Get the free IR 526

Show details

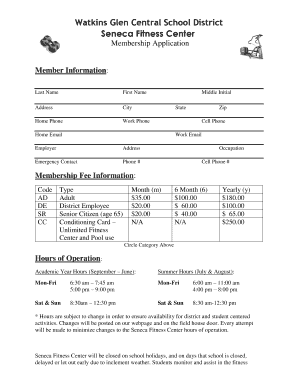

This form is used to claim tax credits related to donations, childcare, and housekeeper payments. It includes instructions for submitting receipts and sharing information with a spouse or partner.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ir 526

Edit your ir 526 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ir 526 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ir 526 online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit ir 526. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ir 526

How to fill out IR 526

01

Obtain the IR 526 form from the official website or the appropriate office.

02

Carefully read the instructions provided with the form.

03

Fill in your personal information including your name, address, and date of birth.

04

Provide details about your immigration status and the reason for applying.

05

If applicable, include information about your family members who are also applying.

06

Review your application for any errors or omissions.

07

Sign and date the application form.

08

Submit the form along with any required supporting documents.

Who needs IR 526?

01

Individuals seeking to adjust their immigration status in specific circumstances.

02

Applicants who have been advised to file an IR 526 by their legal representative or immigration authority.

Fill

form

: Try Risk Free

People Also Ask about

How much can I say I donated to charity without proof?

For any contribution of $250 or more (including contributions of cash or property), you must obtain and keep in your records a contemporaneous written acknowledgment from the qualified organization indicating the amount of the cash and a description of any property other than cash contributed.

What is IR526?

You need to submit your donation receipts to claim your donation tax credit. The easiest way to do this is in myIR. If you do not have myIR, you can submit your receipts using the Tax credit claim form – IR526.

How much can I say I donated to Goodwill?

0:40 2:06 So if you've donated $200 worth of clothes to Goodwill. And you're a single filer you can claim theMoreSo if you've donated $200 worth of clothes to Goodwill. And you're a single filer you can claim the full $200 as a deduction without itemizing. But if you've donated $1500 worth of clothes.

Do you need receipts for donations under $500?

Non-cash donations at least $250 but less than $500 Obtain and keep a written receipt or acknowledgment from the organization for donations between $250 and $500 by your tax filing date or the due date of the tax return, including extensions. Your receipt must include a: Description of donation.

What is the Publication 526 of the Internal Revenue Service?

Publication 526 explains how to claim a deduction for charitable contributions. It discusses: Organizations qualified to receive contributions. The types of contributions you can deduct.

Did the $600 charitable deduction go away?

In response to the COVID-19 pandemic, Congress enacted a $300 charitable deduction for non-itemizers in 2020. This temporary deduction was extended and expanded to $600 for joint filers through 2021. However, the provision expired at the end of 2021 and has yet to be restored.

Can I claim charitable donations without proof?

If you want to take a charitable contribution deduction on your income-tax return, you need to substantiate your gifts. You must have the charity's written acknowledgment for any charitable deduction of $250 or more. A canceled check is not enough to support your deduction.

How much can I claim without receipts?

It is important to check your emails, income statements, and bank statements to ensure you have compiled all the proof you can to claim your deductions. In total, you can claim $300 of work-related expenses without written evidence. For items under $10, you can claim a total of $200.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IR 526?

IR 526 is a tax form used by individuals to report certain income and tax information to the Internal Revenue Service (IRS). It is specifically designed for specific filing purposes.

Who is required to file IR 526?

Individuals who have certain types of income or who meet specific criteria outlined by the IRS are required to file IR 526. This may include self-employed individuals and others who receive income that must be reported.

How to fill out IR 526?

To fill out IR 526, individuals must provide their personal information, report their income figures, and complete sections as directed on the form. It is important to follow IRS instructions carefully.

What is the purpose of IR 526?

The purpose of IR 526 is to ensure that individuals report their income in compliance with tax laws and regulations, thereby allowing the IRS to accurately assess tax liabilities.

What information must be reported on IR 526?

IR 526 requires individuals to report various types of income, any deductions they are claiming, and other relevant tax information as required by the IRS guidelines.

Fill out your ir 526 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ir 526 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.