Get the free CITY OF TORONTO ACT APPLICATION/APPEAL – LIMITS ON TRADITIONAL MUNICIPAL TAXES

Show details

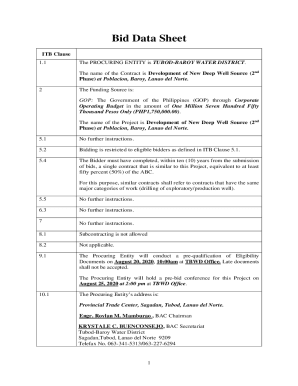

Form and instructions for filing a City of Toronto Act, 2006 application/appeal regarding limits on traditional municipal taxes with the Assessment Review Board.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign city of toronto act

Edit your city of toronto act form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your city of toronto act form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing city of toronto act online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit city of toronto act. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out city of toronto act

How to fill out CITY OF TORONTO ACT APPLICATION/APPEAL – LIMITS ON TRADITIONAL MUNICIPAL TAXES

01

Obtain the CITY OF TORONTO ACT APPLICATION/APPEAL form from the official City of Toronto website or local municipal office.

02

Read the instructions provided on the form carefully to understand the requirements for your application/appeal.

03

Fill out the applicant's information section with your name, address, and contact details.

04

Provide the property details, including the property address and any relevant assessment roll number.

05

Clearly state the reasons for your application or appeal regarding the limits on traditional municipal taxes.

06

Attach any supporting documents that back your claims, such as tax statements or previous assessments.

07

Review all information for accuracy and completeness before submission.

08

Submit the completed application/appeal form along with the supporting documents to the appropriate municipal office by the specified deadline.

Who needs CITY OF TORONTO ACT APPLICATION/APPEAL – LIMITS ON TRADITIONAL MUNICIPAL TAXES?

01

Property owners in Toronto who believe their municipal tax assessments are unjust or excessive.

02

Businesses facing financial constraints due to high municipal taxes looking to challenge their tax assessment.

03

Individuals or organizations wishing to understand their rights regarding municipal tax rates and limits.

Fill

form

: Try Risk Free

People Also Ask about

Can you lower your property taxes in Ontario?

If your property has changed during the year, such as a change in a property class, property damaged by fire, demolition or otherwise, or a building undergoing repairs or renovations, you may be eligible for a cancellation, reduction or refund of your property taxes.

What is Section 325 of the City of Toronto?

Section 325 of COTA allows Council to cancel, reduce or refund taxes relating to errors made in the preparation of the assessment roll for one or both of the two years preceding the year in which the application is made.

Who is eligible for property tax relief in Toronto?

Combined household income must not exceed $60,000. Residential assessment must be below $975,000. Receipt of disability benefits or meet the below requirements. Be over 65 years of age.

What is Section 325 of the City of Toronto Act?

Section 325 of COTA allows Council to cancel, reduce or refund taxes relating to errors made in the preparation of the assessment roll for one or both of the two years preceding the year in which the application is made.

What happens if you don't pay property tax in Toronto?

Late payment charges are added to all past due taxes at a rate of 1.25 per cent on the first day of default and on the first day of each month thereafter, as long as taxes or charges remain unpaid. Penalty and interest charges on overdue amounts cannot be waived or altered. may also be added when taxes are outstanding.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CITY OF TORONTO ACT APPLICATION/APPEAL – LIMITS ON TRADITIONAL MUNICIPAL TAXES?

The CITY OF TORONTO ACT APPLICATION/APPEAL - LIMITS ON TRADITIONAL MUNICIPAL TAXES is a legal process that allows property owners in Toronto to challenge or appeal the limits imposed on traditional municipal taxes as established by the City of Toronto Act.

Who is required to file CITY OF TORONTO ACT APPLICATION/APPEAL – LIMITS ON TRADITIONAL MUNICIPAL TAXES?

Property owners and taxpayers who believe that the limits on traditional municipal taxes set by the City of Toronto Act affect their property tax burden are required to file a CITY OF TORONTO ACT APPLICATION/APPEAL.

How to fill out CITY OF TORONTO ACT APPLICATION/APPEAL – LIMITS ON TRADITIONAL MUNICIPAL TAXES?

To fill out the CITY OF TORONTO ACT APPLICATION/APPEAL, individuals must obtain the appropriate application form from the city’s official website or office, provide their property details, explain the basis for the appeal, and submit the completed form by the deadline specified by the city.

What is the purpose of CITY OF TORONTO ACT APPLICATION/APPEAL – LIMITS ON TRADITIONAL MUNICIPAL TAXES?

The purpose of the CITY OF TORONTO ACT APPLICATION/APPEAL is to provide a mechanism for property owners to contest the municipal tax limits that may be perceived as unfair or overly burdensome, ensuring that the tax system remains equitable.

What information must be reported on CITY OF TORONTO ACT APPLICATION/APPEAL – LIMITS ON TRADITIONAL MUNICIPAL TAXES?

The information that must be reported includes the property owner's name and contact information, property address, details of the tax limits being appealed, reasons for the appeal, and any supporting documentation that substantiates the claims made in the application.

Fill out your city of toronto act online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

City Of Toronto Act is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.