Get the free FIRST TIME HOME BUYERS’ EXEMPTION CLAIM - sbr gov bc

Show details

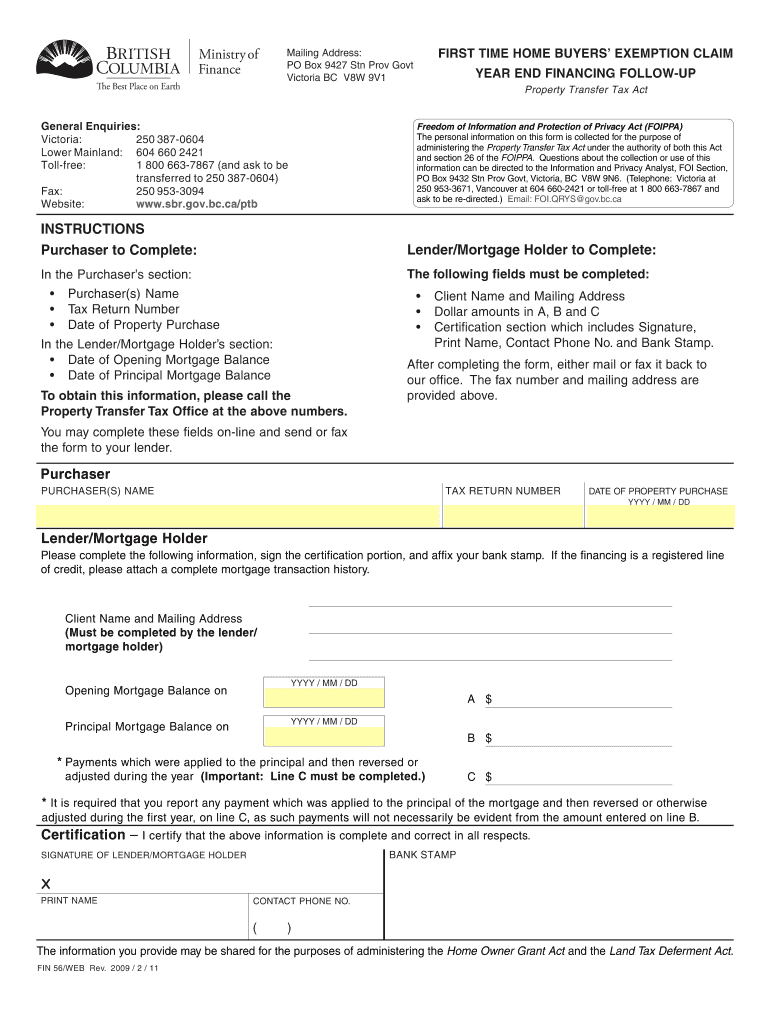

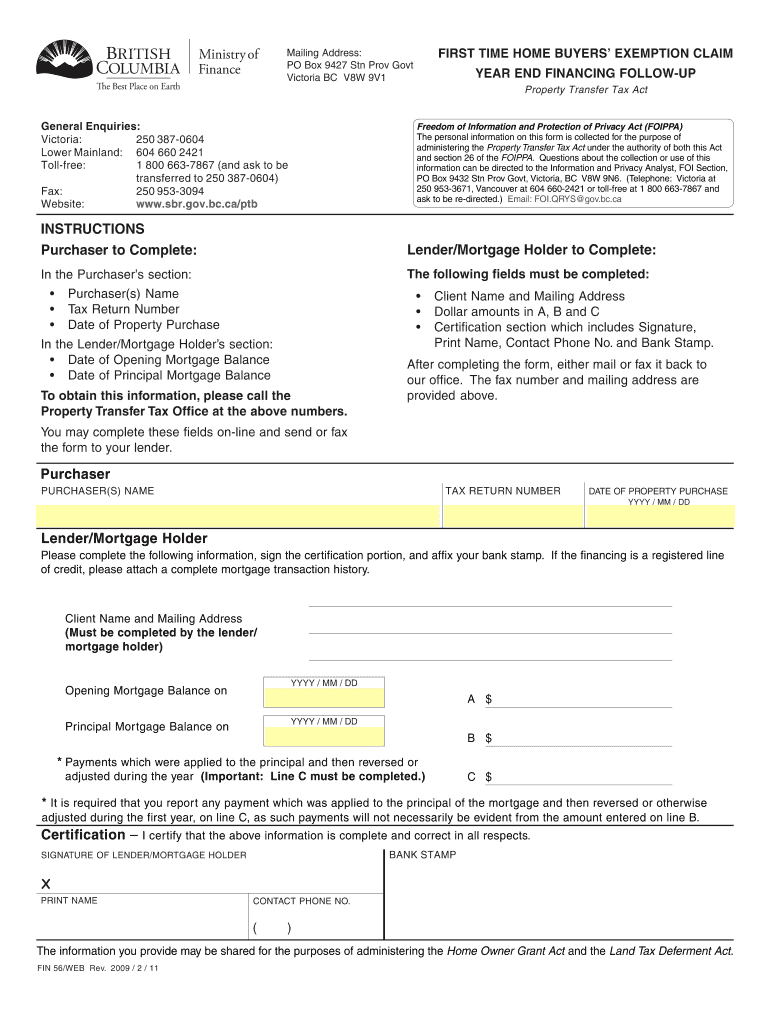

This document is a claim form for the First Time Home Buyers' Exemption under the Property Transfer Tax Act, including instructions for completion by both the purchaser and lender/mortgage holder.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign first time home buyers

Edit your first time home buyers form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your first time home buyers form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit first time home buyers online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit first time home buyers. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out first time home buyers

How to fill out FIRST TIME HOME BUYERS’ EXEMPTION CLAIM

01

Obtain the FIRST TIME HOME BUYERS’ EXEMPTION CLAIM form from your local government's website or office.

