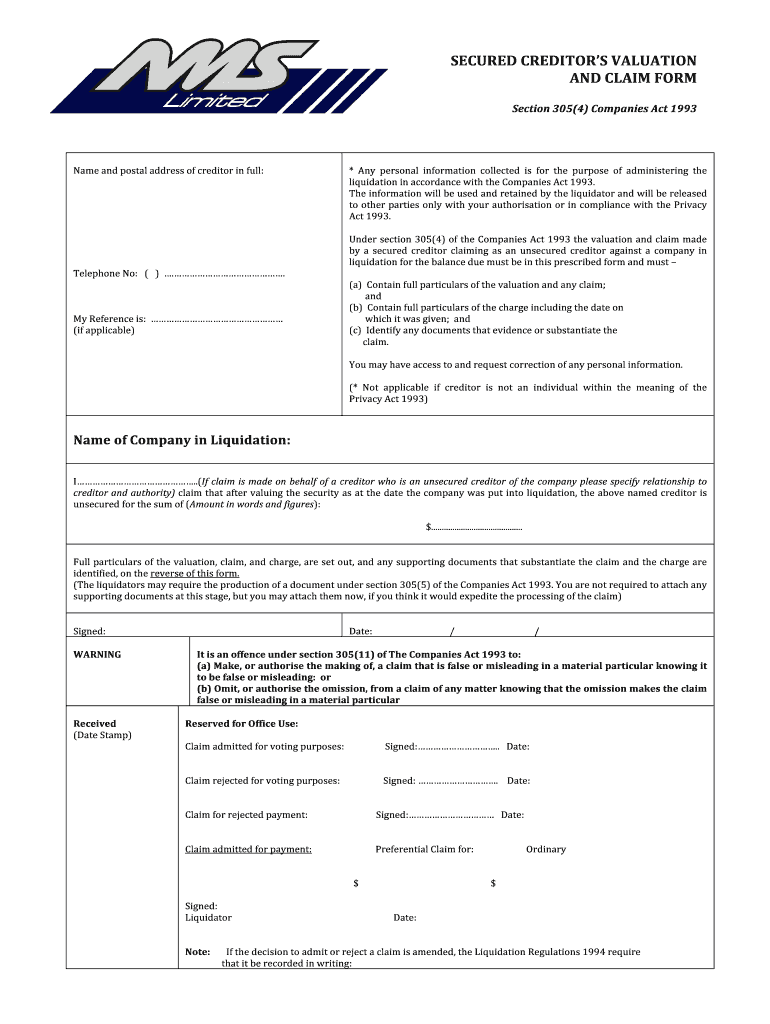

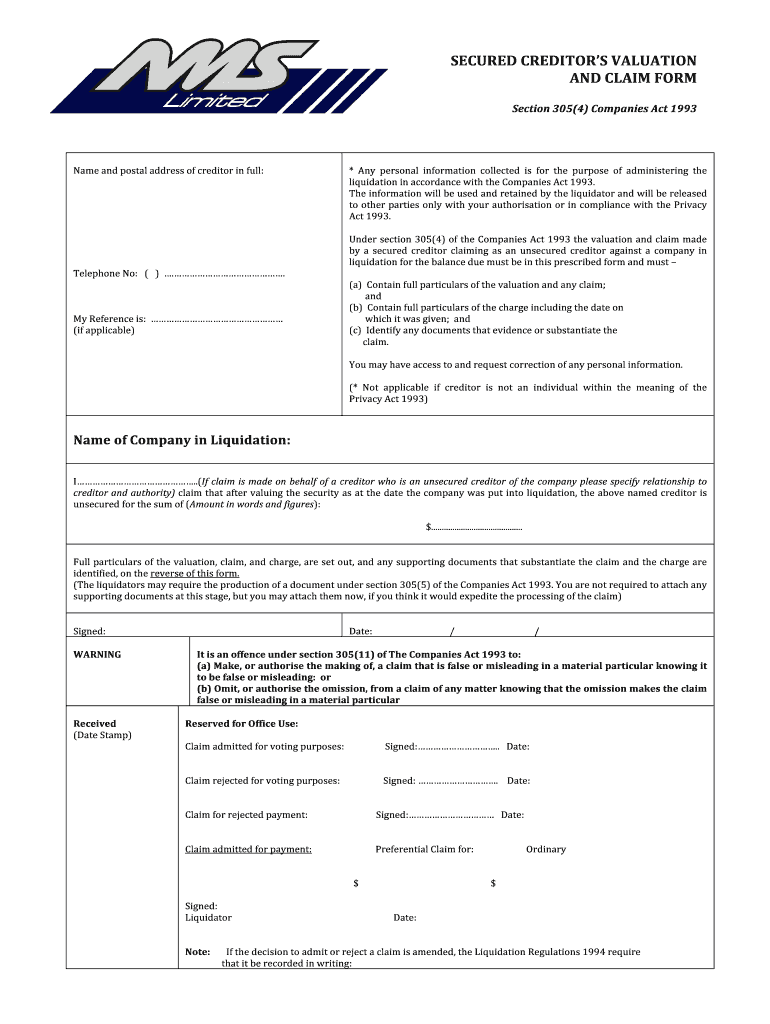

This document is used by secured creditors to submit a valuation and claim against a company in liquidation as per the Companies Act 1993. It includes sections for creditor details, claim particulars,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign secured creditors valuation and

Edit your secured creditors valuation and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your secured creditors valuation and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit secured creditors valuation and online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit secured creditors valuation and. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out secured creditors valuation and

How to fill out SECURED CREDITOR’S VALUATION AND CLAIM FORM

01

Begin by entering the name and contact information of the creditor at the top of the form.

