NZ GST101A 2010 free printable template

Show details

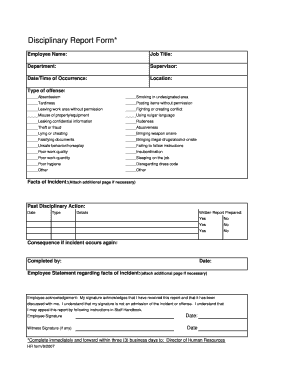

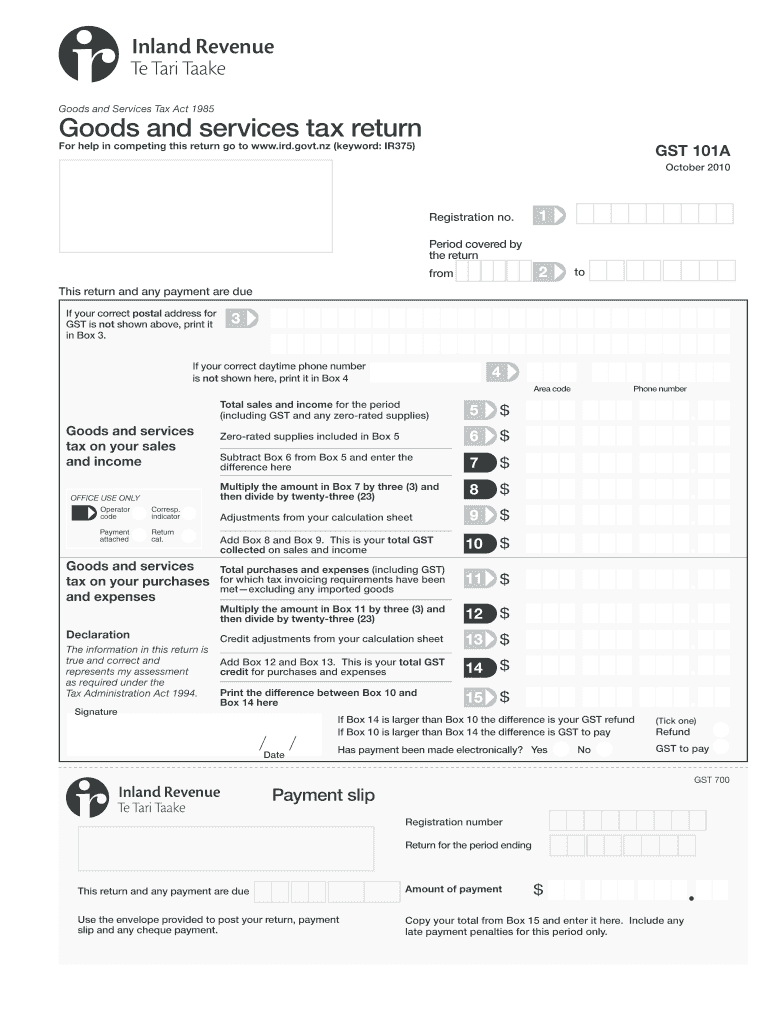

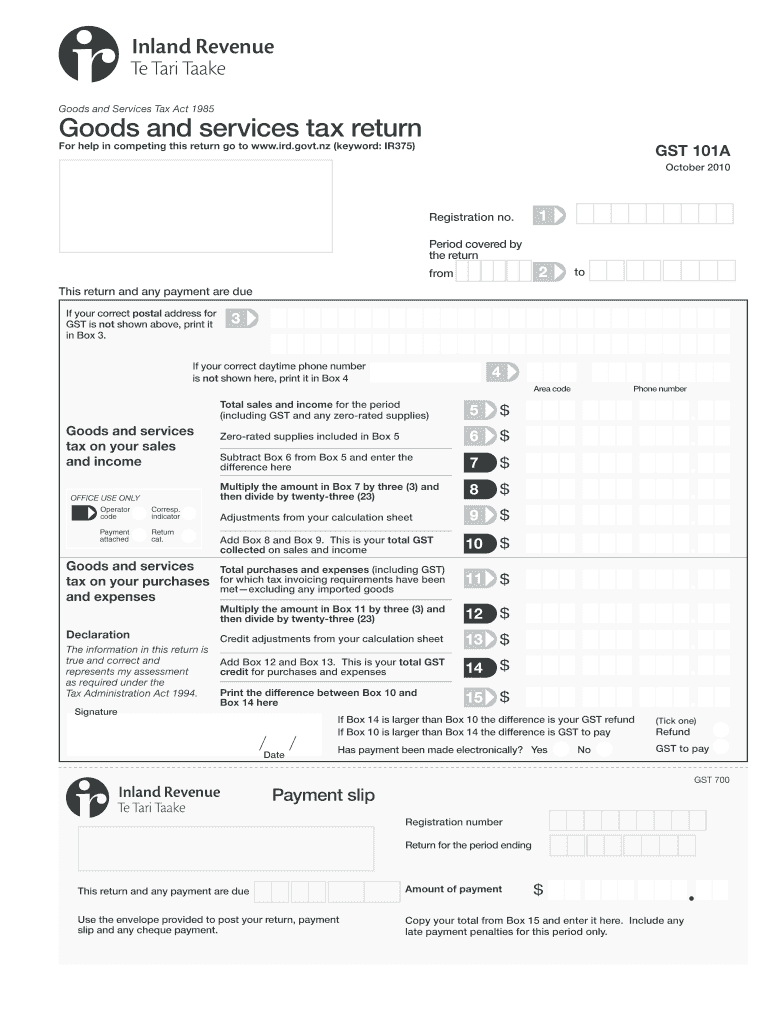

Goods and Services Tax Act 1985 Goods and services tax return For help in competing this return go to www.ird.govt.nz (keyword: IR375) GST 101A October 2010 Registration no. 1 Period covered by the

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NZ GST101A

Edit your NZ GST101A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NZ GST101A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NZ GST101A online

Follow the steps down below to take advantage of the professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NZ GST101A. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NZ GST101A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NZ GST101A

How to fill out NZ GST101A

01

Obtain the NZ GST101A form from the New Zealand Inland Revenue website or your local IRD office.

02

Fill in your IRD number in the designated box at the top of the form.

03

Provide your business name and address in the appropriate fields.

04

Indicate your GST registration status by selecting the relevant option.

05

Enter the period for which you are filing the GST return.

06

Calculate the total sales and income for the period and fill this in the sales section.

07

Enter the total purchases and expenses in the purchases section.

08

Calculate the output tax and input tax based on your sales and purchases and record these amounts.

09

Determine the GST amount you owe or the refund you are entitled to.

10

Sign and date the form, and submit it to the Inland Revenue.

Who needs NZ GST101A?

01

Businesses and organizations that are registered for Goods and Services Tax (GST) in New Zealand.

02

Any entity that needs to report their GST obligations to the Inland Revenue.

Fill

form

: Try Risk Free

People Also Ask about

What is use of English GNS 101?

Use of English (GNS 101) is a course that aims to provide you with the language skills, which will enable you to cope effectively with the challenges of your courses, to use English Language effectively in the practice of their chosen profession as well as interact with others in the society.

Is the term used to describe the process of screening through a passage in a very rapid manner in order to locate a vital information?

Skimming will help you locate the information quickly while making sure you use your time wisely. It will also increase the amount of usable material you obtain for your research. Suppose you have an exam in a few days.

What is GST 101 all about?

GST 101 will enable you to gain understanding on variety of issues relating to effective communication/study skills. GST 101 has specific aim which relates to giving you an understanding of how to communicate effectively in English- which is the medium of instruction at this level of your education.

