Get the free FDARF

Show details

This form is used to continue the Vanguard Fixed Annuity—Single 5 for an additional five-year period and includes sections for policy information, beneficiary designations, and policy owner signatures.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fdarf

Edit your fdarf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fdarf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fdarf online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit fdarf. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

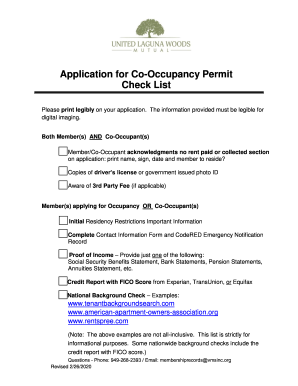

How to fill out fdarf

How to fill out FDARF

01

Gather all necessary personal information including full name, address, and contact details.

02

Ensure you have your financial details ready, including account numbers and any relevant financial documents.

03

Fill out the form starting with your personal information in the designated sections.

04

Provide accurate financial information as required by the FDARF.

05

Double-check all entered information for accuracy before submitting.

06

Follow any specific instructions provided on the form regarding submission.

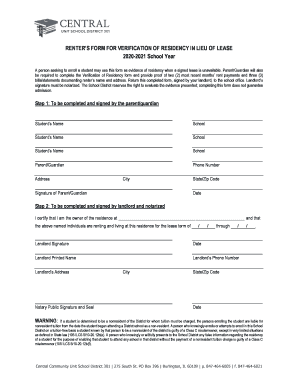

Who needs FDARF?

01

Individuals who are filing for financial assistance or benefits.

02

Business owners applying for funding programs.

03

Any entity required to disclose financial information as per regulatory guidelines.

04

Applicants seeking loans or grants that require this form as part of the process.

Fill

form

: Try Risk Free

People Also Ask about

When to use darf in German?

Dürfen (to be allowed, may) is used to give or refuse permission: Hier darf geraucht werden. You may smoke here. Hier darf nicht getrunken werden.

What does "darf" mean?

DARF means the Federal Revenue Collection Document (Documento de Arrecadação de Receitas Federais). Sample 1Sample 2 Draft Instantly. DARF means Federal Revenue Paying Form, issued for payment of federal tax.

What does "darf er so" mean?

Darf er so?: An abbreviation for “Darf er das einfach so sagen?” (Can he actually say that?), the term expresses astonishment that someone had the nerve to say something.

What does "darf er so" mean?

Darf er so?: An abbreviation for “Darf er das einfach so sagen?” (Can he actually say that?), the term expresses astonishment that someone had the nerve to say something.

What does Darf mean in English?

may , can ( be allowed to ) nicht dürfen must not.

When to use darf in German?

Dürfen (to be allowed, may) is used to give or refuse permission: Hier darf geraucht werden. You may smoke here. Hier darf nicht getrunken werden.

What is the meaning of dürfen in English?

Dürfen is a German modal verb that means "to be able to" or "may" in English. Modal verbs are used in German and many other languages when talking about possibilities, requests, or other hypothetical situations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FDARF?

FDARF stands for the Financial Disclosure and Reporting Form, which is used to collect financial information from certain entities for regulatory and compliance purposes.

Who is required to file FDARF?

Entities that meet specific regulatory criteria, such as public companies and financial institutions, are required to file the FDARF.

How to fill out FDARF?

To fill out the FDARF, one must gather the required financial data, follow the provided instructions for each section of the form, and ensure compliance with relevant regulations before submitting it.

What is the purpose of FDARF?

The purpose of FDARF is to provide a comprehensive overview of an entity's financial condition, ensuring transparency and accountability for stakeholders.

What information must be reported on FDARF?

The FDARF typically requires information such as income statements, balance sheets, cash flow statements, and other financial disclosures relevant to the entity's fiscal performance.

Fill out your fdarf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fdarf is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.