Get the free Milford KiwiSaver Plan

Show details

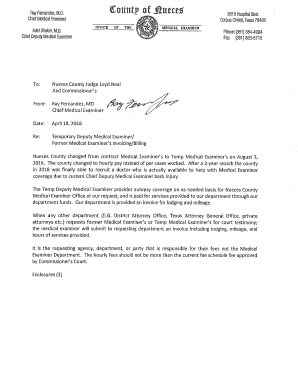

This document serves as an investment statement for the Milford KiwiSaver Plan, providing important information on investment options, contribution rates, risks, fees, and the management structure

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign milford kiwisaver plan

Edit your milford kiwisaver plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your milford kiwisaver plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing milford kiwisaver plan online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit milford kiwisaver plan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out milford kiwisaver plan

How to fill out Milford KiwiSaver Plan

01

Visit the Milford KiwiSaver website.

02

Click on the 'Join Now' button.

03

Fill in your personal details, including your name, address, and date of birth.

04

Provide your IRD number and employment information.

05

Choose your contribution rate.

06

Select your preferred investment option.

07

Review the terms and conditions.

08

Submit your application.

Who needs Milford KiwiSaver Plan?

01

Individuals looking to save for retirement.

02

People who want to benefit from government contributions.

03

Those seeking to invest in a managed fund.

04

Employees wanting to ensure their future financial security.

Fill

form

: Try Risk Free

People Also Ask about

What are the disadvantages of KiwiSaver?

Disadvantages of KiwiSaver: Limited Access: Unlike other investment options, KiwiSaver funds are generally inaccessible until retirement age (currently 65 years old). Limited Investment Options: While KiwiSaver funds are diversified, they are limited to the funds offered by your provider.

How do I withdraw my KiwiSaver Milford?

You will be able to withdraw future lump sum amounts online via the Portal or Mobile App, or you can complete our subsequent eligibility withdrawal form. A minimum balance of $1,000 is required for your KiwiSaver account to remain active.

What is the best KiwiSaver scheme in NZ?

Top 10 KiwiSaver Funds By No. Members 1 ANZ KIWISAVER GROWTH FUND. 2 ASB KIWISAVER GROWTH FUND. 3 WESTPAC KIWISAVER CONSERVATIVE FUND. 4 ASB KIWISAVER CONSERVATIVE FUND. 5 WESTPAC KIWISAVER GROWTH FUND. 6 FISHER FUNDS KIWISAVER GROWTH FUND. 7 GENERATE FOCUSED GROWTH FUND. 8 ASB BALANCED FUND.

Can I opt out of KiwiSaver and get my money back?

You can do it online by sending a completed Opt-out request form (KS10) to Inland Revenue, including your reason for opting out late. It can take up to 3 months to send your refund to you, as we may have to get your contributions back from your KiwiSaver provider.

What are the risks of KiwiSaver?

Some of these are listed below. Equity risk. The funds invest in different classes of assets, each with different risks attached to them. Tax and regulatory risk. Market risk. Liquidity risk. Derivatives risk. Other specific risks. Underlying fund risk. Foreign exchange risk.

What are the negatives of KiwiSaver?

Market Fluctuations: KiwiSaver is a way of investing your money in financial markets. However, it is important to know that the returns on your investment can change depending on how the market is doing. If the market is not doing well, there is a chance that the returns on your investment may be lower.

Is Milford KiwiSaver worth it?

Milford has been around well before KiwiSaver launched and has a solid reputation among historical investors, as well as KiwiSaver investors. Milford outperforms every other growth fund year on year in the latest Morningstar 10 year returns data as at 30 September 2024.

Why is it so hard to withdraw from KiwiSaver?

Comments Section Kiwisaver withdrawal applications can be tough and have to evidenced with what you're seeking such as copies of outstanding debt you may have. They will only give you what is required for those expenses. They won't provide a withdrawal without clear evidence of the financial hardship.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Milford KiwiSaver Plan?

The Milford KiwiSaver Plan is a retirement savings scheme in New Zealand designed to help individuals save for their retirement through regular contributions and investment growth.

Who is required to file Milford KiwiSaver Plan?

Individuals who are members of the Milford KiwiSaver Plan and meet the criteria set forth by the KiwiSaver Act are required to file necessary documentation regarding their contributions and investment choices.

How to fill out Milford KiwiSaver Plan?

To fill out the Milford KiwiSaver Plan, individuals need to complete the application form, providing personal details, selecting investment options, and specifying contribution rates as required by the plan.

What is the purpose of Milford KiwiSaver Plan?

The purpose of the Milford KiwiSaver Plan is to encourage saving for retirement, provide investment options for growth, and ensure financial security for individuals upon reaching retirement age.

What information must be reported on Milford KiwiSaver Plan?

The information that must be reported on the Milford KiwiSaver Plan includes personal identification details, contribution amounts, investment choices, and any changes to membership status or personal circumstances.

Fill out your milford kiwisaver plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Milford Kiwisaver Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.