PH PlantersBank Auto Loan Application Form 2014-2025 free printable template

Show details

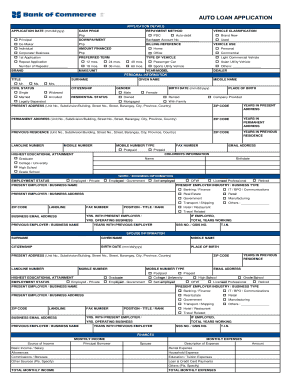

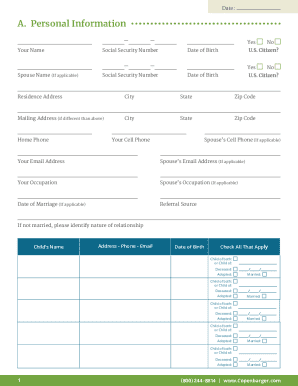

APPLICATION FORM (INDIVIDUAL) Application No. Date of application TYPE OF BORROWER Principal Code Checklist of Requirements EMPLOYED Principal Spouse The Latest IT (photocopy) Certificate of Employment/

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign car loan application

Edit your car loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your car loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing car loan application online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit car loan application. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out car loan application

How to fill out PH PlantersBank Auto Loan Application Form

01

Gather necessary documents such as proof of income, identification, and vehicle information.

02

Visit the PH PlantersBank website or branch to obtain the Auto Loan Application Form.

03

Fill in personal information, including your name, address, and contact details.

04

Provide employment details and monthly income.

05

Specify the details of the vehicle you wish to purchase, including make, model, year, and purchase price.

06

Indicate the loan amount you are applying for and the desired repayment term.

07

Review the application for accuracy and completeness.

08

Submit the application along with any required documents to the bank.

Who needs PH PlantersBank Auto Loan Application Form?

01

Individuals looking to purchase a vehicle and require financing to do so.

02

People with good credit history seeking to take advantage of auto loan offers.

03

Borrowers who wish to consolidate existing auto loans into a more manageable plan.

Fill

form

: Try Risk Free

People Also Ask about

Can I get a car with a 500 credit score?

It's possible to get a car loan with a credit score of 500, but it'll cost you. People with credit scores of 500 or lower received an average rate of 13.97% for new-car loans and 20.67% for used-car loans in the second quarter of 2020, ing to the Experian State of the Automotive Finance Market report.

What is the easiest car company to get financing with bad credit?

More Bad Credit Auto Loans to Consider Ally Clearlane. Ally Clearlane can help you instantly obtain multiple financial offers for a loan on a new or used car. Capital One Auto Finance. Capital One Auto Finance is a direct online lender to drivers with all types of credit. Carvana. DriveTime. LightStream. CarMax. Vroom. CarZing.

What credit score do you need for a $30000 car loan?

In general, lenders look for borrowers in the prime range or better, so you will need a score of 661 or higher to qualify for most conventional car loans.

What is the minimum credit score to buy a car Canada?

You'll usually need a credit score of at least 650 to qualify for a car loan with decent interest rates. However, you may be eligible to qualify with a lower score if you're willing to pay higher rates. You'll likely have difficulties getting approved for any loan if your credit score is below 500.

What proof of income do I need for a car loan?

Verify Your Earnings – when you don't have a paycheque to depend on to prove income, your tax returns, and bank statements are helpful for getting approved. Be prepared and have your last two years of tax returns and current bank statements available when applying for an auto loan when self-employed.

Can I get approved for a car loan online?

You can apply for a car loan from an online lender regardless of time of day or location — all you need is a computer and internet access. And depending on the lender, you may be able to find out if you're prequalified within minutes.

Can I get a car loan immediately?

A same-day or instant auto loan is a loan that can be approved in less than an hour, as long as you meet certain criteria. Since instant car loan companies come with different requirements and interest rates, it's important to comparison shop before deciding which company to go with for your instant auto loan.

What is the easiest way to get approved for a car loan?

How to Qualify for a Car Loan Make Sure You Have Good Credit. Have a Source of Income. Be Able to Prove Your Identity and Residence. Consider Getting Preapproved. Have a Down Payment or Trade-In. Understand How Financing at a Dealer Works. Qualifying for a Car Loan With Bad Credit. Work on Your Credit Before Applying.

What credit score do you need for car loan?

In general, you'll need a credit score of at least 600 to qualify for a traditional auto loan, but the minimum credit score required to finance a car loan varies by lender. If your credit score falls into the subprime category, you may need to look for a bad credit car loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my car loan application in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your car loan application directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I fill out car loan application using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign car loan application. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete car loan application on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your car loan application. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is PH PlantersBank Auto Loan Application Form?

The PH PlantersBank Auto Loan Application Form is a document used by individuals to apply for an auto loan from PlantersBank in the Philippines.

Who is required to file PH PlantersBank Auto Loan Application Form?

Individuals seeking to finance the purchase of a vehicle through PlantersBank are required to file the PH PlantersBank Auto Loan Application Form.

How to fill out PH PlantersBank Auto Loan Application Form?

To fill out the PH PlantersBank Auto Loan Application Form, applicants need to provide personal information, vehicle details, employment information, and financial information as required in the form.

What is the purpose of PH PlantersBank Auto Loan Application Form?

The purpose of the PH PlantersBank Auto Loan Application Form is to formally request financing for an auto purchase and to gather necessary information for the bank to assess the applicant's creditworthiness.

What information must be reported on PH PlantersBank Auto Loan Application Form?

The information that must be reported on the PH PlantersBank Auto Loan Application Form includes the applicant's personal details, income details, vehicle information, and any other financial obligations.

Fill out your car loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Car Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.