Get the free Taxation of Mobile Homes in Florida

Show details

Este documento detalla cómo se gravan las casas móviles en Florida, incluyendo las clasificaciones como propiedad real, impuesto de licencia anual y propiedad personal tangible. Proporciona información

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxation of mobile homes

Edit your taxation of mobile homes form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxation of mobile homes form via URL. You can also download, print, or export forms to your preferred cloud storage service.

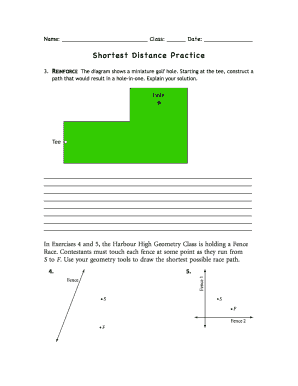

How to edit taxation of mobile homes online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit taxation of mobile homes. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out taxation of mobile homes

How to fill out Taxation of Mobile Homes in Florida

01

Gather all necessary documents related to the mobile home, such as the title, bill of sale, and any prior tax records.

02

Visit the Florida Department of Revenue website or your local county property appraiser's office to obtain the appropriate taxation forms for mobile homes.

03

Fill out the forms with accurate information regarding the mobile home's specifications, ownership details, and location.

04

Calculate the taxation amount based on the assessed value of the mobile home as per the local guidelines.

05

Submit the completed forms along with any required documentation and payment to the appropriate tax authority by the deadline.

06

Keep copies of all submitted documents and confirmation of payment for your records.

Who needs Taxation of Mobile Homes in Florida?

01

Anyone who owns a mobile home in Florida is required to file for taxation.

02

Mobile home owners who are buying, selling, or transferring ownership of a mobile home.

03

Individuals or entities seeking to register a mobile home for the first time in Florida.

04

Owners of mobile homes located in mobile home parks or on private land.

Fill

form

: Try Risk Free

People Also Ask about

Does a mobile home count as owning a home?

Even though mobile homes are not easily removed from land once placed, they are still considered personal property (although in many locations a person who owns both the mobile home and underlying land can convert the mobile home to real property by taking some affirmative steps).

Do you have to report the sale of a mobile home to the IRS?

Therefore, whether a mobile-home sale is treated as a sale of realty or of personal property, the sale must be reported on Form 8300 if more than $10,000 in cash is exchanged. "Cash" is defined as the coin and currency of the United States or a foreign country.

What taxes do you pay on a mobile home in Florida?

Mobile Home Taxes in Florida If your mobile home is located on leased land, then you need to pay sales tax on the home's sale price. The sales tax rate in Florida is 6%, plus any local surtaxes that may apply. You also need to pay an annual registration renewal fee, which is based on the length and width of the home.

Do mobile homes get homestead exemption in Florida?

For a mobile home to qualify for Florida Homestead protection, the following conditions must be met: (1) Ownership: You must own the mobile home and have a legal title or beneficial interest in it. (2) Residency: The mobile home must be your permanent residence.

At what age do you not pay capital gains?

Since there is no age exemption to capital gains taxes, it's crucial to understand the difference between short-term and long-term capital gains so you can manage your tax planning in retirement. Short-term capital gains: Profits from the sale of assets held for one year or less.

Do I have to pay capital gains if I sell my mobile home?

Ed.: If you do not own the land, your property is not considered “real estate.” However, a capital gain on the sale of the mobile home is taxable in the United States. A U.S. tax return would be required to be filed in the year following the year of the sale.

Which property is exempt from property taxes in Florida?

RELIGIOUS, CHARITABLE AND EDUCATIONAL EXEMPTIONS Real estate owned by certain religious, charitable or educational entities that are used for religious, charitable or educational purposes is exempt from property taxation. An exemption must be applied for through the Property Appraiser's office.

Do you have to pay capital gains on a mobile home?

Ed.: If you do not own the land, your property is not considered “real estate.” However, a capital gain on the sale of the mobile home is taxable in the United States. A U.S. tax return would be required to be filed in the year following the year of the sale.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Taxation of Mobile Homes in Florida?

Taxation of mobile homes in Florida involves assessing and collecting taxes on mobile homes as personal property. Mobile homes are subject to property taxes, which are based on their assessed value.

Who is required to file Taxation of Mobile Homes in Florida?

Owners of mobile homes in Florida are required to file for taxation. This includes individuals who hold the title to the mobile home and those who have registered it with the state.

How to fill out Taxation of Mobile Homes in Florida?

To fill out the taxation form for mobile homes in Florida, owners must complete the necessary application forms provided by the local property appraiser's office, providing details such as the mobile home's location, dimensions, condition, and owner information.

What is the purpose of Taxation of Mobile Homes in Florida?

The purpose of taxation on mobile homes in Florida is to generate revenue for local governments, which is used to fund public services such as education, infrastructure, and emergency services.

What information must be reported on Taxation of Mobile Homes in Florida?

Information that must be reported includes the mobile home’s identification number, owner’s contact details, location, the size of the home, any improvements made, and the assessed value of the mobile home.

Fill out your taxation of mobile homes online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxation Of Mobile Homes is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.