Get the free trustees liability insurance proposal

Show details

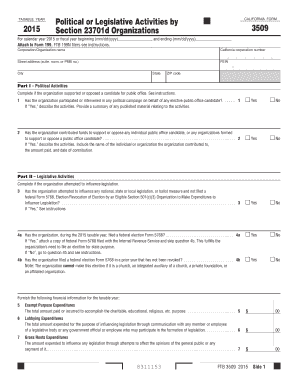

This document serves as a proposal form for a claims made policy regarding trustees liability insurance, outlining the required information, duties, and conditions related to the insurance coverage.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign trustees liability insurance proposal

Edit your trustees liability insurance proposal form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your trustees liability insurance proposal form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing trustees liability insurance proposal online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit trustees liability insurance proposal. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out trustees liability insurance proposal

How to fill out trustees liability insurance proposal

01

Gather all necessary documents related to your trust, including financial statements and governance policies.

02

Review the basic requirements of the insurance company; check their specific format and required information for the proposal.

03

Fill out the applicant's details, including the name of the trust and the trustees involved.

04

Provide a detailed description of the trust's purpose, structure, and financial status.

05

Detail any past claims or legal issues related to the trust and its trustees.

06

Outline risk management strategies already in place to mitigate potential liabilities.

07

Specify the desired coverage limits and types of coverage needed.

08

Complete any additional forms as required by the insurance provider.

09

Review the completed proposal for accuracy and completeness.

10

Submit the proposal along with any accompanying documentation to the insurance company.

Who needs trustees liability insurance proposal?

01

Anyone serving as a trustee for a trust, including individuals and corporate trustees.

02

Organizations that manage trusts, charitable foundations, or estates.

03

Board members of non-profit organizations who are overseeing trust funds.

Fill

form

: Try Risk Free

People Also Ask about

When can trustees be held personally liable?

If a trustee acts in breach of this fiduciary relationship, they will, in their personal capacity, be liable to the body corporate, for any loss suffered by the body corporate as a result of their breach, or for any economic benefit they received as a result of their breach.

How much does trustee liability insurance cost?

Trustee professional liability insurance policies that will protect the trustee, and the trustee's personal assets, from actions arising from their duties as a trustee may include: Premiums starting at $2,000 annually.

What are the legal obligations of a trustee?

The fundamental duties of a trustee are as follows: (1) the duty of good faith and loyalty; (2) the duty of reasonable skill and diligence; (3) the duty to give personal attention; and (4) the duty to keep and render accounts. What is the duty of loyalty and good faith?

What liability do trustees have?

Trustees may still be personally liable if the assets of the charity are not sufficient to meet the indemnity. Failure to deliver services under contract. Some liabilities can be limited through the wording of the “limitation of liability” provision in the contract.

What are the professional liability of trustees?

Trustees can be held personally liable for their actions, decisions, and even omissions while managing a trust. Trustee liability insurance protects your personal assets if you encounter claims of negligence, breach of duty, or errors in judgment.

What insurance does a trustee need?

The primary insurance coverage to protect a trustee is E&O Insurance, specifically Trustee E&O.

What is public liability insurance in English?

Public liability insurance covers the cost of claims made by members of the public for incidents that occur in connection with your business activities. Public liability insurance covers the cost of compensation for: personal injuries. loss of or damage to property.

Can a trustee be personally liable?

Under California trust law, trustees can be held personally liable for losses incurred due to a breach of trustee duties. Trustees have a legal obligation to act in the best interest of beneficiaries and the trust. This obligation is also known as their fiduciary duty.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is trustees liability insurance proposal?

A trustees liability insurance proposal is a formal document submitted by trustees seeking insurance coverage that protects them from claims arising from their responsibilities and duties related to the trust they manage.

Who is required to file trustees liability insurance proposal?

Trustees of a trust, board members of nonprofit organizations, and individuals managing trusts or estates are typically required to file a trustees liability insurance proposal to secure coverage.

How to fill out trustees liability insurance proposal?

To fill out a trustees liability insurance proposal, one should provide detailed information about the trust, the trustees’ credentials, the governance framework, and any prior claims history. Additionally, clear descriptions of the trust's activities and any risk mitigation measures should be included.

What is the purpose of trustees liability insurance proposal?

The purpose of a trustees liability insurance proposal is to obtain insurance coverage that protects trustees from personal liability arising from their actions in the course of managing the trust, ensuring both legal and financial protection.

What information must be reported on trustees liability insurance proposal?

Information that must be reported on a trustees liability insurance proposal includes trust details, trustee information, financial statements, current and past claims history, specific duties of trustees, and risk factors associated with the trust's operations.

Fill out your trustees liability insurance proposal online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Trustees Liability Insurance Proposal is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.