Get the free Deferred Salary Leave Program Application

Show details

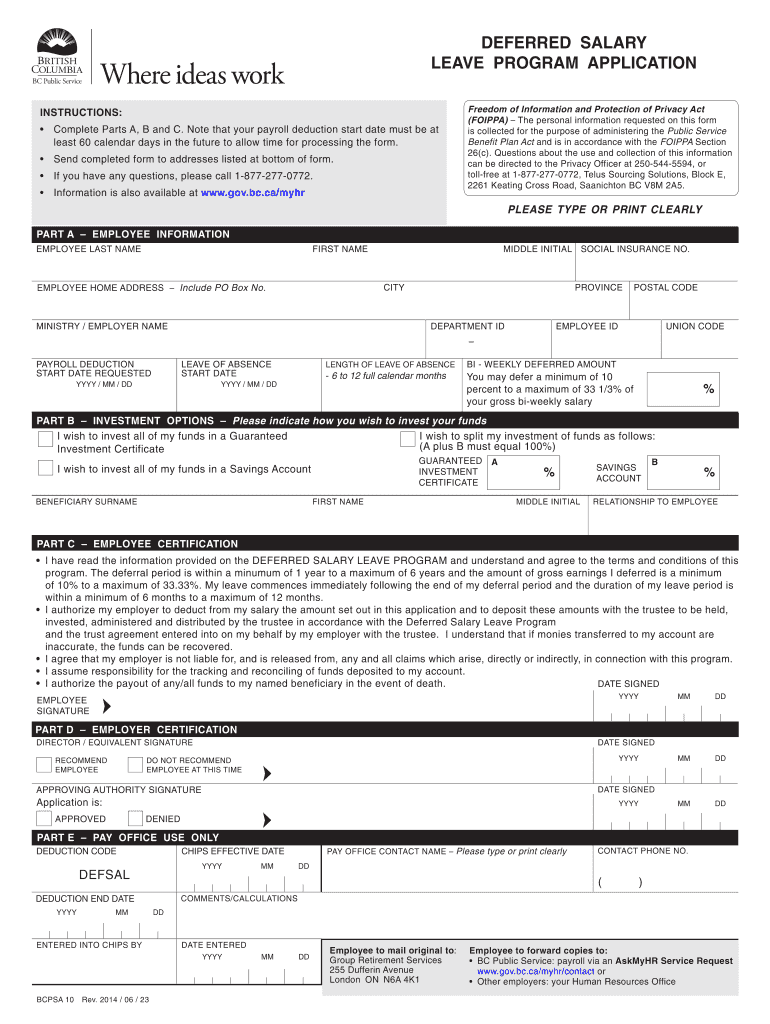

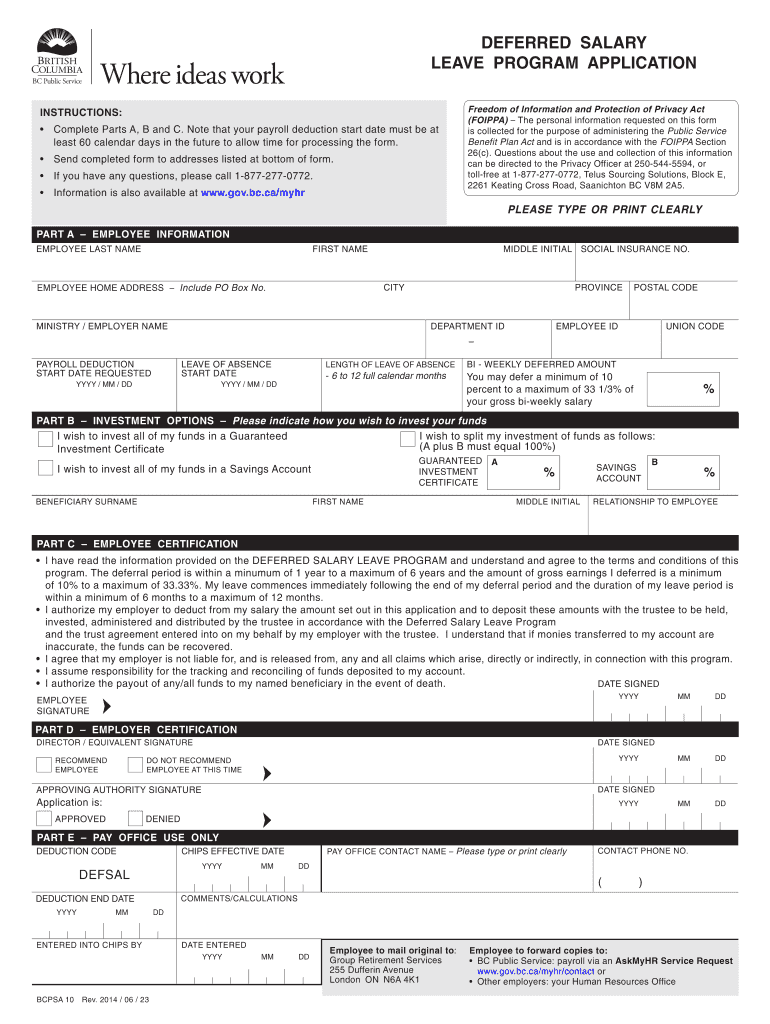

This document is an application form for employees to request participation in the Deferred Salary Leave Program, providing instructions on completing the form and the terms related to salary deferral

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deferred salary leave program

Edit your deferred salary leave program form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deferred salary leave program form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit deferred salary leave program online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit deferred salary leave program. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deferred salary leave program

How to fill out Deferred Salary Leave Program Application

01

Obtain the Deferred Salary Leave Program Application form from your HR department or official website.

02

Fill out your personal information, including your name, employee ID, and department.

03

Specify the duration of the deferred salary period and the anticipated leave dates.

04

Provide details on how you plan to use the funds during your leave.

05

Attach necessary documentation, such as your employment contract and any supporting materials.

06

Review your application for accuracy and completeness.

07

Submit the application to your HR department for approval.

Who needs Deferred Salary Leave Program Application?

01

Employees planning to take a leave of absence for personal reasons.

02

Employees interested in spreading their salary over a longer period to fund a sabbatical or extended time off.

03

Workers in need of financial planning assistance for significant life events.

Fill

form

: Try Risk Free

People Also Ask about

What is the deferred salary leave program in BC?

You may defer a minimum of 10 percent to a maximum of 33.33 percent of your gross earning for a minimum of one year to a maximum of 6 years. Your salary during the deferral period will be your regular earnings less the percentage you have chosen to contribute to your leave period.

How does salary deferral work?

Deferred compensation is an arrangement in which a portion of an employee's wage is paid out at a later date after which it was earned. Examples of deferred compensation include pensions, retirement plans, and employee stock options.

Is salary deferral a good idea?

Given your income level, deferring a portion of your cash bonus (if allowed) could help manage your tax bracket. However, with market volatility affecting your RSUs, balancing liquidity needs against deferred compensation is crucial, especially if you expect tax rates to stay high when you retire.

What is the downside of deferred compensation?

Deferred compensation plans tend to offer better investment options than most 401(k) plans, but are at a disadvantage regarding liquidity. Typically, deferred compensation funds cannot be accessed, for any reason, before the specified distribution date.

