Get the free IRA transfers due to divorce

Show details

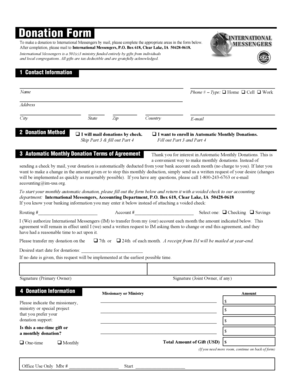

This document outlines the procedures and requirements for transferring Vanguard retirement assets as a result of a divorce. It details the necessary documents and instructions to execute the transfer

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ira transfers due to

Edit your ira transfers due to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira transfers due to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ira transfers due to online

To use the professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ira transfers due to. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira transfers due to

How to fill out IRA transfers due to divorce

01

Review your divorce decree to understand the terms regarding IRA transfers.

02

Obtain a copy of the divorce decree and any Qualified Domestic Relations Order (QDRO) if applicable.

03

Contact the IRA custodian to inform them of the divorce and inquire about their specific requirements for processing transfers.

04

Complete any necessary forms provided by the IRA custodian for the transfer request.

05

Provide required documentation, such as a copy of the divorce decree and QDRO, if applicable.

06

Specify the amount or percentage of the IRA to be transferred to the ex-spouse's account.

07

Submit the completed forms and documentation to the IRA custodian.

08

Follow up with the custodian to ensure the transfer is processed correctly.

Who needs IRA transfers due to divorce?

01

Individuals undergoing a divorce who have assets in an IRA.

02

Ex-spouses entitled to a portion of the other spouse's IRA as part of the divorce settlement.

03

People who wish to divide retirement accounts to ensure equitable distribution of assets.

Fill

form

: Try Risk Free

People Also Ask about

What happens to an IRA when you get divorced?

IRAs — Roth and traditional These accounts are divided under what's called a transfer incident to divorce. Even though money will leave the account, the account owner doesn't owe income taxes because it's part of a divorce settlement.

What is the penalty for taking money out of your IRA during a divorce?

You can shift the obligation to pay the expense to the former spouse along with the additional money in the new IRA for the former spouse that will be sufficient to make the payment, but the former spouse will have to pay the 10% penalty.

Are IRA distributions due to divorce taxable?

Yes. Unless you qualify for an exception, you must still pay the 10% additional tax for taking an early distribution from your traditional IRA even if you take it to satisfy a divorce court order (Internal Revenue Code section 72(t)).

How does the IRS define a property transfer due to a divorce?

A transfer or property between spouses or incident to divorce is treated as a gift, meaning that neither the transferor nor the transferee recognizes any income as a result of the transfer. The transferee spouse's basis in the property is the same as the transferor spouse's basis.

What assets cannot be touched in divorce?

Assets that may be protected from equitable distribution during a divorce are typically belong to one of two types: premarital property that has been kept from being commingled or transitioned and gifts or inheritances.

Does my wife get half of my IRA in a divorce?

The holdings within an IRA or 401k or any other such retirement plan are considered to be marital assets. That means they are jointly owned by both parties in a legal marriage. You cannot make a withdrawal from such an account, even if it is entirely in your own name, unless your spouse consents to the withdrawal.

How to transfer IRA to ex-wife?

Splitting an IRA or health savings account (HSA) typically requires the parties to submit a ``transfer incident to divorce'' form and a copy of the divorce decree. Fidelity requires a copy of the divorce decree or legal separation order signed by a judge along with the form.

What happens to my IRA if I get divorced?

What Happens to My IRA When I Get Divorced? The I in IRA stands for individual, and even after you get divorced, the account doesn't change. After you get divorced, however, you can contribute to your own IRA up to your annual contribution limit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IRA transfers due to divorce?

IRA transfers due to divorce refer to the process of transferring funds from one spouse's Individual Retirement Account (IRA) to another as part of a divorce settlement. This process is often executed through a Qualified Domestic Relations Order (QDRO) or similar legal documentation.

Who is required to file IRA transfers due to divorce?

Both spouses involved in the divorce may need to file documentation related to the IRA transfer. Typically, the spouse receiving the funds is responsible for ensuring the transfer is executed properly, often with assistance from legal or financial advisors.

How to fill out IRA transfers due to divorce?

To fill out IRA transfers due to divorce, one must complete the appropriate forms required by the IRA custodian, which generally include details from the divorce decree, information about the retirement accounts involved, and the amount to be transferred. It may require a QDRO or similar court-issued document.

What is the purpose of IRA transfers due to divorce?

The purpose of IRA transfers due to divorce is to divide retirement assets equitably between spouses as part of the divorce settlement, ensuring each party receives a fair share of the marital property accumulated during the marriage.

What information must be reported on IRA transfers due to divorce?

The information that must be reported typically includes the names and details of both spouses, the type of IRA being transferred, the amount being transferred, and the court reference or case number related to the divorce decree and QDRO.

Fill out your ira transfers due to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Transfers Due To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.