02

Fill in your personal information, including name, address, and contact details.

03

Provide details about the property you are purchasing, including the address and purchase price.

04

Confirm that you meet the criteria of a first-time home buyer, usually defined as not having owned a home in the past few years.

05

Include any necessary documentation, such as proof of income or evidence of your home buyer status.

06

Review the completed form for accuracy and completeness.

07

Submit the form to the appropriate local government office by the specified deadline.

Who needs FIRST TIME HOME BUYERS’ EXEMPTION CLAIM?

01

Individuals or couples who are purchasing their first home.

02

People who have not owned a home or had ownership interests in the last several years.

03

First-time home buyers looking for financial assistance or tax exemptions related to their home purchase.

Fill

form

: Try Risk Free

People Also Ask about

Who is eligible for homeowners exemption in California?

How do I qualify for the Homeowners' Exemption? To obtain the exemption for a property, you must be its owner or co-owner (or a purchaser named in a contract of sale), and you must live in the property as your principal place of residence. You must also file the appropriate exemption claim form with the Assessor.

What is the $8,000 homebuyer tax credit?

The $8000 IRS Tax Credit was part of the Housing and Economic Recovery Act of 2008 and was expanded under the American Recovery and Reinvestment Act of 2009. It provided first-time home buyers with a refundable tax credit of up to $8000, helping them offset the costs associated with purchasing a home.

Is there a tax write-off for first time home buyers?

Tax credits for first-time homebuyers The primary tax credit available to first-time homebuyers is the mortgage credit certificate (MCC). This federal tax credit allows you to deduct a portion of your mortgage interest each tax year. MCCs are limited to low- and moderate-income homeowners.

What is the $8,000 homebuyer tax credit?

The $8000 IRS Tax Credit was part of the Housing and Economic Recovery Act of 2008 and was expanded under the American Recovery and Reinvestment Act of 2009. It provided first-time home buyers with a refundable tax credit of up to $8000, helping them offset the costs associated with purchasing a home.

Who is eligible for the $7500 tax credit in Canada?

Who is eligible for this tax credit? To be eligible for the $7,500 Multigenerational Home Renovation Tax Credit in Canada, you usually need to meet the following criteria: You must be a homeowner in Canada. The resident of the renovated unit must be a family member who is a senior or an adult with a disability.

Are there any tax benefits for first time home buyers?

Tax credits for first-time homebuyers The primary tax credit available to first-time homebuyers is the mortgage credit certificate (MCC). This federal tax credit allows you to deduct a portion of your mortgage interest each tax year.

Do first time home buyers get a bigger tax refund?

You don't automatically get a bigger refund from buying a house, there are a lot of moving parts involved. The main items that helps a homeowner tax-wise are mortgage interest and property taxes, but only if that gives you a bigger itemized deduction than just taking the standard deduction.

Do first time home buyers get a bigger tax refund?

You don't automatically get a bigger refund from buying a house, there are a lot of moving parts involved. The main items that helps a homeowner tax-wise are mortgage interest and property taxes, but only if that gives you a bigger itemized deduction than just taking the standard deduction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FIRST TIME HOME BUYERS’ EXEMPTION CLAIM?

The FIRST TIME HOME BUYERS’ EXEMPTION CLAIM is a tax exemption designed to reduce or eliminate property tax for individuals purchasing their first home.

Who is required to file FIRST TIME HOME BUYERS’ EXEMPTION CLAIM?

Individuals who are purchasing a home for the first time and meet specific eligibility criteria are required to file the FIRST TIME HOME BUYERS’ EXEMPTION CLAIM.

How to fill out FIRST TIME HOME BUYERS’ EXEMPTION CLAIM?

To fill out the FIRST TIME HOME BUYERS’ EXEMPTION CLAIM, you need to provide personal information, details of the property, proof of first-time homebuyer status, and any required documentation as specified by your local taxing authority.

What is the purpose of FIRST TIME HOME BUYERS’ EXEMPTION CLAIM?

The purpose of the FIRST TIME HOME BUYERS’ EXEMPTION CLAIM is to assist first-time homebuyers by providing financial relief through property tax exemptions, making homeownership more affordable.

What information must be reported on FIRST TIME HOME BUYERS’ EXEMPTION CLAIM?

The information that must be reported on the FIRST TIME HOME BUYERS’ EXEMPTION CLAIM includes the buyer's name, address, social security number, property details, and proof that it is the buyer's first home purchase.

Fill out your first time home buyers online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

First Time Home Buyers is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.