What is communication in English course?

Language Connections' Effective English Communication Skills Course for Non-Native Speakers of English is all-skills program that integrates grammar, vocabulary, listening, speaking, reading, pronunciation, and writing — all in an engaging and easy-to-use format that has been embraced by students and teachers

What is GST 102 use of English?

GST102 – Use of English and Communication Skills has aims similar to GST101. The aims are to expose you to the functions and rules of English in order that you may be able to communicate effectively using the language in diverse social and academic settings.

What is noun communication in English?

1[uncountable] the activity or process of expressing ideas and feelings or of giving people information Speech is the fastest method of communication between people. All channels of communication need to be kept open.

What is GST 101 summary?

GST 101 will enable you to gain understanding on variety of issues relating to effective communication/study skills. GST 101 has specific aim which relates to giving you an understanding of how to communicate effectively in English- which is the medium of instruction at this level of your education.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find NZ GST101A?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific NZ GST101A and other forms. Find the template you want and tweak it with powerful editing tools.

Can I edit NZ GST101A on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute NZ GST101A from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete NZ GST101A on an Android device?

Complete NZ GST101A and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is NZ GST101A?

NZ GST101A is a Goods and Services Tax (GST) return form used by businesses in New Zealand to report their GST obligations to the Inland Revenue Department.

Who is required to file NZ GST101A?

Businesses that are registered for GST in New Zealand and have taxable supplies above the GST registration threshold are required to file NZ GST101A.

How to fill out NZ GST101A?

To fill out NZ GST101A, businesses need to report their total sales and purchases, calculate GST collected and paid, and complete the relevant sections provided in the form.

What is the purpose of NZ GST101A?

The purpose of NZ GST101A is to allow businesses to report their GST income and expenses to ensure compliance with New Zealand tax laws and to facilitate the calculation of any GST payable or refundable.

What information must be reported on NZ GST101A?

The information that must be reported on NZ GST101A includes total sales, total purchases, GST collected on sales, GST paid on purchases, and any adjustments for period changes.

Fill out your NZ GST101A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NZ gst101a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.