Canada 2373 RSP 2014 free printable template

Show details

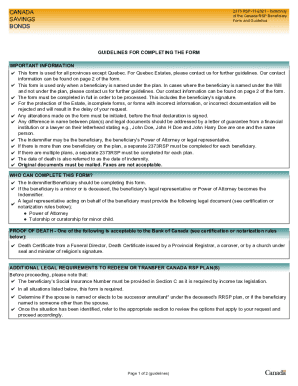

Canada Savings Bonds Indemnity of the Canada RSP Beneficiary Form and Guidelines the way to save. Guaranteed. 2373RSP-07-10 GUIDELINES FOR COMPLETING THE FORM IMPORTANT INFORMATION This form is used

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada 2373 RSP

Edit your Canada 2373 RSP form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada 2373 RSP form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada 2373 RSP online

To use the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Canada 2373 RSP. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada 2373 RSP Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada 2373 RSP

How to fill out Canada 2373 RSP

01

Obtain the Canada 2373 RSP form from the Canada Revenue Agency (CRA) website or your local CRA office.

02

Fill out your personal information including your name, address, and Social Insurance Number (SIN) at the top of the form.

03

Indicate the type of RSP (Registered Savings Plan) you are applying for by checking the appropriate box.

04

Provide details about the amount you wish to contribute to the RSP for the tax year indicated.

05

Complete any additional sections as required, including information about your financial institution if applicable.

06

Review the completed form for accuracy and ensure all required fields are filled out.

07

Sign and date the form at the bottom.

08

Submit the completed form to your financial institution or the CRA, as directed.

Who needs Canada 2373 RSP?

01

Individuals looking to open a Registered Savings Plan (RSP) in Canada.

02

People who want to contribute to their retirement savings and take advantage of tax deductions.

03

Canadian residents wanting to save for future expenses such as home purchases or education.

Fill

form

: Try Risk Free

People Also Ask about

How do I fill out a beneficiary form?

General Instructions Write only one beneficiary on each line. Make sure that you write the full names of all beneficiaries. For example, if you name you children as beneficiaries, DO NOT merely write “children” on one of the lines; instead write the full names of each of your children on separate lines.

What is the purpose of a beneficiary form?

The beneficiary designation forms allow you to name primary and secondary beneficiaries. Your “primary beneficiaries” are the first people or entities that you want to receive your benefit after you die.

How do I designate a beneficiary on RRSP?

As an RRSP issuer, you have to determine who the beneficiary of the RRSP is before you pay out any amounts. The beneficiary may be designated in the RRSP contract or in the deceased annuitant's will. It is possible that no beneficiary is designated.

Do you need to fill out a beneficiary form?

If you get married or divorced, or have children or other life changes, standard sequence will follow those life changes. If you never file a beneficiary designation, your benefit will be paid ing to standard sequence at the time of your death.

Are beneficiary forms required?

Must I complete designation of beneficiary forms? No, these forms are not required.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find Canada 2373 RSP?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the Canada 2373 RSP in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

Can I create an electronic signature for signing my Canada 2373 RSP in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your Canada 2373 RSP and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit Canada 2373 RSP straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing Canada 2373 RSP right away.

What is Canada 2373 RSP?

Canada 2373 RSP is a tax form used to report contributions made to a Registered Retirement Savings Plan (RRSP) in Canada.

Who is required to file Canada 2373 RSP?

Individuals who contribute to an RRSP and wish to claim a tax deduction for those contributions are required to file Canada 2373 RSP.

How to fill out Canada 2373 RSP?

To fill out Canada 2373 RSP, individuals must provide personal information, report the total amount contributed to the RRSP, and calculate any deductions they wish to claim.

What is the purpose of Canada 2373 RSP?

The purpose of Canada 2373 RSP is to allow taxpayers to report RRSP contributions and to claim tax deductions for their contributions, thereby reducing their taxable income.

What information must be reported on Canada 2373 RSP?

On Canada 2373 RSP, individuals must report their personal details, the total contributions made to the RRSP during the tax year, and any carried-over contributions from previous years.

Fill out your Canada 2373 RSP online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada 2373 RSP is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.