Why would you want to defer income?

This can be due to reasons such as retirement, unemployment, or anticipated business difficulties. By doing so, you can defer paying taxes on that income until the following year. This strategy allows you to reduce your overall tax burden.

Can my employer defer my salary?

An employer will offer you the opportunity to defer a portion of your compensation for several years. Doing so defers taxes on any earnings until you withdraw. Examples include pensions, retirement plans, and stock options.

What is a deferred salary example?

These plans help employees save for the future and reduce their tax bills. For example, an employee earning $200,000 annually at age 58 might defer $25,000 annually until retiring at age 65. The employee's deferred compensation plan would then hold $175,000.

Would you be okay with a salary deferral agreement?

You should consider using a Salary Deferral Agreement when: You are planning for long-term financial goals, such as retirement. Your employer offers a retirement savings plan that allows for salary deferral. You wish to reduce your current taxable income by putting pre-tax money into a retirement savings account.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Deferred Salary Leave Program Application?

The Deferred Salary Leave Program Application is a form that allows employees to apply for a leave of absence by deferring a portion of their salary over a period of time, which can then be utilized for extended time off.

Who is required to file Deferred Salary Leave Program Application?

Employees who wish to participate in the Deferred Salary Leave Program and take a leave of absence must file the Deferred Salary Leave Program Application.

How to fill out Deferred Salary Leave Program Application?

To fill out the Deferred Salary Leave Program Application, employees should provide necessary personal information, specify the duration of the leave, detail salary deferral amounts, and obtain the required signatures from their department heads or management.

What is the purpose of Deferred Salary Leave Program Application?

The purpose of the Deferred Salary Leave Program Application is to offer employees an opportunity to take a planned leave of absence while allowing them to manage their salary deferrals in a structured manner.

What information must be reported on Deferred Salary Leave Program Application?

The information that must be reported on the Deferred Salary Leave Program Application includes employee personal details, proposed leave dates, salary deferral amounts, and any endorsements or approvals from supervisors or management.

Fill out your deferred salary leave program online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deferred Salary Leave Program is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.