Canada DFATD-MAECD 1042-2 2013-2025 free printable template

Get, Create, Make and Sign dfatd 1042 printable form

How to edit dfatd 1042 pdf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out dfatdmaecd goods form

How to fill out Canada DFATD-MAECD 1042-2

Who needs Canada DFATD-MAECD 1042-2?

Video instructions and help with filling out and completing maecd1042 form get

Instructions and Help about canada dfatdmaecd formulaire

India and Sri Lanka produce an abundance of tropical fruits such as mango more than 14 varieties of mango have been identified by the Department of Agriculture Sri Lanka however nearly forty percent of the produce is lost due to post harvest handling and post-harvest diseases recently university of wales research has shown that hexagon a saved chemical compound can be successfully used to enhance the shelf life and quality of fruits and vegetables Asia is an international collaborative program the program is a collaboration between the university of Guelph in Canada talon higher education university in Kyoto and the Industrial Technology Institute Sri Lanka the objectives of the project are to ensure nutritional security increase the income of farmer along with gender empowerment the project is also provided the opportunity for capacity building in terms of expanding the scope of our activities in other water trees as well as providing opportunities for forces with training of our team members the project has enriched the research capabilities of our team and help us expand our research capabilities the objective of our research is to reduce the post-harvest loss in mango using XML thereby we have incorporated hexagon into a post harvest bio wax and also into a composite material made of banana fiber in addition we performed a pre-harvest prey using a formula containing hexagon this is our experiment location in galleria gamma where we performed trials for the pre-harvest prey after selecting trees having fruits of the correct maturity we prepare the 2 eff solution which is a formula containing hexagon the fruits were then sprayed with the prepared solution at 30 days and 15 days before harvest the fruits were then harvested at mature green stage d sapped and sorted harvested and sorted fruits were waxed using the hexagon incorporated bio wax and allowed to air-dry like in the previous experiments salted fruits were packaged in boxes containing the hexagon incorporated composite material made of banana fiber in all experiments the fruits were packaged on shredded paper in ventilated cardboard boxes the fruits but then analyzed every 7 days for 21 days the physical chemical tests carried out on all the experiments are weight loss firmness color total soluble solids' timetable acidity disease incidents and sensory analysis in addition mango volatile were analyzed using solid-phase microextraction and gas chromatography the data was finally statistically analyzed and the results generated

People Also Ask about dfatd maecd 1042

What is the difference between Form 1042 and 1042s?

What deposit is required for Form 1042?

Can you file Form 1042 electronically?

Who is the withholding agent on Form 1042?

What is a 1042 annual withholding tax return for US source income of foreign persons?

Who fills out Form 1042?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit maecd permit from Google Drive?

Can I create an eSignature for the maecd export download in Gmail?

Can I edit 1042 demande on an iOS device?

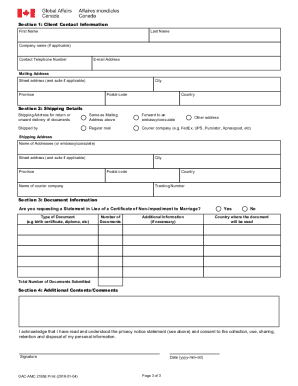

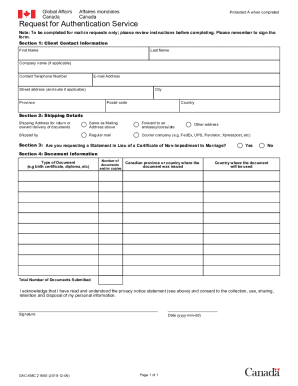

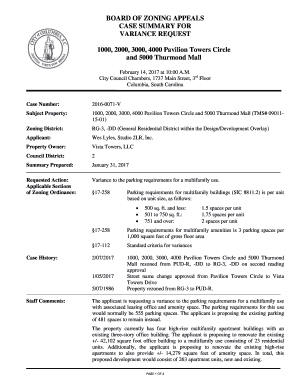

What is Canada DFATD-MAECD 1042-2?

Who is required to file Canada DFATD-MAECD 1042-2?

How to fill out Canada DFATD-MAECD 1042-2?

What is the purpose of Canada DFATD-MAECD 1042-2?

What information must be reported on Canada DFATD-MAECD 1042-2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.