02

Next, provide the details of the debtor, including their name and any relevant identification numbers.

03

Indicate the type of security interest the creditor holds, specifying whether it is a lien, mortgage, or another form of security.

04

Describe the collateral backing the claim in detail, including its condition and location.

05

State the total amount owed by the debtor to the creditor, ensuring to include any interest accrued.

06

Attach supporting documentation, such as loan agreements and valuation appraisals of the collateral.

07

Sign and date the form to certify the accuracy of the information provided.

Who needs SECURED CREDITOR’S VALUATION AND CLAIM FORM?

01

The SECURED CREDITOR’S VALUATION AND CLAIM FORM is needed by creditors who have a secured interest in a debtor's asset and are seeking to assert their claim in the event of the debtor's insolvency or bankruptcy.

Fill

form

: Try Risk Free

People Also Ask about

What is a proof of claim for a secured creditor?

A claim may be secured or unsecured. A proof of claim is a form used by the creditor to indicate the amount of the debt owed by the debtor on the date of the bankruptcy filing. The creditor must file the form with the clerk of the same bankruptcy court in which the bankruptcy case was filed.

What is an example of proof of claim?

Attach redacted copies of documents, if any, that show evidence of perfection of a security interest (for example, a mortgage, lien, certificate of title, financing statement, or other document that shows the lien has been filed or recorded.)

What is an example of proof of claim?

Attach redacted copies of documents, if any, that show evidence of perfection of a security interest (for example, a mortgage, lien, certificate of title, financing statement, or other document that shows the lien has been filed or recorded.)

What to attach to proof of claim?

∎ Attach any supporting documents to this form. debt exists, a lien secures the debt, or both. (See the definition of redaction on the next page.) Also attach redacted copies of any documents that show perfection of any security interest or any assignments or transfers of the debt.

Which of the following creditors must file proofs of claims?

In both Chapter 7 bankruptcies and Chapter 13 bankruptcies, all creditors must file a proof of claim or interest in the bankruptcy case for the claim or interest to be allowed (See Federal Rule of Bankruptcy Procedure 3002). This is true for all secured creditors, unsecured creditors and even equity security holders.

Does a secured creditor have to file a proof of claim?

(a) Necessity for Filing. A secured creditor, unsecured creditor, or equity security holder must file a proof of claim or interest for the claim or interest to be allowed, except as provided in Rules 1019(3), 3003, 3004, and 3005.

What is a form 410 proof of claim?

Proof of claim: A form that shows the amount of debt the. debtor owed to a creditor on the date of the bankruptcy filing. The form must be filed in the district where the case is pending.

What does creditors who have claims secured by property mean?

A secured debt is a debt that is secured by property. If you don't repay the debt ing to your contract — for example, you fail to make your monthly payment — the creditor has the right to take back the secured property, such as your home or car. In contrast, your unsecured creditors don't have the same rights.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SECURED CREDITOR’S VALUATION AND CLAIM FORM?

The SECURED CREDITOR'S VALUATION AND CLAIM FORM is a document used by secured creditors to assert their security interests in the property of a debtor and to provide a valuation of the secured assets. It is typically used in bankruptcy proceedings.

Who is required to file SECURED CREDITOR’S VALUATION AND CLAIM FORM?

Secured creditors, those who hold a security interest in collateral owned by the debtor, are required to file the SECURED CREDITOR’S VALUATION AND CLAIM FORM during bankruptcy proceedings or other debt restructuring processes.

How to fill out SECURED CREDITOR’S VALUATION AND CLAIM FORM?

To fill out the SECURED CREDITOR’S VALUATION AND CLAIM FORM, the creditor must provide details such as the debtor's information, the description of the collateral, the valuation of the collateral, and any relevant security agreements or documentation supporting the claim.

What is the purpose of SECURED CREDITOR’S VALUATION AND CLAIM FORM?

The purpose of the SECURED CREDITOR’S VALUATION AND CLAIM FORM is to allow secured creditors to formally stake their claims against a debtor's assets, provide a valuation for those assets, and facilitate the resolution of debts during insolvency proceedings.

What information must be reported on SECURED CREDITOR’S VALUATION AND CLAIM FORM?

The information that must be reported on the SECURED CREDITOR’S VALUATION AND CLAIM FORM includes the creditor's name and contact information, details about the debtor, a description of the secured assets, their current market value, the nature of the security interest, and any relevant documentation.

Fill out your secured creditors valuation and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Secured Creditors Valuation And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.