Get the free HEALTH INSURANCE PROPOSAL FORM AND MEDICAL QUESTIONNAIRE

Show details

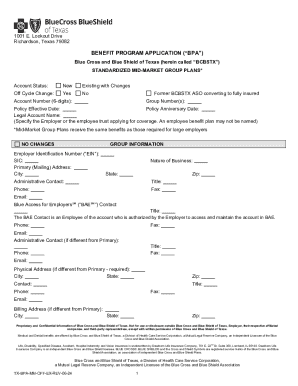

This document serves as a proposal form and medical questionnaire for health insurance applicants, collecting personal, medical, and contact information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign health insurance proposal form

Edit your health insurance proposal form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your health insurance proposal form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing health insurance proposal form online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit health insurance proposal form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out health insurance proposal form

How to fill out HEALTH INSURANCE PROPOSAL FORM AND MEDICAL QUESTIONNAIRE

01

Gather necessary personal information including your name, address, date of birth, and contact details.

02

Fill in your employment information and income details as required by the form.

03

Answer the medical questionnaire by providing details about your medical history, including any pre-existing conditions, surgeries, and medications.

04

Specify any health screenings or tests that you have recently undergone.

05

Include information about your dependents, if applicable, and their medical history.

06

Review the form for completeness and accuracy before submitting it.

07

Submit the completed form and questionnaire as instructed, either online or by mail.

Who needs HEALTH INSURANCE PROPOSAL FORM AND MEDICAL QUESTIONNAIRE?

01

Individuals seeking health insurance coverage.

02

New applicants for health insurance plans.

03

Those needing to update their medical information for insurance purposes.

04

Employers providing health insurance options to employees.

Fill

form

: Try Risk Free

People Also Ask about

Can insurance companies ask for your medical history?

It's important to know that insurance companies cannot access your entire medical history without your permission. The insurance adjuster can only request information pertinent to your claim.

Can insurance companies ask medical questions?

Yes. They will ask for you medical records during underwriting and outright deny you. Other insurance companies will also ask if you have ever been denied life insurance -- and they will also turn you down.

How to write a proposal for insurance?

Creating a comprehensive insurance proposal involves several key sections, which may or may not include: Cover letter and title page. An executive or client summary. Summary of benefits. Coverage details, costs, and policies. Detailed description of products and services. A section about your business or organization.

What is included in the proposal form of insurance?

Definition: Proposal form is the most important and basic document required for life insurance contract between the insured and insurance company. It includes the insured's fundamental information like address, age, name, education, occupation etc. It also includes the person's medical history.

Can health insurance companies ask about pre-existing conditions?

Is there health insurance for pre-existing conditions? Choosing a health plan is no longer based on the concept of a pre-existing condition. A health insurer cannot deny you coverage or raise rates for plans if you have a medical condition at the time of enrollment.

What are insurance companies allowed to ask you?

Basic Information. The first step is to provide basic information about yourself. That includes your name, age, hometown, and Social Security number as well. Life insurance companies will also ask about marital status and number of children, which can help them understand who you are looking to protect.

Can insurance companies access medical records in Canada?

Except for limited circumstances specified in the HIA, a custodian must get your written consent before releasing information to a third party, such as a family member, lawyer, or insurance company. Consent allows for disclosure to anyone for any purpose, ing to the terms of the consent.

Why did I get a health insurance claim form?

A medical claim is an invoice (or bill) that is submitted by your doctor's office to your health insurance company after you receive care. Each claim has a list of unique codes that describe the care you received and help your health plan process and pay them faster.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HEALTH INSURANCE PROPOSAL FORM AND MEDICAL QUESTIONNAIRE?

The Health Insurance Proposal Form and Medical Questionnaire is a document used by insurance companies to gather necessary information about an applicant's health status and medical history in order to assess their suitability for health insurance coverage.

Who is required to file HEALTH INSURANCE PROPOSAL FORM AND MEDICAL QUESTIONNAIRE?

Anyone applying for health insurance coverage is required to file the Health Insurance Proposal Form and Medical Questionnaire, including individuals seeking individual, family, or group health insurance plans.

How to fill out HEALTH INSURANCE PROPOSAL FORM AND MEDICAL QUESTIONNAIRE?

To fill out the Health Insurance Proposal Form and Medical Questionnaire, applicants should read the instructions carefully, provide accurate personal information, disclose their medical history, and answer all health-related questions truthfully before submitting the form.

What is the purpose of HEALTH INSURANCE PROPOSAL FORM AND MEDICAL QUESTIONNAIRE?

The purpose of the Health Insurance Proposal Form and Medical Questionnaire is to evaluate the risk involved in insuring an individual, to determine premium rates, and to ensure that the applicant meets the eligibility criteria for the health insurance policy.

What information must be reported on HEALTH INSURANCE PROPOSAL FORM AND MEDICAL QUESTIONNAIRE?

The Health Insurance Proposal Form and Medical Questionnaire must include personal details such as name, age, and address, as well as medical history, existing health conditions, medications taken, lifestyle choices (like smoking or drinking), and any past surgeries or hospitalizations.

Fill out your health insurance proposal form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Health Insurance Proposal Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.